5 Tips Fix Claims

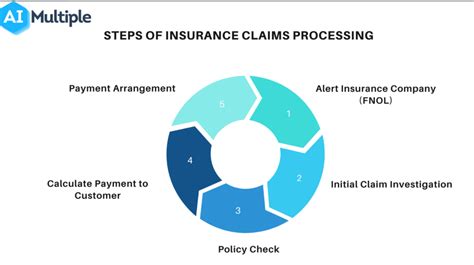

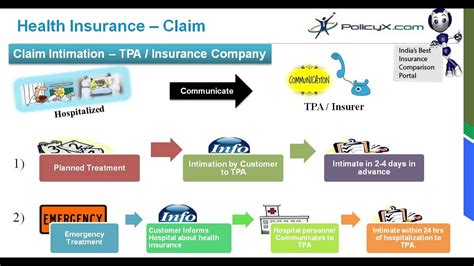

Understanding the Claims Process

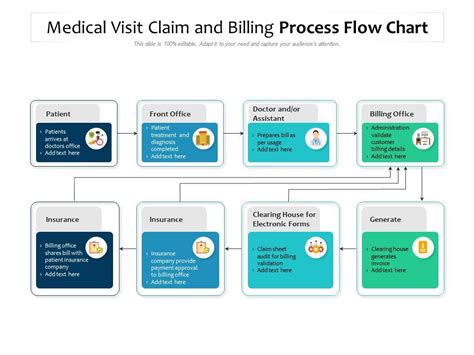

When dealing with insurance, one of the most critical aspects is the claims process. It’s the moment of truth where policyholders find out if their investment was worth it. However, this process can sometimes be daunting, filled with paperwork, and may lead to frustration if not navigated correctly. To help mitigate these issues, we’ve compiled a list of tips to ensure a smoother claims experience.

Preparation is Key

Before diving into the claims process, it’s essential to be prepared. This means having all necessary documents and information at hand. Policy documents, claim forms, and any evidence supporting your claim should be readily available. Organizing these documents digitally can help prevent loss and ensure they are easily accessible when needed.

5 Tips to Fix Claims Issues

Here are five key tips to help fix common claims issues: - Understand Your Policy: Before filing a claim, make sure you understand what your policy covers. This can prevent unnecessary claims and reduce the risk of your claim being denied. - Document Everything: Keep detailed records of any incidents leading to a claim. This includes photos, witness statements, and any communication with the insurance company. - Act Quickly: Most insurance policies have time limits for filing claims. Acting quickly ensures you don’t miss these deadlines. - Seek Professional Advice: If you’re unsure about any part of the claims process, consider seeking advice from a professional, such as an insurance broker or a lawyer specializing in insurance law. - Stay Persistent but Polite: If your claim is denied, don’t give up. You have the right to appeal. Stay polite and professional in your communications, as this can positively impact the outcome of your appeal.

Navigating the Appeals Process

If your claim is denied, understanding the appeals process is crucial. This typically involves submitting additional evidence to support your claim or clarifying any misunderstandings. Persistency and patience are vital during this phase, as the appeals process can be lengthy.

Utilizing Technology for Efficiency

In today’s digital age, many insurance companies offer online platforms for filing and tracking claims. Utilizing these resources can significantly streamline the process, providing updates in real-time and reducing the need for physical paperwork.

Common Mistakes to Avoid

Several common mistakes can hinder the claims process. These include:

- Insufficient Documentation: Not having enough evidence to support your claim can lead to denial.

- Missing Deadlines: Failing to file your claim within the specified timeframe can result in your claim being rejected.

- Lack of Understanding of Policy Terms: Not knowing what your policy covers can lead to filing unnecessary claims.

💡 Note: Always review your policy documents carefully to understand the terms and conditions before filing a claim.

Importance of Communication

Effective communication with your insurance provider is key to a successful claims process. Keeping them informed of any developments and promptly responding to their requests can expedite the process. Additionally, being transparent about the circumstances of your claim can help build trust and prevent potential issues.

| Tip | Description |

|---|---|

| 1. Stay Organized | Keep all relevant documents and information readily available. |

| 2. Be Proactive | Act quickly when filing a claim to avoid missing deadlines. |

| 3. Seek Advice | Consult professionals if you're unsure about any part of the process. |

In the end, navigating the claims process effectively requires a combination of preparation, persistence, and the right mindset. By understanding your policy, documenting everything, acting quickly, seeking professional advice when needed, and staying polite and persistent, you can significantly improve your chances of a successful claim. Remember, the goal is to ensure that you receive the compensation you deserve without unnecessary hassle or delay.

What is the first step in the claims process?

+

The first step is typically to notify your insurance provider of your intention to file a claim. This is often done over the phone or through the insurer’s website.

How long does the claims process usually take?

+

The duration of the claims process can vary significantly depending on the complexity of the claim and the efficiency of the insurance company. It can range from a few days to several months.

What should I do if my claim is denied?

+

If your claim is denied, review the denial letter carefully to understand the reasons for the denial. You then have the right to appeal, which involves providing additional information or clarification to support your claim.

Related Terms:

- Claims processing steps

- Claims processing software healthcare

- Claim processing steps in healthcare

- Claims processing companies

- Healthcare claims processing companies

- Claim processing in healthcare jobs