Health

First Health PPO Insurance Plans

Introduction to First Health PPO Insurance Plans

First Health PPO insurance plans are a type of health insurance that offers a wide range of benefits and flexibility to policyholders. Preferred Provider Organization (PPO) plans allow individuals to choose their healthcare providers from a network of participating doctors and hospitals. In this article, we will delve into the details of First Health PPO insurance plans, their benefits, and how they work.

How First Health PPO Insurance Plans Work

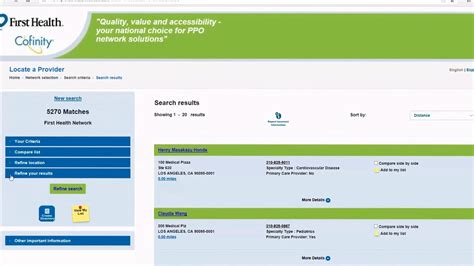

First Health PPO insurance plans work by creating a network of healthcare providers who agree to offer discounted services to policyholders. Policyholders can choose to receive care from any doctor or hospital within the network, without the need for a referral. If a policyholder chooses to receive care from a provider outside of the network, they will typically pay a higher copayment or coinsurance. The network of providers is usually large, giving policyholders a wide range of options for their healthcare needs.

Benefits of First Health PPO Insurance Plans

There are several benefits to First Health PPO insurance plans, including: * Flexibility: Policyholders have the freedom to choose their healthcare providers from a large network of participating doctors and hospitals. * No referrals needed: Policyholders do not need a referral to see a specialist, making it easier to get the care they need. * Discounted services: Policyholders receive discounted services from network providers, which can help reduce out-of-pocket costs. * Wide range of providers: The network of providers is usually large, giving policyholders a wide range of options for their healthcare needs. * Emergency coverage: First Health PPO insurance plans typically cover emergency services, even if the provider is not in the network.

Types of First Health PPO Insurance Plans

There are several types of First Health PPO insurance plans available, including: * Individual plans: These plans are designed for individuals and families who are not covered by an employer-sponsored plan. * Group plans: These plans are designed for businesses and organizations who want to offer health insurance to their employees. * Medicare plans: These plans are designed for individuals who are eligible for Medicare and want to supplement their coverage. * Dental and vision plans: These plans are designed to provide additional coverage for dental and vision care.

Cost of First Health PPO Insurance Plans

The cost of First Health PPO insurance plans varies depending on several factors, including: * Age: Premiums are typically higher for older individuals. * Location: Premiums can vary depending on the state and zip code. * Plan type: Different plan types, such as individual or group plans, can have different premium costs. * Network: The size and quality of the network can affect the premium cost. * Deductible: Plans with higher deductibles typically have lower premiums. * Copayment: Plans with higher copayments typically have lower premiums.

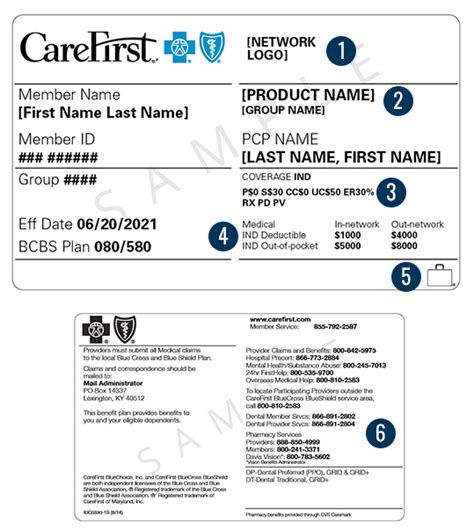

| Plan Type | Premium | Deductible | Copayment |

|---|---|---|---|

| Individual Plan | $300-$500 per month | $1,000-$2,000 per year | $20-$50 per visit |

| Group Plan | $200-$400 per month | $500-$1,000 per year | $10-$30 per visit |

| Medicare Plan | $100-$300 per month | $0-$500 per year | $0-$20 per visit |

📝 Note: The costs listed in the table are examples and may vary depending on individual circumstances.

Enrolling in First Health PPO Insurance Plans

To enroll in a First Health PPO insurance plan, individuals can: * Contact a licensed insurance agent: Agents can help individuals navigate the enrollment process and choose the best plan for their needs. * Visit the First Health website: The First Health website allows individuals to browse plans, get quotes, and enroll online. * Call the First Health customer service number: Customer service representatives can answer questions and help individuals enroll over the phone.

In summary, First Health PPO insurance plans offer a wide range of benefits and flexibility to policyholders. With a large network of providers, no referrals needed, and discounted services, these plans can provide individuals and families with the healthcare coverage they need. By understanding the different types of plans, costs, and enrollment process, individuals can make informed decisions about their health insurance needs. Ultimately, choosing the right health insurance plan is an important decision that can have a significant impact on one’s health and wellbeing.

Related Terms:

- First Health PPO reviews

- First Health Network providers

- First Health insurance phone number

- First Health PPO Aetna

- First Health Network Address

- first health ppo provider search