5 Health Insurance Tips

Introduction to Health Insurance

Health insurance is a type of insurance that covers the cost of an individual’s medical and surgical expenses. In today’s world, having health insurance is crucial as it helps to reduce the financial burden of medical expenses. With the rising cost of healthcare, it is essential to have a health insurance plan that provides adequate coverage. In this article, we will discuss five health insurance tips that can help individuals make informed decisions when choosing a health insurance plan.

Tip 1: Assess Your Needs

Before choosing a health insurance plan, it is essential to assess your needs. Consider the following factors: * Age: If you are young and healthy, you may not need a comprehensive plan. However, if you are older or have pre-existing medical conditions, you may need a plan that provides more coverage. * Health status: If you have a pre-existing medical condition, you may need a plan that provides more coverage for that condition. * Family size: If you have a large family, you may need a plan that provides coverage for all family members. * Budget: Consider how much you can afford to pay for premiums, deductibles, and out-of-pocket expenses.

Tip 2: Understand the Types of Health Insurance Plans

There are several types of health insurance plans available, including: * Health Maintenance Organization (HMO): This type of plan requires you to receive medical care from a specific network of providers. * Preferred Provider Organization (PPO): This type of plan allows you to receive medical care from any provider, but you pay less for care from providers within the network. * Exclusive Provider Organization (EPO): This type of plan is similar to a PPO, but it does not cover care from providers outside the network. * Point of Service (POS): This type of plan combines features of HMO and PPO plans.

Tip 3: Check the Network

When choosing a health insurance plan, it is essential to check the network of providers. Consider the following: * Primary care physicians: Make sure the plan includes primary care physicians in your area. * Specialists: Make sure the plan includes specialists in your area, especially if you have a pre-existing medical condition. * Hospitals: Make sure the plan includes hospitals in your area.

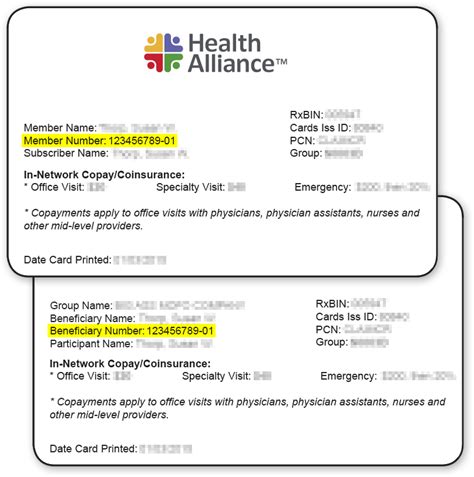

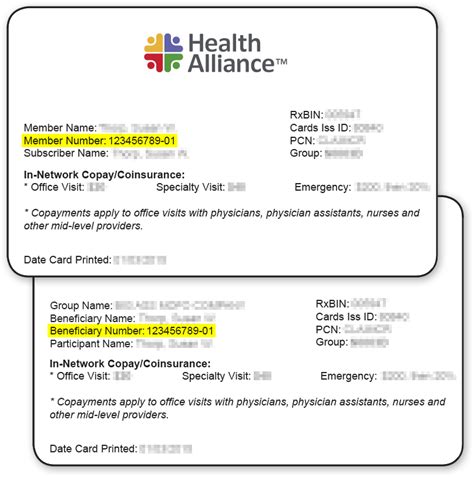

Tip 4: Review the Costs

When choosing a health insurance plan, it is essential to review the costs. Consider the following: * Premiums: The monthly cost of the plan. * Deductibles: The amount you must pay out-of-pocket before the plan starts paying. * Co-payments: The amount you must pay for each medical service. * Co-insurance: The percentage of medical expenses that you must pay. The following table summarizes the costs associated with a health insurance plan:

| Cost | Description |

|---|---|

| Premiums | The monthly cost of the plan |

| Deductibles | The amount you must pay out-of-pocket before the plan starts paying |

| Co-payments | The amount you must pay for each medical service |

| Co-insurance | The percentage of medical expenses that you must pay |

Tip 5: Read the Fine Print

When choosing a health insurance plan, it is essential to read the fine print. Consider the following: * Pre-existing conditions: Make sure the plan covers pre-existing conditions. * Maximum out-of-pocket expenses: Make sure the plan limits the amount you must pay out-of-pocket. * Exclusions and limitations: Make sure you understand what is not covered by the plan.

💡 Note: Always review the plan’s terms and conditions before enrolling.

In summary, choosing a health insurance plan can be a complex and overwhelming process. However, by assessing your needs, understanding the types of health insurance plans, checking the network, reviewing the costs, and reading the fine print, you can make an informed decision and choose a plan that provides adequate coverage for you and your family.

What is health insurance?

+

Health insurance is a type of insurance that covers the cost of an individual’s medical and surgical expenses.

What are the different types of health insurance plans?

+

The main types of health insurance plans are HMO, PPO, EPO, and POS.

How do I choose a health insurance plan?

+

To choose a health insurance plan, assess your needs, understand the types of health insurance plans, check the network, review the costs, and read the fine print.

Related Terms:

- Health Insurance Alliance careers

- Health insurance Alliance LLC reviews

- Health insurance Alliance reddit

- Health insurance Alliance spam calls

- Health insurance alliance address

- Health insurance Alliance BBB