Health

Europe Travel Health Insurance

Introduction to Europe Travel Health Insurance

When planning a trip to Europe, one of the most important considerations is health insurance. Europe travel health insurance provides financial protection against unexpected medical expenses that may arise during your trip. With so many options available, it can be overwhelming to choose the right policy. In this article, we will guide you through the process of selecting the best Europe travel health insurance for your needs.

Why Do You Need Europe Travel Health Insurance?

Traveling to Europe can be a dream come true, but it’s essential to be prepared for any unexpected medical emergencies that may arise. Medical expenses in Europe can be extremely high, and without proper insurance coverage, you may find yourself facing financial difficulties. Europe travel health insurance provides coverage for:

- Medical emergencies: Hospitalization, surgery, and other medical expenses

- Evacuation: Emergency evacuation to a nearby hospital or back to your home country

- Trip cancellations: Trip cancellations or interruptions due to medical reasons

Types of Europe Travel Health Insurance

There are several types of Europe travel health insurance policies available, including:

- Single-trip policies: Coverage for a single trip to Europe

- Multi-trip policies: Coverage for multiple trips to Europe within a year

- Annual policies: Coverage for an entire year, regardless of the number of trips

- Group policies: Coverage for groups of travelers, such as families or tour groups

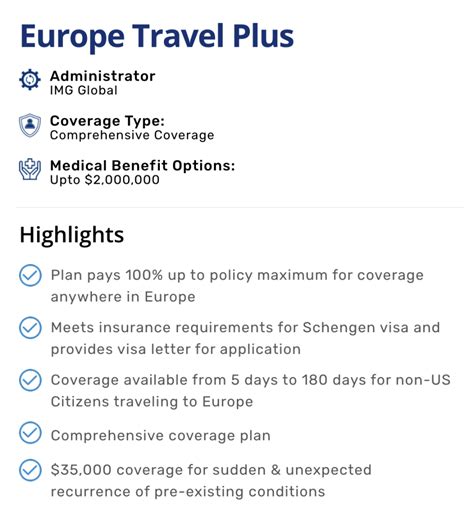

What to Look for in a Europe Travel Health Insurance Policy

When selecting a Europe travel health insurance policy, there are several factors to consider:

- Coverage limits: The maximum amount of coverage provided by the policy

- Deductibles: The amount you must pay out-of-pocket before the insurance coverage kicks in

- Pre-existing conditions: Coverage for pre-existing medical conditions, such as diabetes or heart disease

- Adventure activities: Coverage for adventure activities, such as skiing or scuba diving

- Provider network: The network of healthcare providers that are part of the insurance plan

Top Europe Travel Health Insurance Providers

Some of the top Europe travel health insurance providers include:

- Allianz: Offers a range of travel insurance policies, including single-trip and multi-trip options

- AXA: Provides coverage for medical emergencies, trip cancellations, and evacuations

- Europ Assistance: Offers 24⁄7 emergency assistance and coverage for medical expenses

- Travelex: Provides coverage for trip cancellations, interruptions, and medical emergencies

How to Choose the Best Europe Travel Health Insurance Policy

To choose the best Europe travel health insurance policy, follow these steps:

- Research: Research different insurance providers and policies to find the best option for your needs

- Compare: Compare coverage limits, deductibles, and provider networks to find the best policy

- Read reviews: Read reviews from other travelers to get an idea of the insurance provider’s customer service and claims process

- Check policy details: Carefully review the policy details, including coverage limits and exclusions

🚨 Note: Always carefully review the policy details and ask questions before purchasing a Europe travel health insurance policy.

Cost of Europe Travel Health Insurance

The cost of Europe travel health insurance varies depending on several factors, including:

- Age: Older travelers may pay higher premiums

- Health: Pre-existing medical conditions may increase premiums

- Destination: Traveling to certain countries in Europe may increase premiums

- Length of trip: Longer trips may increase premiums

| Insurance Provider | Single-Trip Policy | Multi-Trip Policy |

|---|---|---|

| Allianz | $50-$100 | $200-$500 |

| AXA | $70-$150 | $300-$600 |

| Europ Assistance | $100-$200 | $400-$800 |

Claims Process

In the event of a medical emergency, it’s essential to know how to file a claim with your Europe travel health insurance provider. Here are the steps to follow:

- Contact the insurance provider: Reach out to the insurance provider’s emergency assistance team

- Provide documentation: Provide documentation, such as medical records and receipts

- Submit a claim: Submit a claim to the insurance provider for reimbursement

Final Thoughts

Europe travel health insurance is an essential aspect of planning a trip to Europe. By understanding the different types of policies available, what to look for in a policy, and how to choose the best policy for your needs, you can ensure that you’re protected against unexpected medical expenses. Remember to always carefully review policy details and ask questions before purchasing a policy.

What is Europe travel health insurance?

+

Europe travel health insurance provides financial protection against unexpected medical expenses that may arise during your trip to Europe.

Do I need Europe travel health insurance if I have health insurance at home?

+

Yes, it’s still a good idea to purchase Europe travel health insurance, as your home health insurance may not cover you abroad.

How do I choose the best Europe travel health insurance policy for my needs?

+

Research different insurance providers and policies, compare coverage limits and deductibles, and read reviews from other travelers to find the best policy for your needs.

Related Terms:

- Schengen insurance

- Nomad travel insurance

- World Nomads travel insurance

- cheapest medical travel insurance europe

- travel insurance 5 days europe

- travel insurance europe 1 month