Military

Financial Manager Key Duties

Introduction to Financial Management

As a crucial part of any organization, financial management plays a significant role in ensuring the financial health and stability of a company. A financial manager is responsible for overseeing and managing the financial activities of the organization, including planning, organizing, and controlling financial resources. In this blog post, we will delve into the key duties of a financial manager and explore the importance of their role in driving business success.

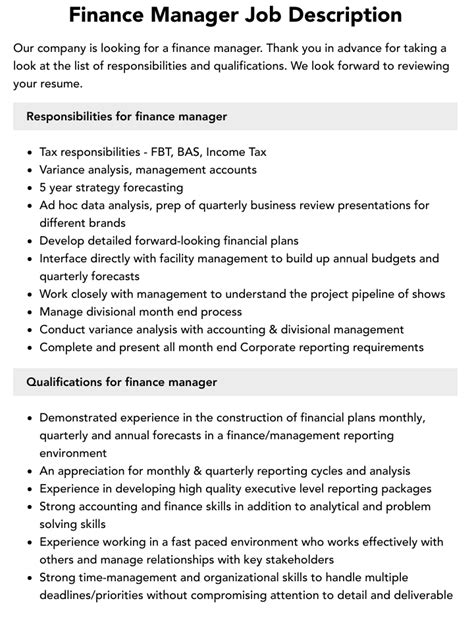

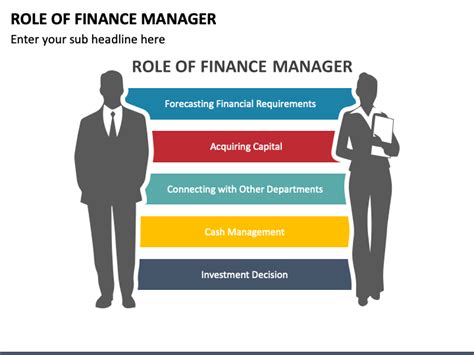

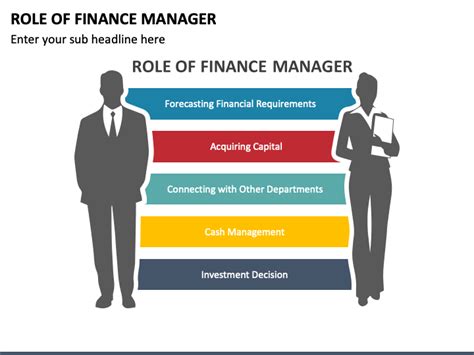

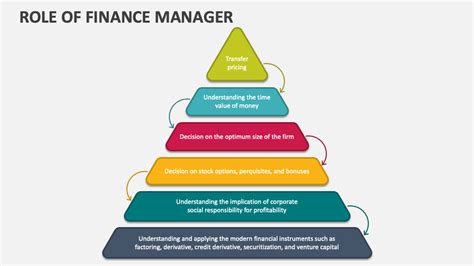

Key Responsibilities of a Financial Manager

A financial manager’s primary objective is to maximize shareholder value by making informed financial decisions. Some of the key duties of a financial manager include: * Financial Planning: Developing and implementing financial plans and strategies to achieve business objectives * Financial Analysis: Analyzing financial data and performance metrics to identify trends, opportunities, and risks * Budgeting: Preparing and managing budgets to ensure effective allocation of financial resources * Financial Reporting: Preparing and presenting financial reports to stakeholders, including management, investors, and regulatory bodies * Risk Management: Identifying and mitigating financial risks to minimize potential losses

Financial Planning and Strategy

Financial planning is a critical aspect of financial management, as it enables organizations to make informed decisions about investments, funding, and resource allocation. A financial manager must develop a comprehensive financial plan that aligns with the company’s overall business strategy. This plan should include: * Financial goals and objectives: Clearly defining what the organization wants to achieve in terms of financial performance * Financial forecasting: Estimating future financial performance based on historical data and market trends * Capital budgeting: Evaluating investment opportunities and allocating funds to projects that generate the highest returns

Financial Analysis and Performance Metrics

Financial analysis is essential for evaluating an organization’s financial performance and identifying areas for improvement. A financial manager must analyze financial data and performance metrics, such as: * Revenue growth: Analyzing trends in revenue and identifying opportunities to increase sales * Profitability: Evaluating the company’s ability to generate profits and identifying areas to improve margins * Return on investment (ROI): Measuring the return on investments and identifying opportunities to optimize returns * Debt-to-equity ratio: Evaluating the company’s capital structure and identifying opportunities to optimize financing

| Financial Metric | Description |

|---|---|

| Current Ratio | Measures a company's ability to pay short-term debts |

| Quick Ratio | Measures a company's ability to pay short-term debts without relying on inventory |

| Debt-to-Equity Ratio | Measures a company's capital structure and financing strategy |

📝 Note: Financial managers must stay up-to-date with changing market trends, regulatory requirements, and industry developments to make informed financial decisions.

Financial Reporting and Compliance

Financial reporting is a critical aspect of financial management, as it provides stakeholders with accurate and timely information about an organization’s financial performance. A financial manager must prepare and present financial reports that comply with regulatory requirements and industry standards. This includes: * Financial statements: Preparing and presenting financial statements, such as balance sheets, income statements, and cash flow statements * Regulatory reporting: Complying with regulatory requirements, such as tax returns and financial filings * Auditing and assurance: Ensuring that financial reports are accurate and reliable through auditing and assurance processes

Conclusion and Final Thoughts

In summary, a financial manager plays a vital role in driving business success by overseeing and managing financial activities, developing financial plans and strategies, analyzing financial performance, and ensuring compliance with regulatory requirements. By understanding the key duties and responsibilities of a financial manager, organizations can better appreciate the importance of financial management in achieving their goals and objectives. As the business landscape continues to evolve, financial managers must stay adaptable and responsive to changing market trends, regulatory requirements, and industry developments.

What are the primary responsibilities of a financial manager?

+

A financial manager’s primary responsibilities include financial planning, financial analysis, budgeting, financial reporting, and risk management.

What is the importance of financial planning in an organization?

+

Financial planning is essential for an organization, as it enables informed decisions about investments, funding, and resource allocation, ultimately driving business success.

What are some common financial metrics used to evaluate an organization’s financial performance?

+

Common financial metrics used to evaluate an organization’s financial performance include revenue growth, profitability, return on investment (ROI), and debt-to-equity ratio.

Related Terms:

- Finance manager adalah

- Dentist job description

- Role of financial manager ppt

- Skill finance manager

- My job description

- Qualification finance manager