5 Tips Wex Health Cobra

Understanding COBRA Insurance: A Comprehensive Guide

COBRA (Consolidated Omnibus Budget Reconciliation Act) insurance is a federal law that allows individuals to continue their health insurance coverage after leaving a job, reducing work hours, or experiencing other qualifying events. This law applies to companies with 20 or more employees and provides a safety net for those who might otherwise lose their health insurance. In this article, we will delve into the specifics of COBRA insurance, its benefits, and how it can be a vital component of your health care strategy.

What is COBRA Insurance?

COBRA insurance is not a type of health insurance itself but rather a provision that allows you to extend your existing group health plan coverage for a limited time after you are no longer eligible for the plan. This could be due to various reasons such as job loss, reduction in work hours, divorce, or death of the covered employee. The law requires that the employer offer the option to continue coverage for a specified period, usually up to 18, 24, or 36 months, depending on the qualifying event.

Benefits of COBRA Insurance

One of the primary benefits of COBRA insurance is that it allows individuals and their families to maintain continuous health insurance coverage, which is crucial for managing chronic conditions, undergoing treatments, or simply having peace of mind. Here are some key advantages: - Continuous Coverage: You can keep your current health plan without interruptions, which means you won’t have to worry about pre-existing conditions or waiting periods. - Family Coverage: COBRA also applies to your spouse and dependent children, ensuring they can maintain their health insurance as well. - Time to Explore Options: The extension period gives you time to find new employment that offers health benefits or to explore other health insurance options, such as individual or family plans through the Health Insurance Marketplace.

How to Choose the Right COBRA Plan

Choosing the right COBRA plan involves considering several factors, including your current health needs, the cost of premiums, and the length of coverage you require. Here are some steps to help you make an informed decision: - Assess Your Needs: Evaluate your health care needs and those of your family. Consider any ongoing medical treatments or needs that will require continuous coverage. - Cost Consideration: COBRA premiums can be expensive since you will be responsible for the full cost of the plan, including any portion that your employer previously covered. You need to weigh the cost against your budget and consider other affordable options. - Duration of Coverage: Determine how long you will need the coverage. If you anticipate a short gap before finding new employment with benefits, a shorter COBRA period might suffice.

5 Tips for Managing COBRA Insurance

Managing COBRA insurance effectively requires understanding your options, planning ahead, and making informed decisions. Here are five tips to help you navigate the process: - Understand Your Eligibility: Familiarize yourself with the qualifying events that make you eligible for COBRA and the notice requirements. Your employer must notify the plan administrator within 30 days of the qualifying event. - Review Plan Options: If your employer offers multiple health plans, review each option carefully. The plan you were on before might not be the best choice for COBRA, considering the cost and coverage. - Consider Alternatives: Explore other health insurance options such as Affordable Care Act (ACA) plans, short-term health insurance, or spouse’s plan, if available. Sometimes, these alternatives can offer more affordable or suitable coverage. - Budget for Premiums: Since you will be paying the full premium, ensure you budget accordingly. COBRA premiums can be high, so it’s essential to factor this expense into your financial planning. - Keep Records: Maintain detailed records of your COBRA coverage, including premiums paid, coverage start and end dates, and any claims submitted. This documentation can be crucial for tax purposes or when applying for future health insurance coverage.

Alternatives to COBRA Insurance

While COBRA provides a vital safety net, it’s not the only option for those losing their job-based health insurance. Here are some alternatives to consider: - Affordable Care Act (ACA) Plans: Also known as Obamacare, these plans are available through the Health Insurance Marketplace and offer comprehensive coverage with subsidies based on income. - Short-Term Health Insurance: These plans provide temporary coverage for a limited period (usually up to 12 months but can vary by state) and are generally cheaper than COBRA. However, they often do not cover pre-existing conditions and offer limited benefits. - Spouse’s Plan: If your spouse is employed and their employer offers health insurance, you might be able to get covered under their plan.

📝 Note: Always compare the costs and benefits of these alternatives against COBRA to make the best decision for your health care needs and financial situation.

In the end, understanding and navigating the complexities of health insurance, including COBRA and its alternatives, is crucial for maintaining continuous coverage and managing your health care expenses effectively. By being informed and planning ahead, you can ensure that you and your family have the health insurance coverage you need, even during times of transition or uncertainty.

What is the primary purpose of COBRA insurance?

+

The primary purpose of COBRA insurance is to allow individuals and their families to temporarily continue their health insurance coverage after experiencing a qualifying event that would otherwise result in the loss of their group health plan coverage.

How long does COBRA coverage last?

+

COBRA coverage can last for 18, 24, or 36 months, depending on the qualifying event. For example, job loss typically qualifies for 18 months of coverage, while the death of the covered employee or divorce can qualify for 36 months.

Do I have to pay for COBRA insurance myself?

+

Yes, when you elect COBRA coverage, you are responsible for paying the full premium yourself, which includes the portion that your employer used to cover. However, you may be able to deduct these premiums from your taxes as medical expenses.

Related Terms:

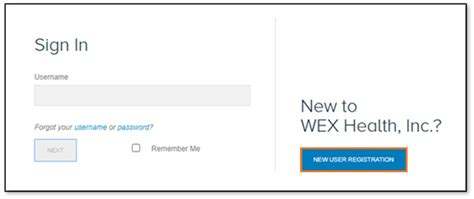

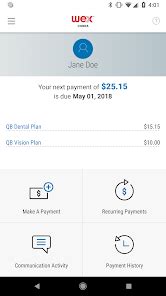

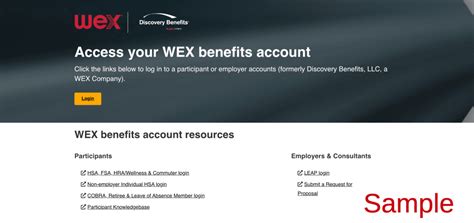

- WEX health COBRA payment online

- WEX health COBRA phone number

- WEX health COBRA customer service

- COBRA WEX login

- WEX health COBRA login app

- cobra login health