5 Tips Vanguard Health Care Fund

Introduction to Vanguard Health Care Fund

The Vanguard Health Care Fund is a popular investment option for those looking to capitalize on the growth and innovation in the healthcare sector. With its diverse portfolio of healthcare stocks, the fund offers a way for investors to tap into the potential of this rapidly evolving industry. However, navigating the complexities of healthcare investing can be challenging, especially for novice investors. In this article, we will explore five key tips for investing in the Vanguard Health Care Fund, helping you make informed decisions and maximize your returns.

Understanding the Fund’s Investment Strategy

Before investing in the Vanguard Health Care Fund, it’s essential to understand its investment strategy. The fund focuses on investing in stocks of companies involved in the healthcare industry, including pharmaceuticals, biotechnology, medical devices, and healthcare services. The fund’s managers use a combination of quantitative and qualitative analysis to select stocks with strong growth potential. By understanding the fund’s investment approach, you can better assess whether it aligns with your investment goals and risk tolerance.

Tip 1: Evaluate Your Investment Goals and Risk Tolerance

Before investing in the Vanguard Health Care Fund, it’s crucial to evaluate your investment goals and risk tolerance. The healthcare sector can be volatile, with stocks experiencing significant fluctuations in response to regulatory changes, clinical trial results, and market trends. If you’re a conservative investor, you may want to consider allocating a smaller portion of your portfolio to the fund. On the other hand, if you’re willing to take on more risk in pursuit of higher returns, you may consider allocating a larger portion of your portfolio to the fund. Consider the following factors when evaluating your investment goals and risk tolerance: * Your investment time horizon * Your risk tolerance * Your overall financial situation * Your investment goals (e.g., growth, income, or capital preservation)

Tip 2: Diversify Your Portfolio

Diversification is a key principle of investing, and it’s especially important when investing in a sector-specific fund like the Vanguard Health Care Fund. By diversifying your portfolio across different asset classes, sectors, and geographic regions, you can reduce your exposure to any one particular market or sector. Consider allocating your portfolio across a range of asset classes, including: * Stocks * Bonds * Real estate * Commodities * International markets By diversifying your portfolio, you can help reduce risk and increase potential returns over the long term.

Tip 3: Monitor and Adjust Your Portfolio Regularly

Investing in the Vanguard Health Care Fund requires ongoing monitoring and adjustment. The healthcare sector is constantly evolving, with new technologies, treatments, and regulations emerging all the time. As a result, it’s essential to regularly review your portfolio to ensure it remains aligned with your investment goals and risk tolerance. Consider the following factors when monitoring and adjusting your portfolio: * Changes in the healthcare sector or market trends * Shifts in your investment goals or risk tolerance * Changes in the fund’s investment strategy or management team * Tax implications of buying or selling fund shares

Tip 4: Consider the Fund’s Expenses and Fees

The Vanguard Health Care Fund, like all mutual funds, charges expenses and fees to investors. These fees can eat into your returns over time, so it’s essential to understand the fund’s expense ratio and other fees. The fund’s expense ratio is currently around 0.34%, which is relatively low compared to other healthcare funds. However, it’s still important to consider the impact of fees on your returns over the long term. Consider the following factors when evaluating the fund’s expenses and fees: * Expense ratio * Management fees * Distribution fees * Other expenses

Tip 5: Stay Informed and Up-to-Date

Finally, it’s essential to stay informed and up-to-date on the latest developments in the healthcare sector and the Vanguard Health Care Fund. This includes monitoring news and trends, as well as staying informed about the fund’s performance and investment strategy. Consider the following resources to stay informed: * News articles and industry publications * The fund’s website and investor reports * Financial news and analysis * Social media and online forums

💡 Note: It's essential to do your own research and consult with a financial advisor before investing in the Vanguard Health Care Fund or any other investment product.

In summary, investing in the Vanguard Health Care Fund requires careful consideration of your investment goals, risk tolerance, and overall financial situation. By following these five tips, you can make informed decisions and maximize your returns. Remember to evaluate your investment goals and risk tolerance, diversify your portfolio, monitor and adjust your portfolio regularly, consider the fund’s expenses and fees, and stay informed and up-to-date on the latest developments in the healthcare sector.

The Vanguard Health Care Fund offers a unique opportunity for investors to tap into the growth and innovation in the healthcare sector. With its diverse portfolio of healthcare stocks, the fund provides a way for investors to capitalize on the potential of this rapidly evolving industry. By understanding the fund’s investment strategy, evaluating your investment goals and risk tolerance, diversifying your portfolio, monitoring and adjusting your portfolio regularly, considering the fund’s expenses and fees, and staying informed and up-to-date, you can make informed decisions and achieve your investment objectives.

As you consider investing in the Vanguard Health Care Fund, remember that investing in the stock market involves risks, and there are no guarantees of returns. However, with careful planning, ongoing monitoring, and a long-term perspective, you can increase your potential for success and achieve your investment goals.

What is the Vanguard Health Care Fund’s investment strategy?

+

The Vanguard Health Care Fund invests in stocks of companies involved in the healthcare industry, including pharmaceuticals, biotechnology, medical devices, and healthcare services. The fund’s managers use a combination of quantitative and qualitative analysis to select stocks with strong growth potential.

How do I evaluate my investment goals and risk tolerance?

+

To evaluate your investment goals and risk tolerance, consider factors such as your investment time horizon, risk tolerance, overall financial situation, and investment goals (e.g., growth, income, or capital preservation). You may also want to consult with a financial advisor to determine the best investment strategy for your individual circumstances.

What are the benefits of diversifying my portfolio?

+

Diversifying your portfolio can help reduce risk and increase potential returns over the long term. By allocating your portfolio across different asset classes, sectors, and geographic regions, you can reduce your exposure to any one particular market or sector and increase your potential for long-term success.

Related Terms:

- Vanguard login

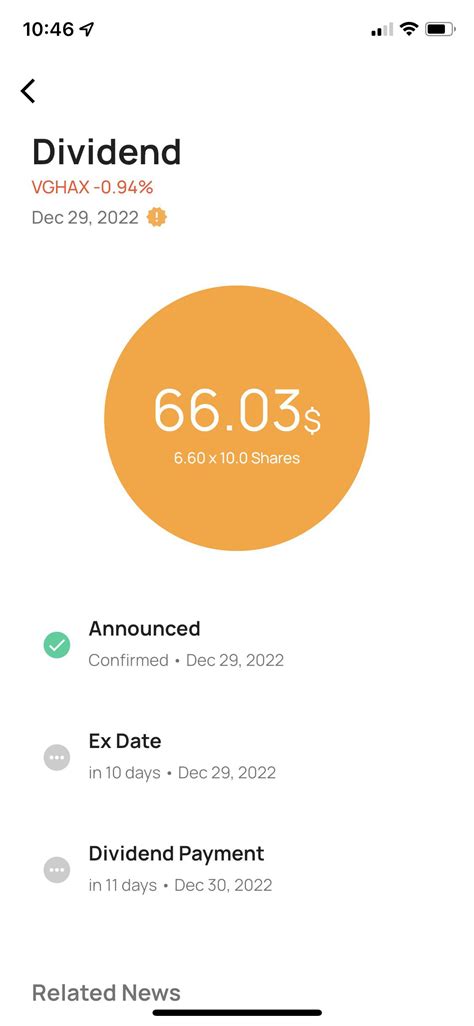

- VGHAX dividend History

- Vanguard Health Care Index fund

- Is Vanguard Healthcare fund good

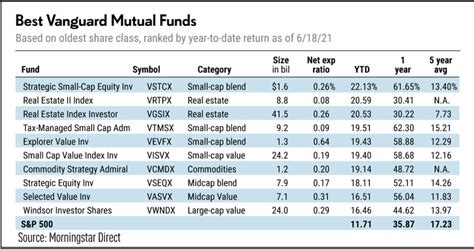

- Best Vanguard Healthcare funds

- Vanguard index funds