5 Ways USAF Deployment Pay

Introduction to USAF Deployment Pay

The United States Air Force (USAF) offers its personnel various forms of compensation, especially when they are deployed to different parts of the world. Deployment pay is a critical aspect of the compensation package for airmen, as it acknowledges the sacrifices and challenges they face while serving abroad. This pay is designed to help offset the costs associated with deployment, ensuring that airmen and their families are financially supported throughout their service. In this article, we will delve into the different ways USAF deployment pay works, highlighting the benefits and how they are calculated.

Understanding Deployment Pay Basics

Before exploring the specifics of USAF deployment pay, it’s essential to understand the basics. Deployment pay, also known as combat pay or hazardous duty pay, is a form of special pay that is tax-free. It is provided to airmen who are deployed to combat zones or hazardous duty areas. The primary purpose of this pay is to compensate airmen for the dangers and hardships they endure during their deployment.

5 Ways USAF Deployment Pay Works

USAF deployment pay can be categorized into several types, each with its own eligibility criteria and payment structures. Here are five ways USAF deployment pay works:

- 1. Combat Zone Tax Exclusion (CZTE): This is a form of deployment pay that excludes the income earned by airmen in combat zones from federal income tax. The CZTE is not a separate pay but rather a tax benefit that reduces the taxable income of deployed airmen.

- 2. Hazardous Duty Pay: Airmen who perform hazardous duties, such as flying combat missions or working in hazardous environments, are eligible for hazardous duty pay. This pay is a monthly allowance that acknowledges the risks associated with these duties.

- 3. Hostile Fire Pay: This type of deployment pay is awarded to airmen who come under hostile fire or are in a zone where they are subject to sniper fire or other forms of attack. Hostile fire pay is a tax-free allowance that recognizes the danger faced by airmen in these situations.

- 4. Hardship Duty Pay: Airmen who are deployed to areas with harsh living conditions or limited amenities may be eligible for hardship duty pay. This pay is designed to compensate airmen for the difficulties they face in these environments.

- 5. Family Separation Allowance: When airmen are deployed for extended periods, they may be eligible for a family separation allowance. This pay is intended to help offset the costs associated with maintaining a family while serving abroad, such as increased communication costs or travel expenses to visit family members.

Calculation and Eligibility

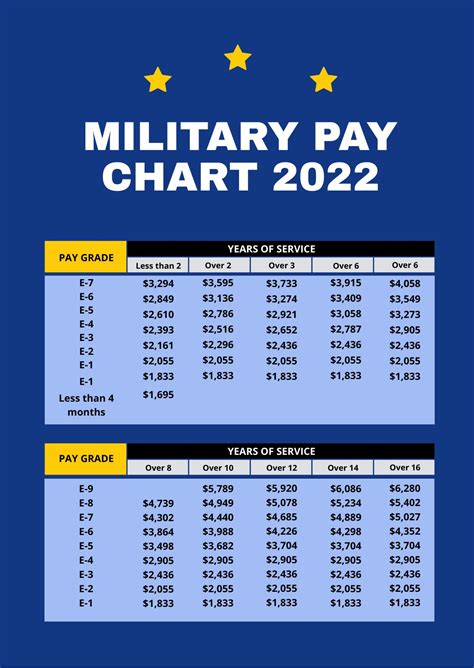

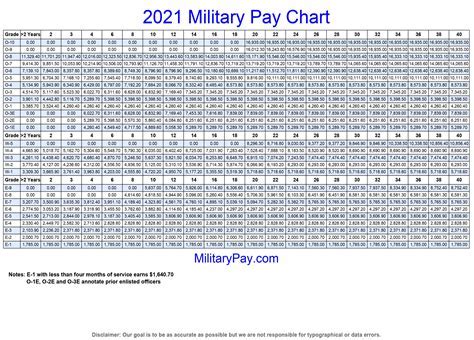

The calculation and eligibility for USAF deployment pay vary depending on the type of pay and the individual’s circumstances. Generally, deployment pay is calculated based on the airman’s rank, time in service, and the specific deployment location. Eligibility is typically determined by the airman’s deployment orders and the nature of their duties.

📝 Note: Airmen should consult their deployment orders and speak with their finance office to determine their eligibility for deployment pay and to understand how their pay will be calculated.

Benefits of Deployment Pay

Deployment pay offers several benefits to airmen and their families. These benefits include: - Tax-Free Income: Many forms of deployment pay are tax-free, which can significantly increase an airman’s take-home pay. - Increased Financial Security: Deployment pay helps ensure that airmen and their families have the financial resources they need while serving abroad. - Recognition of Service: Deployment pay serves as a recognition of the sacrifices and hardships that airmen endure during their deployment.

Conclusion

In summary, USAF deployment pay is a vital component of the compensation package for airmen serving abroad. Understanding the different types of deployment pay, their eligibility criteria, and how they are calculated is crucial for airmen to navigate their financial situation effectively during deployment. By acknowledging the challenges and dangers faced by airmen, the USAF aims to provide comprehensive support to its personnel and their families, ensuring that they can focus on their duties without undue financial stress.

What is the primary purpose of USAF deployment pay?

+

The primary purpose of USAF deployment pay is to compensate airmen for the dangers and hardships they endure during their deployment, ensuring they and their families are financially supported.

Is all deployment pay tax-free?

+

Many forms of deployment pay are tax-free, such as combat zone tax exclusion and hostile fire pay. However, not all deployment-related compensation is tax-free, so airmen should consult their finance office for specific details.

How is eligibility for deployment pay determined?

+

Eligibility for deployment pay is typically determined by the airman’s deployment orders, the nature of their duties, and the specific location of their deployment. Airmen should review their orders and consult with their finance office to understand their eligibility.

Related Terms:

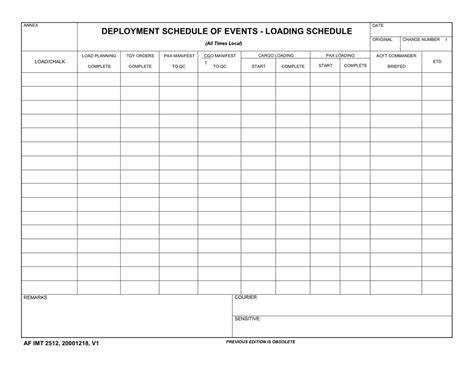

- 7 day deployment chart

- militarypay defense gov calculator

- military deployment payment calculator

- calculate deployment pay army

- us army deployment calculator

- army deployment pay chart