5 Utah Health Plans

Introduction to Utah Health Plans

When it comes to health insurance, Utah residents have a variety of options to choose from. With the Affordable Care Act (ACA) in place, individuals and families can select from a range of plans that cater to their unique needs and budgets. In this post, we’ll delve into the world of Utah health plans, exploring the different types of plans available, their benefits, and what to consider when selecting a plan.

Types of Utah Health Plans

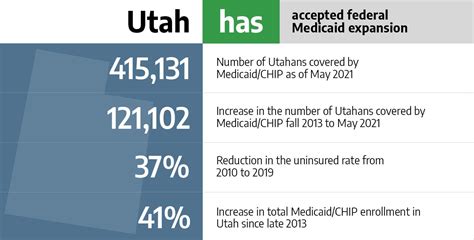

Utah health plans can be broadly categorized into several types, each with its own set of characteristics and advantages. Some of the most common types of plans include: * Individual and Family Plans: These plans are designed for individuals and families who are not covered by an employer-sponsored plan. They can be purchased through the health insurance marketplace or directly from an insurance company. * Group Plans: These plans are offered by employers to their employees and are often more affordable than individual plans. * Medicaid Plans: These plans are designed for low-income individuals and families who meet specific eligibility requirements. * Medicare Plans: These plans are designed for individuals who are 65 or older, or have a disability. * Short-Term Plans: These plans provide temporary coverage for individuals who are between jobs, waiting for a new plan to start, or need coverage for a short period.

Benefits of Utah Health Plans

Utah health plans offer a range of benefits, including: * Comprehensive Coverage: Most plans cover essential health benefits, such as doctor visits, hospital stays, prescription medications, and more. * Affordability: Many plans offer affordable premiums, deductibles, and copays, making health care more accessible to Utah residents. * Network of Providers: Plans often have a network of providers, including doctors, hospitals, and specialists, who offer discounted rates to plan members. * Preventive Care: Many plans cover preventive care services, such as annual check-ups, screenings, and vaccinations, at no additional cost.

Top 5 Utah Health Plans

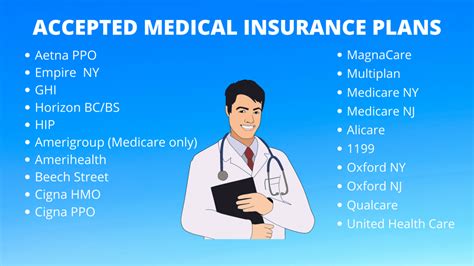

Here are five Utah health plans that are worth considering: * Regence BlueCross BlueShield of Utah: This plan offers a range of individual and family plans, including catastrophic, bronze, silver, gold, and platinum options. * University of Utah Health Plans: This plan offers a range of individual and family plans, including Medicaid and Medicare options. * SelectHealth: This plan offers a range of individual and family plans, including catastrophic, bronze, silver, gold, and platinum options. * Molina Healthcare of Utah: This plan offers a range of individual and family plans, including Medicaid and Medicare options. * BridgeSpan Health Company: This plan offers a range of individual and family plans, including catastrophic, bronze, silver, gold, and platinum options.

What to Consider When Selecting a Utah Health Plan

When selecting a Utah health plan, there are several factors to consider, including: * Premiums: The monthly cost of the plan. * Deductibles: The amount you pay out-of-pocket before the plan starts covering costs. * Copays: The amount you pay for doctor visits, prescriptions, and other services. * Network of Providers: The range of doctors, hospitals, and specialists who participate in the plan. * Maximum Out-of-Pocket: The maximum amount you pay for health care expenses in a given year.

📝 Note: It's essential to carefully review the plan's benefits, limitations, and exclusions before making a decision.

Utah Health Plan Enrollment

Utah health plan enrollment typically takes place during the annual open enrollment period, which runs from November to December. However, special enrollment periods may be available for individuals who experience a qualifying life event, such as losing job-based coverage or getting married.

| Plan Type | Premium | Deductible | Copay |

|---|---|---|---|

| Catastrophic | $200-$300 | $7,900 | $50-$100 |

| Bronze | $300-$400 | $6,000 | $50-$100 |

| Silver | $400-$500 | $4,000 | $30-$70 |

| Gold | $500-$600 | $2,000 | $20-$50 |

| Platinum | $600-$700 | $1,000 | $10-$30 |

In summary, Utah health plans offer a range of options for individuals and families, including individual and family plans, group plans, Medicaid plans, Medicare plans, and short-term plans. When selecting a plan, it’s essential to consider factors such as premiums, deductibles, copays, network of providers, and maximum out-of-pocket. By carefully reviewing the plan’s benefits, limitations, and exclusions, individuals can make an informed decision and choose a plan that meets their unique needs and budget.

What is the difference between a bronze and silver plan?

+

A bronze plan typically has a lower premium but a higher deductible, while a silver plan has a higher premium but a lower deductible.

Can I enroll in a Utah health plan outside of the open enrollment period?

+

Yes, you may be eligible for a special enrollment period if you experience a qualifying life event, such as losing job-based coverage or getting married.

What is the maximum out-of-pocket for a Utah health plan?

+

The maximum out-of-pocket for a Utah health plan varies by plan, but it is typically around 8,000-10,000 per year.

Related Terms:

- Midvalley Health Center

- Utah health insurance Marketplace

- Utah health insurance plans

- what insurance does ihc accept

- u health insurance plans accepted

- utah short term health insurance