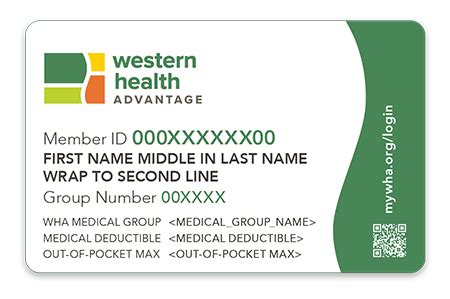

Western Health Advantage Plans

Introduction to Western Health Advantage Plans

Western Health Advantage (WHA) is a non-profit health plan that offers a range of health insurance plans to individuals, families, and groups in California. With a focus on providing high-quality, affordable healthcare, WHA has become a popular choice for those seeking comprehensive coverage. In this article, we will delve into the details of Western Health Advantage plans, exploring their features, benefits, and eligibility requirements.

Types of Western Health Advantage Plans

WHA offers a variety of plans to cater to different needs and budgets. Some of the most popular plans include: * HMO (Health Maintenance Organization) plans: These plans provide coverage for a wide range of medical services, including doctor visits, hospital stays, and prescriptions, with a focus on preventive care. * PPO (Preferred Provider Organization) plans: These plans offer more flexibility, allowing members to see any healthcare provider, both in-network and out-of-network, although out-of-network care typically costs more. * EPO (Exclusive Provider Organization) plans: These plans combine elements of HMO and PPO plans, offering a network of providers but also allowing members to see specialists without a referral. * Medicare Advantage plans: These plans are designed for individuals eligible for Medicare, providing additional benefits and coverage beyond traditional Medicare.

Key Features and Benefits

Western Health Advantage plans come with a range of features and benefits, including: * Comprehensive coverage: WHA plans cover a wide range of medical services, including doctor visits, hospital stays, prescriptions, and more. * Preventive care: WHA plans emphasize preventive care, covering services like routine check-ups, screenings, and vaccinations. * Low out-of-pocket costs: WHA plans often have low deductibles, copays, and coinsurance, making healthcare more affordable. * Large network of providers: WHA has a extensive network of healthcare providers, including primary care physicians, specialists, and hospitals. * Additional benefits: Some WHA plans offer additional benefits, such as vision, dental, and hearing coverage.

Eligibility and Enrollment

To be eligible for a Western Health Advantage plan, individuals and families must meet certain requirements, including: * Residency: Applicants must reside in California. * Age: There are no age restrictions for WHA plans, although some plans may have specific age-related requirements. * Income: Some WHA plans have income requirements, although these vary depending on the plan. * Open enrollment: WHA plans are available during the annual open enrollment period, although special enrollment periods may be available for qualifying life events.

📝 Note: Eligibility and enrollment requirements may vary depending on the specific plan and individual circumstances.

Plan Comparison and Selection

With so many Western Health Advantage plans available, choosing the right one can be overwhelming. To make the process easier, consider the following factors: * Premium cost: Calculate the monthly premium cost and ensure it fits within your budget. * Out-of-pocket costs: Consider the deductible, copays, and coinsurance associated with each plan. * Network of providers: Ensure the plan’s network includes your preferred healthcare providers. * Additional benefits: Think about any additional benefits you may need, such as vision or dental coverage. * Plan type: Decide whether an HMO, PPO, EPO, or Medicare Advantage plan best suits your needs.

Conclusion and Final Thoughts

In conclusion, Western Health Advantage plans offer a range of comprehensive and affordable health insurance options for individuals, families, and groups in California. By understanding the features, benefits, and eligibility requirements of each plan, you can make an informed decision and choose the best plan for your unique needs and circumstances. Remember to carefully review and compare plans, considering factors like premium cost, out-of-pocket costs, and network of providers, to ensure you find the perfect fit.

What is the difference between an HMO and PPO plan?

+

An HMO plan typically requires members to receive care from a specific network of providers, while a PPO plan offers more flexibility, allowing members to see any healthcare provider, both in-network and out-of-network.

Are Western Health Advantage plans available to individuals with pre-existing conditions?

+

Yes, Western Health Advantage plans are available to individuals with pre-existing conditions, as they are prohibited from denying coverage based on pre-existing conditions under the Affordable Care Act.

Can I enroll in a Western Health Advantage plan outside of the open enrollment period?

+

Yes, you may be eligible to enroll in a Western Health Advantage plan outside of the open enrollment period if you experience a qualifying life event, such as losing job-based coverage, getting married, or having a baby.

Related Terms:

- Natomas Gateway Corporate Center

- western health advantage alamat

- western health advantage telepon

- western health advantage jam buka

- Western Health Advantage careers

- Western Health Advantage Claims Address