Wellstar Health Employee Loan Options

Introduction to Wellstar Health Employee Loan Options

Wellstar Health is a leading healthcare system in the United States, known for its commitment to providing high-quality patient care and supporting the well-being of its employees. As part of its employee benefits package, Wellstar Health offers various loan options to help its staff manage their financial needs. In this article, we will explore the different types of loans available to Wellstar Health employees, their benefits, and the application process.

Types of Loans Available

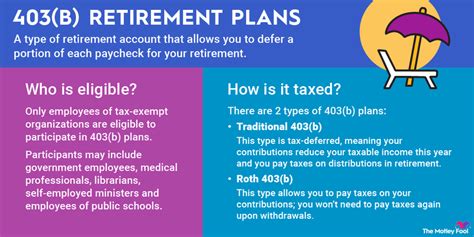

Wellstar Health offers several types of loans to its employees, including: * Personal Loans: These loans can be used for any personal purpose, such as paying off debt, financing a large purchase, or covering unexpected expenses. * Auto Loans: Designed to help employees purchase a new or used vehicle, these loans often come with competitive interest rates and flexible repayment terms. * Home Loans: Wellstar Health offers home loans to help employees purchase, refinance, or renovate a home, with options for fixed-rate and adjustable-rate mortgages. * Education Loans: These loans are designed to help employees pursue higher education or continuing education courses, with options for undergraduate and graduate degree programs. * Emergency Loans: In cases of financial hardship or unexpected expenses, Wellstar Health offers emergency loans with flexible repayment terms and competitive interest rates.

Benefits of Wellstar Health Employee Loan Options

The loan options offered by Wellstar Health come with several benefits, including: * Competitive Interest Rates: Wellstar Health offers competitive interest rates on all its loan products, helping employees save money on interest payments. * Flexible Repayment Terms: Employees can choose from a range of repayment terms, including monthly, bi-weekly, or weekly payments, to fit their individual financial needs. * No Prepayment Penalties: Wellstar Health does not charge prepayment penalties, allowing employees to pay off their loans early without incurring additional fees. * Simple Application Process: The application process for Wellstar Health employee loans is straightforward and easy to navigate, with minimal paperwork and quick approval times.

Application Process

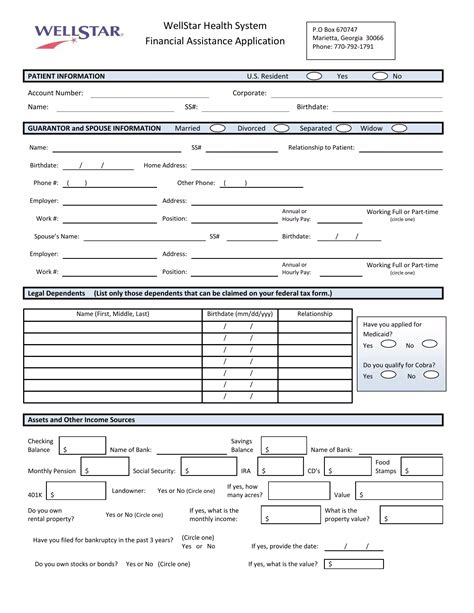

To apply for a Wellstar Health employee loan, follow these steps: * Check your eligibility: Review the loan options and eligibility criteria to ensure you meet the requirements. * Gather required documents: Typically, you will need to provide proof of income, employment, and identity. * Submit your application: You can apply online, by phone, or in person at a Wellstar Health financial center. * Review and sign your loan agreement: Once your application is approved, review the terms and conditions of your loan and sign the agreement.

💡 Note: It's essential to carefully review the terms and conditions of your loan before signing the agreement, and to ask questions if you're unsure about any aspect of the loan.

Repayment Options

Wellstar Health offers various repayment options to help employees manage their loan payments, including: * Automated Payments: Employees can set up automatic payments from their paycheck or bank account. * Online Payments: Employees can make payments online through the Wellstar Health website or mobile app. * Phone Payments: Employees can make payments over the phone by calling the Wellstar Health customer service center. * In-Person Payments: Employees can make payments in person at a Wellstar Health financial center.

Managing Your Loan

To ensure you’re making the most of your Wellstar Health employee loan, consider the following tips: * Create a budget: Track your income and expenses to ensure you can afford your loan payments. * Make timely payments: Set up automatic payments or reminders to ensure you never miss a payment. * Monitor your credit report: Keep an eye on your credit report to ensure it’s accurate and up-to-date. * Consider loan consolidation: If you have multiple loans, consider consolidating them into a single loan with a lower interest rate and lower monthly payments.

| Loan Type | Interest Rate | Repayment Term |

|---|---|---|

| Personal Loan | 6.99% - 18.99% | 12 - 60 months |

| Auto Loan | 4.99% - 12.99% | 24 - 72 months |

| Home Loan | 4.5% - 10.5% | 120 - 360 months |

In summary, Wellstar Health employee loan options provide a range of benefits, including competitive interest rates, flexible repayment terms, and a simple application process. By understanding the different types of loans available and following the tips outlined above, employees can make informed decisions about their financial needs and manage their loans effectively. As we reflect on the key points discussed, it’s clear that Wellstar Health is committed to supporting the financial well-being of its employees, and its loan options are an essential part of this effort.

What types of loans are available to Wellstar Health employees?

+

Wellstar Health offers personal loans, auto loans, home loans, education loans, and emergency loans to its employees.

How do I apply for a Wellstar Health employee loan?

+

You can apply online, by phone, or in person at a Wellstar Health financial center. You will need to provide proof of income, employment, and identity.

What are the benefits of Wellstar Health employee loan options?

+

The benefits of Wellstar Health employee loan options include competitive interest rates, flexible repayment terms, and no prepayment penalties.

Related Terms:

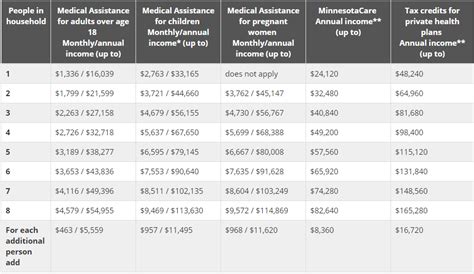

- Wellstar Financial Assistance income limits

- Wellstar financial assistance phone number

- Wellstar financial assistance reviews

- Wellstar benefits 2024

- Wellstar student loan Forgiveness

- Wellstar employee Assistance program