5 Vanguard HSA Tips

Introduction to Vanguard HSA

The Health Savings Account (HSA) offered by Vanguard is a valuable tool for individuals with high-deductible health plans, allowing them to save pre-tax dollars for medical expenses. Vanguard, known for its investment options, brings a unique approach to managing HSA funds by offering a range of investment choices. This flexibility can help HSA owners grow their savings over time, making it a crucial component of health care financial planning. Understanding how to maximize the benefits of a Vanguard HSA requires some strategy and planning.

Understanding Vanguard HSA Benefits

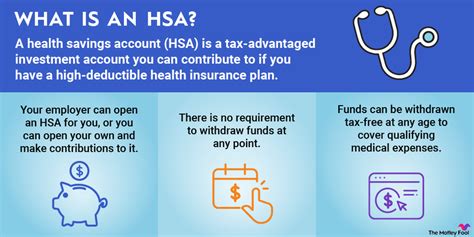

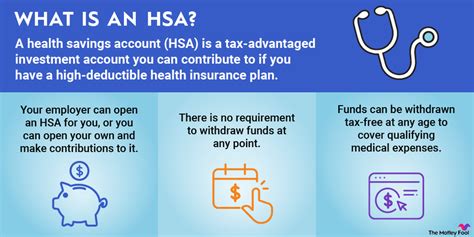

Before diving into the tips, it’s essential to understand the benefits of a Vanguard HSA. These accounts are triple tax-advantaged, meaning contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free. Additionally, HSAs are portable, meaning they stay with you even if you change jobs or retire. Vanguard’s investment options allow you to potentially grow your HSA funds significantly over time, making it a long-term savings vehicle for healthcare costs in retirement.

5 Vanguard HSA Tips

To get the most out of your Vanguard HSA, consider the following strategies:

- Contribute Consistently: Contributing to your HSA consistently, even if it’s a small amount each month, can add up over time. Vanguard allows you to set up automatic contributions, making it easier to build your HSA balance.

- Invest for Growth: Vanguard offers a variety of investment options for HSA funds. Investing a portion of your HSA in stocks or mutual funds can help your balance grow faster than inflation, especially if you don’t anticipate needing the funds immediately.

- Keep Receipts and Records: It’s crucial to keep detailed records of your medical expenses and receipts for items purchased with HSA funds. Vanguard may request documentation to verify the eligibility of expenses, and having everything organized can make the process smoother.

- Consider Catch-Up Contributions: If you’re 55 or older, you can make catch-up contributions to your HSA, which is an additional $1,000 in 2022. This can be a great way to boost your savings, especially if you’re nearing retirement and anticipate higher healthcare costs.

- Plan for Retirement Healthcare Costs: HSAs can be a powerful tool for saving for healthcare costs in retirement. By contributing to and investing your HSA over time, you can build a dedicated fund for healthcare expenses, helping to ensure that you’re prepared for any medical needs that may arise.

Investment Options with Vanguard HSA

Vanguard offers a range of investment options for HSA funds, including index funds, ETFs, and other low-cost investments. When investing your HSA, it’s essential to consider your risk tolerance and time horizon. If you won’t need the funds for several years, you may be able to take on more risk in pursuit of higher returns. Conversely, if you anticipate needing the funds sooner, more conservative investments might be more appropriate.

| Investment Type | Risk Level | Potential Return |

|---|---|---|

| Conservative Funds | Low | Lower Returns |

| Moderate Funds | Medium | Medium Returns |

| Agressive Funds | High | Higher Returns |

💡 Note: Always consult with a financial advisor before making investment decisions, especially when it comes to your HSA.

Maximizing HSA Benefits

To maximize the benefits of your Vanguard HSA, it’s crucial to understand the rules and regulations surrounding these accounts. For instance, qualified medical expenses can be reimbursed tax-free from your HSA, but non-qualified expenses may incur penalties and taxes before age 65. After age 65, you can use HSA funds for non-qualified expenses without penalty, though you’ll pay income tax on those withdrawals.

In summary, a Vanguard HSA can be a valuable tool for managing healthcare costs, both now and in retirement. By contributing consistently, investing wisely, and understanding the rules, you can make the most of this unique savings opportunity.

What is the main benefit of a Vanguard HSA?

+

The main benefit of a Vanguard HSA is its triple tax advantage: contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free.

Can I use my HSA for non-medical expenses?

+

Yes, but with some caveats. Before age 65, using HSA funds for non-qualified expenses incurs a 20% penalty and income tax on the withdrawal. After age 65, you won’t face a penalty, but you’ll pay income tax on those withdrawals.

How do I invest my Vanguard HSA funds?

+

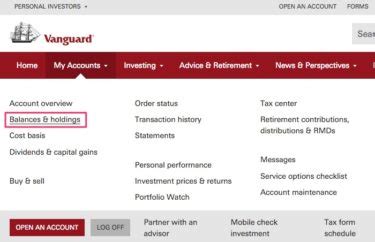

Vanguard offers a variety of investment options for HSA funds, including index funds and ETFs. You can log in to your Vanguard account to explore and select investments that align with your risk tolerance and financial goals.

Related Terms:

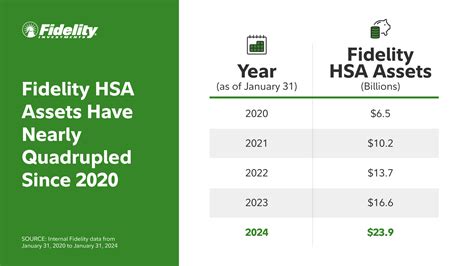

- Fidelity health savings account

- Best health savings account

- Vanguard login

- Health Equity HSA

- Vanguard savings plan

- How to open HSA account