Health

5 Ways Anthem HSA Works

Introduction to Anthem HSA

Anthem Health Savings Account (HSA) is a type of savings account that allows individuals with high-deductible health plans to set aside pre-tax dollars for medical expenses. The funds contributed to an HSA are not subject to federal income tax, and the account earnings grow tax-free. In this article, we will discuss the 5 ways Anthem HSA works and how it can benefit individuals and families.

What is an HSA?

An HSA is a tax-advantaged savings account that is designed to help individuals with high-deductible health plans pay for qualified medical expenses. To be eligible for an HSA, an individual must have a high-deductible health plan and cannot be enrolled in any other health coverage, such as Medicare or a general health insurance plan. The key benefits of an HSA include: * Tax-deductible contributions * Tax-free earnings * Tax-free withdrawals for qualified medical expenses * Portability, meaning the account stays with the individual even if they change jobs or retire

5 Ways Anthem HSA Works

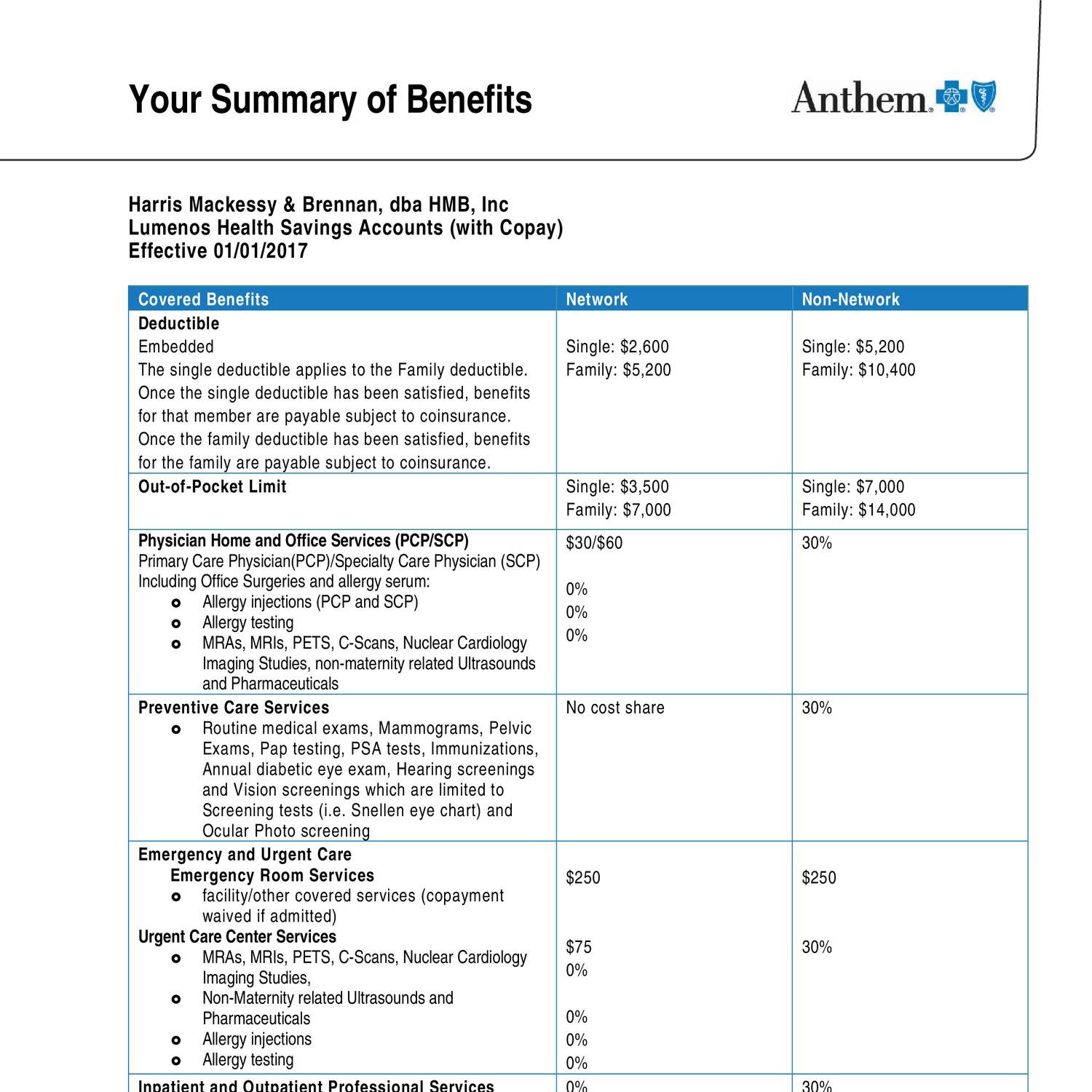

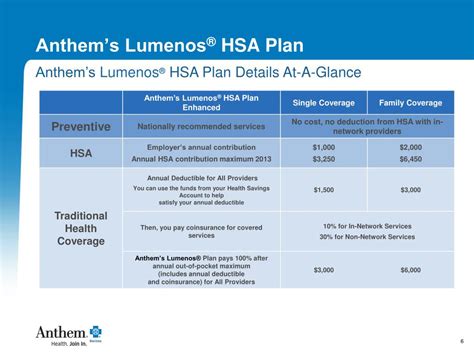

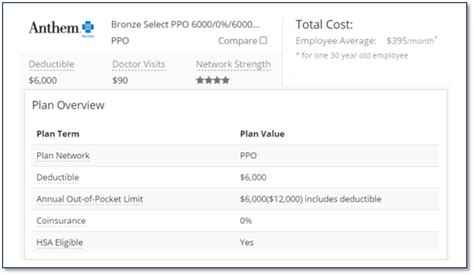

Here are 5 ways Anthem HSA works to help individuals and families manage their medical expenses: * Contribution Limits: Anthem HSA has contribution limits that are set by the IRS each year. In 2022, the contribution limit for an individual is 3,650 and 7,300 for a family. These limits apply to the total contributions made by the individual and their employer. * Eligible Expenses: Anthem HSA allows individuals to use their funds to pay for qualified medical expenses, such as doctor visits, prescription medications, and hospital stays. Some examples of eligible expenses include: + Medical services, such as doctor visits and hospital stays + Prescription medications and equipment + Dental and vision care + Over-the-counter medications and supplies * Investment Options: Anthem HSA offers investment options that allow individuals to grow their funds over time. These options may include: + Stocks + Bonds + Mutual funds + Exchange-traded funds (ETFs) * Portability: Anthem HSA is portable, meaning that the account stays with the individual even if they change jobs or retire. This allows individuals to take their HSA with them and continue to use it to pay for qualified medical expenses. * Account Management: Anthem HSA provides online account management tools that allow individuals to track their account balance, view their transaction history, and manage their investments. These tools make it easy for individuals to manage their HSA and make informed decisions about their healthcare expenses.

Benefits of Anthem HSA

Anthem HSA offers several benefits to individuals and families, including: * Tax savings: Contributions to an HSA are tax-deductible, and the funds grow tax-free. * Flexibility: HSAs are portable, and individuals can use their funds to pay for qualified medical expenses at any time. * Investment opportunities: HSAs offer investment options that allow individuals to grow their funds over time. * Control: Individuals have control over their HSA and can make decisions about how to use their funds.

How to Get Started with Anthem HSA

To get started with Anthem HSA, individuals can follow these steps: * Check eligibility: Ensure that you have a high-deductible health plan and are not enrolled in any other health coverage. * Open an account: Apply for an HSA through Anthem or another provider. * Fund your account: Contribute to your HSA through payroll deductions or online transfers. * Manage your account: Use online tools to track your account balance, view your transaction history, and manage your investments.

📝 Note: It's essential to review the terms and conditions of your HSA and understand the rules and regulations that apply to your account.

To summarize, Anthem HSA is a valuable tool for individuals and families who want to manage their medical expenses and save for the future. By understanding how Anthem HSA works and the benefits it offers, individuals can make informed decisions about their healthcare expenses and take control of their financial well-being.

What is the contribution limit for an HSA in 2022?

+

The contribution limit for an individual is 3,650 and 7,300 for a family in 2022.

Can I use my HSA to pay for non-medical expenses?

+

No, HSAs can only be used to pay for qualified medical expenses. Non-medical expenses are subject to income tax and a 20% penalty.

Can I invest my HSA funds in stocks or mutual funds?

+

Related Terms:

- Anthem HSA login

- Anthem HSA card balance

- Anthem spending account login

- Anthem hsa plan providers

- Anthem HSA plan PPO

- Anthem HSA ATM withdrawal