5 Ways Cut Premiums

Introduction to Cutting Premiums

When it comes to insurance, one of the most significant concerns for individuals and businesses alike is the cost of premiums. High premiums can be a financial burden, making it difficult to manage budgets and allocate resources effectively. However, there are several strategies that can be employed to cut premiums without compromising on the quality of coverage. In this article, we will explore five effective ways to reduce insurance premiums, making insurance more affordable and accessible to all.

Understanding Insurance Premiums

Before diving into the ways to cut premiums, it’s essential to understand what insurance premiums are and how they are calculated. Insurance premiums are the amounts paid to an insurance company to maintain coverage. These premiums are calculated based on various factors, including the type of insurance, the level of coverage, the insured’s risk profile, and the insurance company’s operational costs. By understanding these factors, individuals and businesses can identify areas where they can make adjustments to lower their premiums.

1. Assess and Adjust Your Risk Profile

One of the primary factors that influence insurance premiums is the insured’s risk profile. This refers to the likelihood of the insured making a claim. To cut premiums, it’s crucial to assess and adjust your risk profile. This can be done by: - Implementing safety measures to reduce the risk of accidents or damage. - Improving health and lifestyle habits for health insurance. - Installing security systems for home or business insurance. By reducing your risk profile, you can significantly lower your insurance premiums.

📝 Note: Regularly review your risk profile and adjust your insurance coverage accordingly to ensure you're not over-insured or under-insured.

2. Shop Around for Insurance Quotes

Another effective way to cut premiums is to shop around for insurance quotes. Different insurance companies offer varying rates for the same coverage. By comparing quotes from multiple insurers, you can find the best rates for your needs. It’s also worth considering working with an insurance broker who can help navigate the market and find the most competitive quotes.

3. Bundle Insurance Policies

Bundling insurance policies is a strategy that can lead to significant premium savings. Many insurance companies offer discounts when you purchase multiple policies from them, such as combining home and auto insurance. This not only reduces premiums but also simplifies policy management.

4. Increase Your Deductible

Increasing your deductible can lower your premiums. The deductible is the amount you pay out of pocket before your insurance coverage kicks in. By choosing a higher deductible, you’re taking on more of the financial risk, which can result in lower premiums. However, it’s essential to ensure that you can afford the deductible amount in case you need to make a claim.

5. Take Advantage of Discounts

Finally, taking advantage of discounts can be a straightforward way to cut premiums. Many insurance companies offer a variety of discounts, such as: - Good student discounts for young drivers. - Discounts for non-smokers or healthy individuals for health insurance. - Loyalty discounts for long-term customers. - Professional association discounts. It’s worth inquiring about available discounts when purchasing or renewing your insurance policy.

Implementing Changes and Monitoring Progress

After implementing these strategies, it’s crucial to monitor your progress and adjust your approach as needed. This might involve regularly reviewing your insurance policies, reassessing your risk profile, and shopping around for new quotes. By being proactive and informed, you can ensure that you’re getting the best possible rates for your insurance coverage.

| Strategy | Description | Potential Savings |

|---|---|---|

| Assess and Adjust Risk Profile | Implement safety measures and improve habits | Varies |

| Shop Around for Quotes | Compare rates from different insurers | Up to 20% |

| Bundle Insurance Policies | Purchase multiple policies from one insurer | Up to 15% |

| Increase Deductible | Take on more financial risk | Up to 10% |

| Take Advantage of Discounts | Inquire about available discounts | Up to 10% |

In summary, cutting insurance premiums requires a combination of understanding your risk profile, shopping around for quotes, bundling policies, increasing your deductible, and taking advantage of discounts. By implementing these strategies, individuals and businesses can significantly reduce their insurance costs without compromising on the quality of their coverage. This approach not only helps in managing budgets more effectively but also ensures that insurance remains a viable and accessible option for all. Ultimately, the key to cutting premiums lies in being informed, proactive, and flexible in your approach to insurance coverage.

Related Terms:

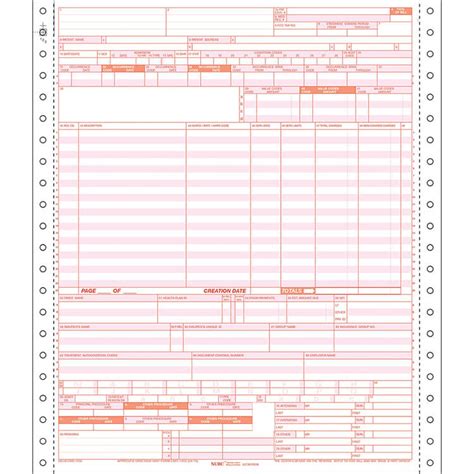

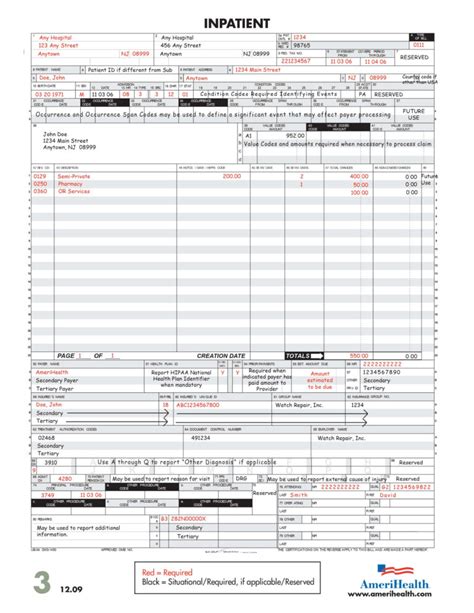

- ub residents health insurance premiums

- ub residents health insurance premiums

- UB health insurance waiver deadline

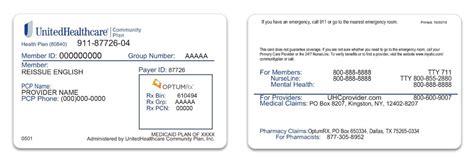

- UB Health insurance Card

- UB health insurance Portal

- UB Student Health insurance