5 Tips Alliant Health Plans

Introduction to Alliant Health Plans

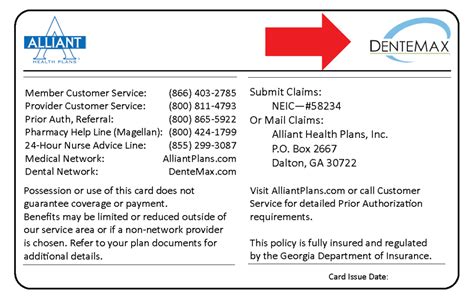

Alliant Health Plans are designed to provide individuals and families with comprehensive and affordable healthcare solutions. With the ever-increasing costs of medical care, having a reliable health plan is crucial for maintaining financial stability and ensuring access to quality healthcare services. In this article, we will discuss five essential tips for navigating Alliant Health Plans, helping you make informed decisions about your healthcare coverage.

Understanding Your Health Insurance Needs

Before selecting an Alliant Health Plan, it’s essential to assess your health insurance needs. Consider the following factors: * Age and health status: Older adults or individuals with pre-existing medical conditions may require more comprehensive coverage. * Family size and structure: Families with multiple members may need plans that offer broader coverage and higher limits. * Income and budget: Your income and budget will influence the type of plan you can afford, including the premium, deductible, and out-of-pocket expenses. * Lifestyle and health habits: Individuals with active lifestyles or those who require frequent medical check-ups may need plans with more flexible coverage options.

Comparing Alliant Health Plans

When comparing Alliant Health Plans, consider the following key aspects: * Network and provider coverage: Ensure the plan includes your preferred healthcare providers and offers a sufficient network of specialists and hospitals. * Coverage and benefits: Review the plan’s coverage for essential health benefits, such as doctor visits, hospital stays, and prescription medications. * Cost-sharing and out-of-pocket expenses: Understand the plan’s cost-sharing structure, including deductibles, copays, and coinsurance. * Plan limitations and exclusions: Be aware of any plan limitations or exclusions, such as pre-existing condition exclusions or waiting periods.

Maximizing Your Alliant Health Plan Benefits

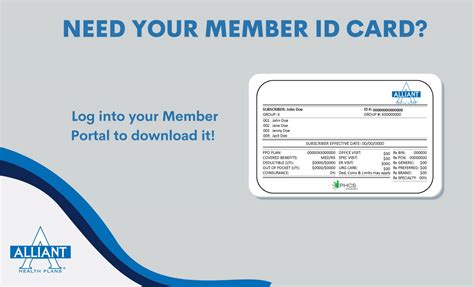

To get the most out of your Alliant Health Plan, follow these tips: * Stay informed about plan changes and updates: Regularly review your plan’s terms and conditions to ensure you’re aware of any changes or updates. * Utilize preventive care services: Take advantage of preventive care services, such as routine check-ups and screenings, to maintain your health and prevent costly medical issues. * Manage your out-of-pocket expenses: Keep track of your out-of-pocket expenses, including deductibles, copays, and coinsurance, to avoid unexpected costs. * Seek assistance when needed: Don’t hesitate to reach out to your plan’s customer support or a healthcare professional if you have questions or concerns about your coverage.

Common Mistakes to Avoid

When navigating Alliant Health Plans, be aware of the following common mistakes to avoid: * Insufficient research: Failing to thoroughly research and compare plans can lead to inadequate coverage or unexpected expenses. * Ignoring plan limitations and exclusions: Overlooking plan limitations and exclusions can result in denied claims or unexpected costs. * Not utilizing preventive care services: Failing to take advantage of preventive care services can lead to preventable medical issues and increased healthcare costs. * Not seeking assistance when needed: Delaying or avoiding seeking assistance can lead to misunderstandings about your coverage and potentially costly consequences.

Staying Ahead with Alliant Health Plans

To stay ahead with your Alliant Health Plan, consider the following strategies: * Regularly review and update your plan: Periodically assess your plan to ensure it still meets your changing healthcare needs. * Stay informed about healthcare trends and updates: Stay up-to-date with the latest healthcare trends, research, and advancements to make informed decisions about your coverage. * Seek professional advice when needed: Consult with a healthcare professional or insurance expert if you have questions or concerns about your plan or healthcare needs. * Take advantage of plan resources and tools: Utilize plan resources and tools, such as online portals or mobile apps, to manage your coverage and stay organized.

📝 Note: Always carefully review your plan's terms and conditions to ensure you understand your coverage and any potential limitations or exclusions.

In summary, navigating Alliant Health Plans requires careful consideration of your health insurance needs, plan comparisons, and maximizing your benefits. By avoiding common mistakes and staying ahead with the latest healthcare trends and updates, you can make informed decisions about your coverage and maintain financial stability.

What is the primary purpose of Alliant Health Plans?

+

The primary purpose of Alliant Health Plans is to provide individuals and families with comprehensive and affordable healthcare solutions.

How do I choose the right Alliant Health Plan for my needs?

+

To choose the right Alliant Health Plan, consider factors such as your age, health status, family size, income, and lifestyle. It’s also essential to compare plans, review coverage and benefits, and understand cost-sharing and out-of-pocket expenses.

What are some common mistakes to avoid when navigating Alliant Health Plans?

+

Common mistakes to avoid include insufficient research, ignoring plan limitations and exclusions, not utilizing preventive care services, and not seeking assistance when needed.

Related Terms:

- Truist

- alliant health plans dalton alamat

- Alliant Health Plans Provider Portal

- Who owns Alliant Health Plans

- Alliant healthcare login

- Alliant Health Plans SoloCare reviews