United Health Group Nasdaq Profile

Introduction to UnitedHealth Group

UnitedHealth Group is a multinational health care company based in the United States, operating in two main businesses: UnitedHealthcare and Optum. The company is one of the largest health insurers in the United States and offers a wide range of products and services to individuals, employers, and governments. UnitedHealth Group is listed on the Nasdaq stock exchange under the ticker symbol UNH.

Business Segments

The company operates through two primary business segments: * UnitedHealthcare: This segment offers a wide range of health insurance products and services, including individual, employer-sponsored, and government-sponsored plans. UnitedHealthcare is one of the largest health insurers in the United States, serving over 45 million people. * Optum: This segment provides health services, including pharmacy benefit management, health care delivery, and health care technology. Optum serves over 100 million people and is one of the largest health care services companies in the United States.

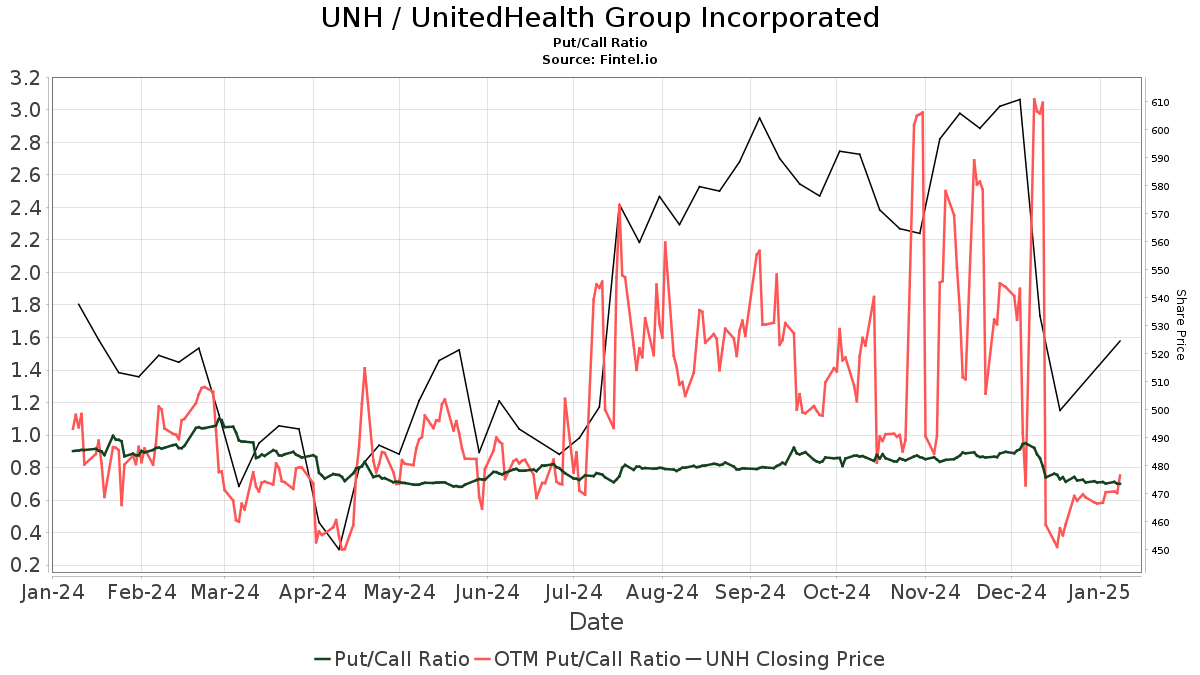

Financial Performance

UnitedHealth Group has consistently delivered strong financial performance, with revenue and earnings growth driven by its diversified business model and strategic acquisitions. In recent years, the company has reported: * Revenue growth: UnitedHealth Group’s revenue has grown at a compound annual growth rate (CAGR) of over 10% in the past five years, driven by growth in both its UnitedHealthcare and Optum segments. * Earnings growth: The company’s earnings per share (EPS) have grown at a CAGR of over 15% in the past five years, driven by strong revenue growth and margin expansion. * Dividend yield: UnitedHealth Group pays a dividend yield of around 1.5%, providing investors with a relatively stable source of income.

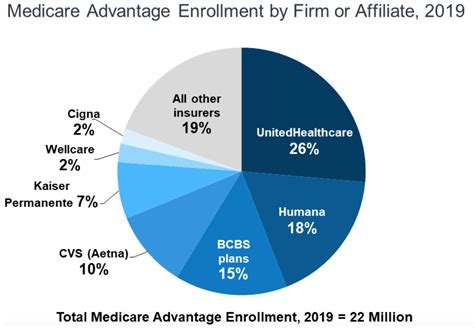

Competitive Landscape

The health insurance industry is highly competitive, with several large players competing for market share. UnitedHealth Group’s main competitors include: * Anthem, Inc.: A large health insurer with a strong presence in the individual and employer-sponsored markets. * Aetna Inc.: A large health insurer with a strong presence in the individual and employer-sponsored markets. * Cigna Corporation: A large health insurer with a strong presence in the individual and employer-sponsored markets. * Humana Inc.: A large health insurer with a strong presence in the individual and employer-sponsored markets.

Investment Thesis

UnitedHealth Group’s diversified business model, strong financial performance, and competitive position make it an attractive investment opportunity. The company’s growth prospects are driven by: * Demographic trends: The growing and aging population in the United States is driving demand for health care services. * Health care reform: The Affordable Care Act (ACA) has expanded health insurance coverage to millions of Americans, driving growth in the individual and employer-sponsored markets. * Strategic acquisitions: UnitedHealth Group has a strong track record of making strategic acquisitions to expand its business and drive growth.

Valuation

UnitedHealth Group’s valuation is attractive, with the company trading at a: * Price-to-earnings (P/E) ratio: The company’s P/E ratio is around 20x, which is in line with its historical average and lower than its peers. * Price-to-book (P/B) ratio: The company’s P/B ratio is around 4x, which is higher than its historical average but lower than its peers. * Dividend yield: The company’s dividend yield is around 1.5%, which is relatively stable and attractive to income investors.

💡 Note: Investors should conduct their own research and analysis before making an investment decision.

Conclusion and Future Outlook

In conclusion, UnitedHealth Group is a well-established health care company with a strong track record of financial performance and growth. The company’s diversified business model, competitive position, and attractive valuation make it an attractive investment opportunity. Looking ahead, UnitedHealth Group is well-positioned to drive growth and expansion in the health care industry, driven by demographic trends, health care reform, and strategic acquisitions.

What is UnitedHealth Group’s business model?

+

UnitedHealth Group operates through two primary business segments: UnitedHealthcare and Optum. UnitedHealthcare offers a wide range of health insurance products and services, while Optum provides health services, including pharmacy benefit management, health care delivery, and health care technology.

Who are UnitedHealth Group’s main competitors?

+

UnitedHealth Group’s main competitors include Anthem, Inc., Aetna Inc., Cigna Corporation, and Humana Inc. These companies are all large health insurers with a strong presence in the individual and employer-sponsored markets.

What is UnitedHealth Group’s investment thesis?

+

UnitedHealth Group’s diversified business model, strong financial performance, and competitive position make it an attractive investment opportunity. The company’s growth prospects are driven by demographic trends, health care reform, and strategic acquisitions.

Related Terms:

- unitedhealth group profile details nasdaq

- AWS Nasdaq

- AAPL Nasdaq

- Jnj nasdaq

- UnitedHealthcare earnings

- Nasdaq companies