5 Tips SC Health Insurance

Understanding the Basics of SC Health Insurance

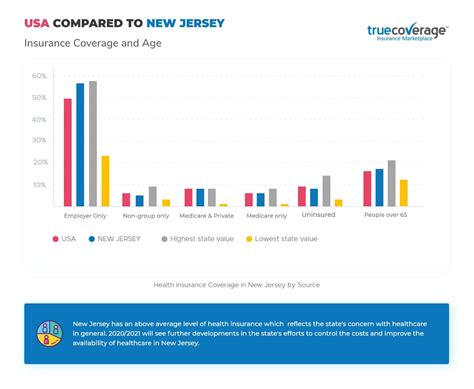

When it comes to health insurance in South Carolina, there are numerous options available, making it challenging to choose the right plan. With the Affordable Care Act (ACA) in place, individuals and families can now access affordable health insurance plans. However, navigating the complex world of health insurance can be overwhelming. In this article, we will provide you with 5 valuable tips to help you make an informed decision when selecting a health insurance plan in South Carolina.

Tip 1: Assess Your Health Needs

Before selecting a health insurance plan, it’s essential to assess your health needs. Consider your age, health status, and any pre-existing conditions you may have. If you have a chronic condition, you may want to opt for a plan with lower out-of-pocket costs. On the other hand, if you’re relatively healthy, you may prefer a plan with lower premiums. Make a list of your health priorities and use it as a guide when evaluating different plans. Remember, your health needs should be the primary factor in your decision-making process.

Tip 2: Choose the Right Network

Health insurance plans in South Carolina often have different network options. A network refers to the group of healthcare providers who have agreed to work with the insurance company. When selecting a plan, consider the network of providers. Ask yourself: * Are my primary care physicians and specialists part of the network? * Are the hospitals and medical facilities I prefer part of the network? * Are there any out-of-network benefits? * What are the costs associated with out-of-network care? Consider the following bullet points when evaluating network options: * HMO (Health Maintenance Organization): A type of plan that requires you to receive care from a specific network of providers. * PPO (Preferred Provider Organization): A type of plan that allows you to see any healthcare provider, but offers lower costs for in-network care. * EPO (Exclusive Provider Organization): A type of plan that only covers care from in-network providers, except in emergency situations.

Tip 3: Evaluate Plan Costs

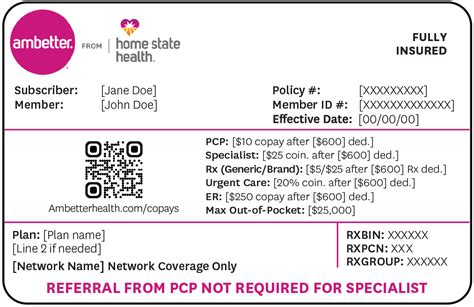

The cost of a health insurance plan in South Carolina can vary significantly. When evaluating plan costs, consider the following factors: * Premiums: The monthly cost of the plan. * Deductible: The amount you must pay out-of-pocket before the insurance company starts paying. * Co-pays: The fixed amount you pay for each doctor visit or prescription. * Co-insurance: The percentage of costs you pay after meeting the deductible. * Out-of-pocket maximum: The maximum amount you pay for healthcare expenses in a year. Create a table to compare the costs of different plans:

| Plan | Premium | Deductible | Co-pay | Co-insurance | Out-of-pocket Maximum |

|---|---|---|---|---|---|

| Plan A | 500</td> <td>1,000 | 20</td> <td>20%</td> <td>5,000 | |||

| Plan B | 400</td> <td>500 | 30</td> <td>30%</td> <td>7,000 |

📝 Note: When evaluating plan costs, consider your budget and health needs to ensure you choose a plan that balances affordability with adequate coverage.

Tip 4: Consider Additional Benefits

In addition to basic health coverage, many plans in South Carolina offer additional benefits. These may include: * Dental and vision coverage: Separate plans or riders that cover dental and vision care. * Prescription drug coverage: Coverage for prescription medications. * Mental health and substance abuse coverage: Coverage for mental health and substance abuse treatment. * Alternative therapy coverage: Coverage for alternative therapies, such as acupuncture or chiropractic care. When evaluating additional benefits, consider your individual needs and priorities. Ask yourself: * Do I need dental and vision coverage? * Do I take prescription medications regularly? * Do I prioritize mental health and substance abuse coverage? * Do I prefer alternative therapies?

Tip 5: Review Plan Ratings and Reviews

Finally, when selecting a health insurance plan in South Carolina, review plan ratings and reviews. Check the following sources: * NCQA (National Committee for Quality Assurance) ratings: A non-profit organization that evaluates health plans based on quality and performance. * CMS (Centers for Medicare and Medicaid Services) ratings: A government agency that rates health plans based on quality and performance. * Consumer reviews: Online reviews from current or former plan members. Consider the following bullet points when evaluating plan ratings and reviews: * Look for plans with high overall ratings: Plans with high ratings tend to offer better quality and performance. * Check for complaints and issues: Research any complaints or issues with the plan or insurance company. * Read consumer reviews: Get a sense of the plan’s strengths and weaknesses from current or former members.

In summary, choosing the right health insurance plan in South Carolina requires careful consideration of your health needs, network options, plan costs, additional benefits, and plan ratings and reviews. By following these 5 tips, you can make an informed decision and select a plan that meets your unique needs and priorities.

What is the difference between an HMO and PPO plan?

+

An HMO plan requires you to receive care from a specific network of providers, while a PPO plan allows you to see any healthcare provider, but offers lower costs for in-network care.

How do I choose the right network for my health insurance plan?

+

Consider your primary care physicians, specialists, hospitals, and medical facilities when selecting a network. Ensure that your preferred providers are part of the network to minimize out-of-pocket costs.

What are the key factors to consider when evaluating plan costs?

+

When evaluating plan costs, consider premiums, deductibles, co-pays, co-insurance, and out-of-pocket maximums. Create a table to compare the costs of different plans and choose a plan that balances affordability with adequate coverage.

Related Terms:

- Affordable health insurance SC

- Cigna health insurance sc

- Aetna Health insurance SC

- Free health insurance South Carolina

- healthcare gov sc

- health care marketplace cost estimator