5 Transamerica Health Plans

Introduction to Transamerica Health Plans

Transamerica is a well-established company that offers a variety of health plans to cater to different needs and budgets. With a long history of providing insurance products, Transamerica has built a reputation for reliability and flexibility. In this article, we will delve into the details of Transamerica health plans, exploring their features, benefits, and what sets them apart from other health insurance providers.

Types of Transamerica Health Plans

Transamerica offers a range of health plans, including:

- Individual and Family Plans: These plans are designed for individuals and families who are not covered by an employer-sponsored health plan. They offer a variety of deductible and copayment options to suit different budgets and needs.

- Group Health Plans: These plans are designed for businesses and organizations, providing coverage for employees and their families. They offer a range of options, including fully insured and self-funded plans.

- Medicare Supplement Plans: These plans are designed for individuals who are eligible for Medicare, providing additional coverage for out-of-pocket expenses, such as deductibles, copayments, and coinsurance.

- Short-Term Health Plans: These plans provide temporary coverage for individuals who are between jobs, waiting for other coverage to start, or need coverage for a short period.

Key Features of Transamerica Health Plans

Transamerica health plans offer a range of features, including:

- Network of Providers: Transamerica has a large network of healthcare providers, including doctors, hospitals, and specialists.

- Preventive Care: Transamerica health plans cover preventive care services, such as routine check-ups, screenings, and vaccinations.

- Chronic Condition Management: Transamerica offers programs to help manage chronic conditions, such as diabetes, heart disease, and asthma.

- Mental Health and Substance Abuse Coverage: Transamerica health plans cover mental health and substance abuse treatment, including counseling, therapy, and rehabilitation.

Benefits of Transamerica Health Plans

Transamerica health plans offer a range of benefits, including:

- Flexibility: Transamerica offers a range of plan options, allowing individuals and families to choose the coverage that best suits their needs and budget.

- Affordability: Transamerica health plans are competitively priced, making them an affordable option for individuals and families.

- Reliability: Transamerica has a long history of providing reliable and trustworthy health insurance products.

- Customer Support: Transamerica offers excellent customer support, including online resources, phone support, and in-person support at local offices.

How to Choose the Right Transamerica Health Plan

Choosing the right Transamerica health plan depends on several factors, including:

- Age and Health Status: Individuals with pre-existing conditions or chronic health issues may need to choose a plan with more comprehensive coverage.

- Budget: Individuals and families should consider their budget and choose a plan that fits within their means.

- Network of Providers: Individuals should consider the network of providers included in the plan and choose a plan that includes their preferred healthcare providers.

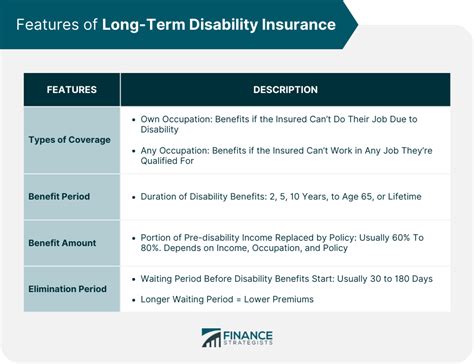

- Additional Benefits: Individuals may want to consider additional benefits, such as dental, vision, or disability coverage.

💡 Note: It's essential to carefully review the plan details, including the summary of benefits, exclusions, and limitations, before making a decision.

Transamerica Health Plan Rates and Pricing

Transamerica health plan rates and pricing vary depending on several factors, including:

- Age: Older individuals may pay more for health insurance due to increased health risks.

- Location: Health insurance rates can vary depending on the state and region.

- Plan Type: Different plan types, such as individual and family plans, group health plans, and Medicare supplement plans, may have different pricing structures.

- Deductible and Copayment Options: Individuals who choose higher deductible and copayment options may pay lower premiums.

Transamerica Health Plan Enrollment and Eligibility

Transamerica health plan enrollment and eligibility vary depending on the plan type and individual circumstances. Generally, individuals can enroll in Transamerica health plans during:

- Open Enrollment: The annual open enrollment period, usually between November and December, allows individuals to enroll in or change health plans.

- Special Enrollment: Individuals may be eligible for special enrollment periods, such as when they experience a qualifying life event, such as marriage, divorce, or the birth of a child.

- Medicare Enrollment: Medicare-eligible individuals can enroll in Medicare supplement plans during their initial enrollment period or during the annual election period.

Transamerica Health Plan Customer Support and Resources

Transamerica offers a range of customer support and resources, including:

- Online Portal: Transamerica’s online portal allows individuals to manage their health plan, access claims information, and communicate with customer support.

- Phone Support: Transamerica’s customer support team is available to answer questions and provide assistance via phone.

- In-Person Support: Transamerica has local offices where individuals can receive in-person support and guidance.

- Education and Wellness Resources: Transamerica offers education and wellness resources, including health and wellness programs, to help individuals manage their health and prevent illness.

As we have explored the various aspects of Transamerica health plans, it's clear that they offer a range of options and benefits to suit different needs and budgets. By considering factors such as age, health status, budget, and network of providers, individuals can choose the right Transamerica health plan to meet their unique circumstances. With its long history of providing reliable and trustworthy health insurance products, Transamerica is a reputable choice for individuals and families seeking comprehensive health coverage.

What types of health plans does Transamerica offer?

+

Transamerica offers a range of health plans, including individual and family plans, group health plans, Medicare supplement plans, and short-term health plans.

How do I choose the right Transamerica health plan?

+

To choose the right Transamerica health plan, consider factors such as age, health status, budget, and network of providers. It’s also essential to carefully review the plan details, including the summary of benefits, exclusions, and limitations.

What is the difference between a deductible and a copayment?

+

A deductible is the amount an individual must pay out-of-pocket before their health plan begins to pay for covered services. A copayment, on the other hand, is a fixed amount an individual pays for a specific service, such as a doctor’s visit or prescription medication.

Related Terms:

- Transamerica login

- Transamerica Life insurance

- Transamerica customer service

- Transamerica phone number

- Transamerica Employee Benefits PDF

- Transamerica Employee Benefits provider portal