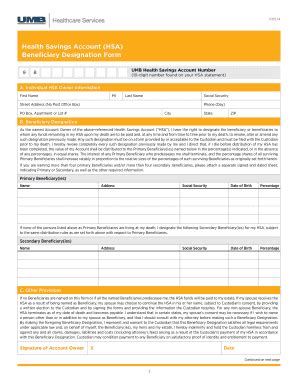

Health

UMB Health Savings Plans

Introduction to UMB Health Savings Plans

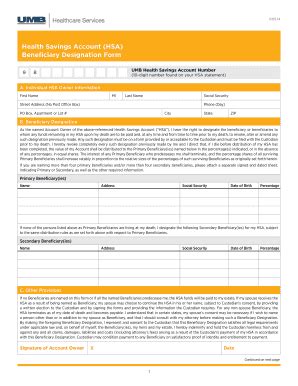

UMB Health Savings Plans are designed to help individuals and families save for medical expenses while also providing a tax-advantaged way to pay for healthcare costs. These plans are typically paired with a High-Deductible Health Plan (HDHP) and offer a unique opportunity to set aside pre-tax dollars for healthcare expenses. In this article, we will delve into the details of UMB Health Savings Plans, their benefits, and how they can be used to manage healthcare costs effectively.

Benefits of UMB Health Savings Plans

UMB Health Savings Plans offer several benefits, including: * Tax advantages: Contributions to a UMB Health Savings Plan are made with pre-tax dollars, reducing your taxable income. * Flexibility: You can use the funds in your UMB Health Savings Plan to pay for a wide range of qualified medical expenses, including doctor visits, prescriptions, and hospital stays. * Portability: UMB Health Savings Plans are portable, meaning you can take the plan with you if you change jobs or retire. * Earning interest: UMB Health Savings Plans earn interest, allowing your savings to grow over time. * Investment options: Some UMB Health Savings Plans offer investment options, allowing you to grow your savings more aggressively.

How UMB Health Savings Plans Work

UMB Health Savings Plans are designed to work in conjunction with a High-Deductible Health Plan (HDHP). Here’s how they work: * You enroll in a HDHP, which has a higher deductible than a traditional health plan. * You set up a UMB Health Savings Plan, which allows you to contribute pre-tax dollars to a savings account. * You use the funds in your UMB Health Savings Plan to pay for qualified medical expenses, such as doctor visits, prescriptions, and hospital stays. * You can also use the funds in your UMB Health Savings Plan to pay for other qualified expenses, such as vision and dental care.

Eligibility and Contribution Limits

To be eligible for a UMB Health Savings Plan, you must meet certain requirements, including: * You must be enrolled in a High-Deductible Health Plan (HDHP). * You must not be enrolled in any other health plan that is not a HDHP. * You must not be eligible for Medicare. * You must not be claimed as a dependent on someone else’s tax return. The contribution limits for UMB Health Savings Plans vary from year to year, but for 2022, the limits are: * 3,650 for individual coverage * 7,300 for family coverage You can contribute to a UMB Health Savings Plan up to the annual limit, and you can also catch up on contributions if you are 55 or older.

Qualified Medical Expenses

UMB Health Savings Plans can be used to pay for a wide range of qualified medical expenses, including: * Doctor visits and copays * Prescriptions and medications * Hospital stays and surgery * Vision and dental care * Medical equipment and supplies * Transportation costs related to medical care You can use the funds in your UMB Health Savings Plan to pay for these expenses, and you can also use the funds to pay for other qualified expenses, such as: * Acupuncture and chiropractic care * Mental health and substance abuse treatment * Smoking cessation programs * Weight loss programs

UMB Health Savings Plan Investment Options

Some UMB Health Savings Plans offer investment options, allowing you to grow your savings more aggressively. These investment options may include: * Stocks and bonds * Mutual funds * Exchange-traded funds (ETFs) * Real estate investment trusts (REITs) You can choose to invest your UMB Health Savings Plan funds in one or more of these options, and you can also choose to keep your funds in a savings account or money market fund.

UMB Health Savings Plan Fees and Charges

UMB Health Savings Plans may have fees and charges associated with them, including: * Monthly maintenance fees * Investment management fees * Transaction fees * Withdrawal fees It’s essential to understand these fees and charges before opening a UMB Health Savings Plan, as they can affect the overall cost of the plan.

💡 Note: It's crucial to review the fees and charges associated with a UMB Health Savings Plan before opening an account, as they can impact the overall cost of the plan.

Conclusion and Final Thoughts

UMB Health Savings Plans offer a unique opportunity to save for medical expenses while also providing a tax-advantaged way to pay for healthcare costs. By understanding how these plans work, their benefits, and their eligibility requirements, you can make an informed decision about whether a UMB Health Savings Plan is right for you. Remember to review the fees and charges associated with a UMB Health Savings Plan, as well as the investment options available, to ensure that you are getting the most out of your plan.

What is a UMB Health Savings Plan?

+

A UMB Health Savings Plan is a type of savings account that allows you to set aside pre-tax dollars for medical expenses.

How do I contribute to a UMB Health Savings Plan?

+

You can contribute to a UMB Health Savings Plan through payroll deductions or by making direct contributions to the plan.

Can I use a UMB Health Savings Plan to pay for non-medical expenses?

+

No, UMB Health Savings Plans can only be used to pay for qualified medical expenses.

Do I have to be enrolled in a High-Deductible Health Plan to have a UMB Health Savings Plan?

+

Can I invest my UMB Health Savings Plan funds in stocks and bonds?

+

Yes, some UMB Health Savings Plans offer investment options, including stocks and bonds.

Related Terms:

- UMB HSA app

- My UMB HSA login

- Bank umb

- UMB HSA customer service

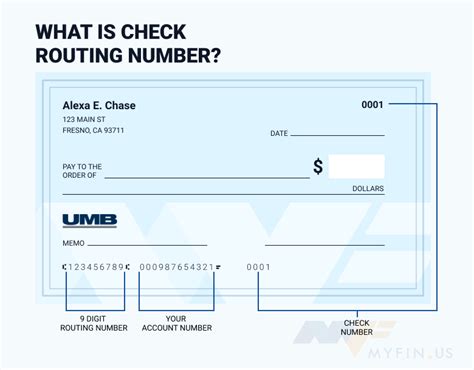

- UMB HSA routing number

- Umb health savings visa account