5 UMB Bank HSA Benefits

Understanding the Benefits of UMB Bank HSA

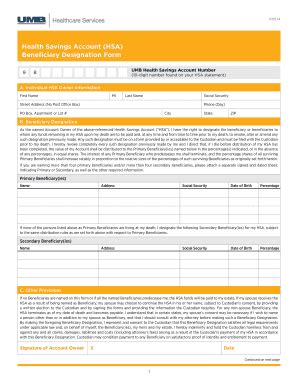

When it comes to managing healthcare expenses, a Health Savings Account (HSA) can be a valuable tool. UMB Bank, a leading financial institution, offers a comprehensive HSA program designed to help individuals and families save for medical expenses while also providing a range of benefits. In this article, we will delve into the 5 key benefits of UMB Bank HSA, exploring how it can help you navigate the complex world of healthcare financing.

Benefit 1: Tax Advantages

One of the most significant advantages of the UMB Bank HSA is its tax benefits. Contributions to an HSA are tax-deductible, which means you can reduce your taxable income by the amount you contribute to your HSA each year. Additionally, the funds in your HSA grow tax-free, and withdrawals for qualified medical expenses are tax-free as well. This triple tax advantage makes an HSA an attractive option for those looking to minimize their tax liability while saving for healthcare costs.

Benefit 2: Flexibility and Portability

UMB Bank HSAs are designed to be flexible and portable. You can use your HSA funds to pay for a wide range of qualified medical expenses, including doctor visits, prescriptions, and medical equipment. Moreover, your HSA is portable, meaning you can take it with you if you change jobs or retire. This flexibility ensures that your HSA funds are always available to help you cover healthcare expenses, regardless of your employment status.

Benefit 3: Investment Options

UMB Bank offers a range of investment options for HSA funds, allowing you to grow your account balance over time. You can choose from a variety of investments, including stocks, bonds, and mutual funds, to create a diversified portfolio that aligns with your financial goals and risk tolerance. By investing your HSA funds, you can potentially earn higher returns and build a larger nest egg to cover future healthcare expenses.

Benefit 4: Convenience and Accessibility

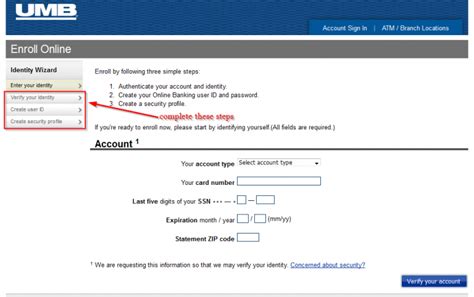

UMB Bank HSAs are designed to be convenient and accessible. You can manage your account online or through the mobile app, making it easy to track your balance, view transaction history, and pay bills. Additionally, you can use your HSA debit card to pay for qualified medical expenses directly, eliminating the need for reimbursement forms and paperwork.

Benefit 5: No “Use It or Lose It” Rule

Unlike Flexible Spending Accounts (FSAs), UMB Bank HSAs do not have a “use it or lose it” rule. This means that any unused funds in your HSA at the end of the year roll over to the next year, allowing you to accumulate a large balance over time. This feature provides peace of mind, knowing that you can save for future healthcare expenses without worrying about forfeiting unused funds.

📝 Note: It's essential to review and understand the terms and conditions of your UMB Bank HSA, including any fees, investment options, and eligibility requirements.

To illustrate the benefits of UMB Bank HSA, consider the following table:

| Benefit | Description |

|---|---|

| Tax Advantages | Tax-deductible contributions, tax-free growth, and tax-free withdrawals |

| Flexibility and Portability | Use funds for qualified medical expenses, portable across jobs and retirement |

| Investment Options | Range of investment choices to grow account balance over time |

| Convenience and Accessibility | Online and mobile account management, HSA debit card for easy payments |

| No "Use It or Lose It" Rule | Unused funds roll over to the next year, no forfeiture of unused balances |

In summary, the UMB Bank HSA offers a range of benefits that can help individuals and families save for healthcare expenses while also providing tax advantages, flexibility, and investment opportunities. By understanding these benefits and how to use them effectively, you can make the most of your HSA and ensure that you’re prepared for any medical expenses that may arise.

What is a Health Savings Account (HSA)?

+

A Health Savings Account (HSA) is a tax-advantaged savings account designed to help individuals and families save for qualified medical expenses.

How do I contribute to a UMB Bank HSA?

+

You can contribute to a UMB Bank HSA through payroll deductions, online transfers, or mobile deposits.

Can I use my HSA funds for non-medical expenses?

+

Yes, but you may be subject to taxes and penalties on non-qualified withdrawals. It’s essential to review the terms and conditions of your UMB Bank HSA to understand the rules and regulations.

Related Terms:

- UMB health savings account

- UMB healthcare Services

- UMB login

- UMB health insurance

- UMB bank loans

- HSA Bank