5 Ways Commercial Health Insurance Works

Introduction to Commercial Health Insurance

Commercial health insurance is a type of health insurance that is provided by private companies, as opposed to government-funded programs. It is designed to help individuals and families cover the costs of medical care, including doctor visits, hospital stays, and other health-related expenses. In this article, we will explore the ways in which commercial health insurance works, including the different types of plans, how premiums are determined, and what is covered.

Types of Commercial Health Insurance Plans

There are several types of commercial health insurance plans, including: * Health Maintenance Organization (HMO) plans, which require policyholders to receive medical care from a specific network of providers * Preferred Provider Organization (PPO) plans, which allow policyholders to receive care from any provider, but offer discounted rates for care received from in-network providers * Point of Service (POS) plans, which combine elements of HMO and PPO plans * Exclusive Provider Organization (EPO) plans, which are similar to HMO plans but do not require a primary care physician referral to see a specialist * High-Deductible Health Plan (HDHP) plans, which have lower premiums but higher deductibles than other types of plans

How Premiums Are Determined

The premiums for commercial health insurance plans are determined by a variety of factors, including: * Age: Older individuals typically pay higher premiums than younger individuals * Health status: Individuals with pre-existing medical conditions may pay higher premiums than those without * Location: Premiums can vary depending on the state or region in which the policyholder lives * Plan type: Different types of plans, such as HMO or PPO plans, may have different premium rates * Level of coverage: Plans with higher levels of coverage, such as lower deductibles and copays, may have higher premiums

What is Covered by Commercial Health Insurance

Commercial health insurance plans typically cover a range of medical expenses, including: * Doctor visits * Hospital stays * Surgical procedures * Prescription medications * Lab tests and imaging services * Rehabilitation and physical therapy However, the specific services and expenses covered can vary depending on the plan and the insurance company.

5 Ways Commercial Health Insurance Works

Here are 5 ways in which commercial health insurance works: * Network providers: Commercial health insurance plans often have a network of providers who have agreed to offer discounted rates to policyholders. Policyholders may be required to receive care from in-network providers in order to receive coverage. * Claims processing: When a policyholder receives medical care, the provider will submit a claim to the insurance company. The insurance company will then process the claim and determine the amount of coverage. * Out-of-pocket costs: Policyholders may be required to pay out-of-pocket costs, such as deductibles, copays, and coinsurance, in addition to their premiums. * Pre-authorization: Some commercial health insurance plans may require pre-authorization for certain medical services or procedures. * Appeals process: If a claim is denied, policyholders may be able to appeal the decision through the insurance company’s appeals process.

💡 Note: It's essential to carefully review the terms and conditions of a commercial health insurance plan before purchasing to understand what is covered and what is not.

Table of Commercial Health Insurance Plan Types

| Plan Type | Description |

|---|---|

| HMO | Requires policyholders to receive care from a specific network of providers |

| PPO | Allows policyholders to receive care from any provider, but offers discounted rates for in-network care |

| POS | Combines elements of HMO and PPO plans |

| EPO | Similar to HMO plans, but does not require a primary care physician referral to see a specialist |

| HDHP | Has lower premiums but higher deductibles than other types of plans |

In summary, commercial health insurance works by providing policyholders with access to a network of providers, processing claims, and covering a range of medical expenses. Policyholders can choose from a variety of plan types, including HMO, PPO, POS, EPO, and HDHP plans, and can customize their coverage to meet their individual needs. By understanding how commercial health insurance works, individuals and families can make informed decisions about their health care coverage and ensure that they have access to the medical care they need.

What is the difference between an HMO and a PPO plan?

+

An HMO plan requires policyholders to receive care from a specific network of providers, while a PPO plan allows policyholders to receive care from any provider, but offers discounted rates for in-network care.

How do I choose the right commercial health insurance plan for me?

+

To choose the right commercial health insurance plan, consider your individual needs and budget, as well as the plan’s network, coverage, and out-of-pocket costs.

Can I customize my commercial health insurance coverage?

+

Yes, many commercial health insurance plans offer customization options, such as adding or removing coverage for specific services or increasing or decreasing deductibles and copays.

Related Terms:

- What is commercial insurance

- Is united healthcare commercial Insurance

- Commercial health insurance eligibility

- Is Medicare commercial insurance

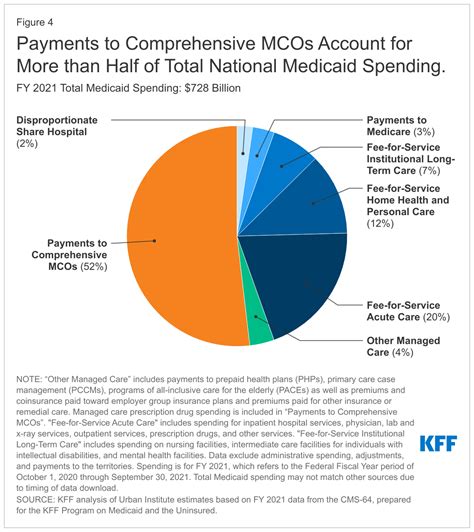

- Is Medicaid commercial insurance

- is bcbs considered commercial insurance