Big Data Health Insurance Security

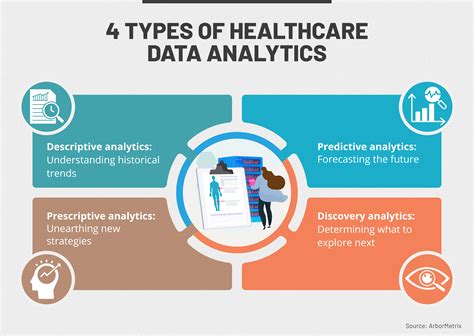

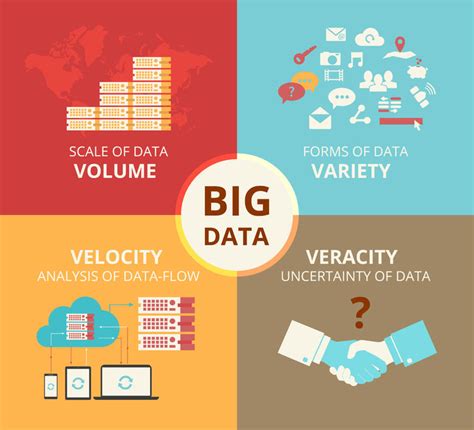

Introduction to Big Data in Health Insurance

The integration of big data in the health insurance sector has revolutionized the way companies operate, make decisions, and provide services to their customers. With the ability to collect, analyze, and interpret vast amounts of data, health insurance companies can now offer more personalized policies, improve claims processing, and reduce fraud. However, with the increased use of big data comes the need for robust security measures to protect sensitive customer information.

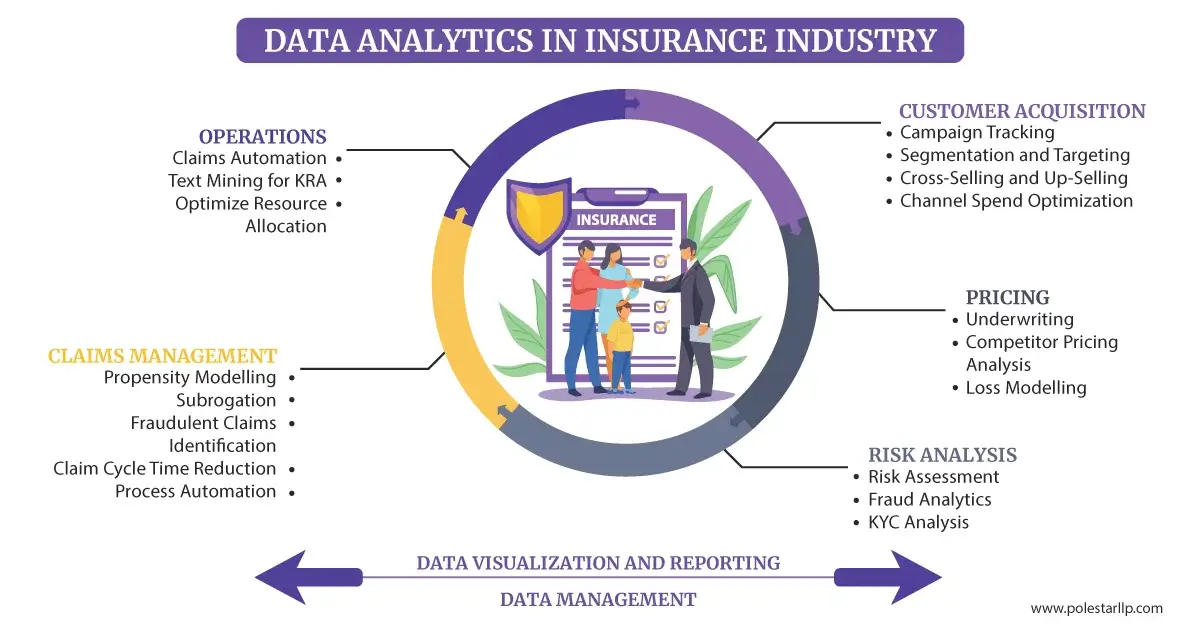

Benefits of Big Data in Health Insurance

The benefits of big data in health insurance are numerous. Some of the key advantages include: * Improved risk assessment: By analyzing large datasets, insurance companies can better assess the risk of individual policyholders and adjust their premiums accordingly. * Personalized policies: Big data allows insurance companies to offer customized policies that cater to the specific needs of each customer. * Enhanced claims processing: Big data can help automate the claims process, reducing the time and effort required to process claims. * Reduced fraud: By analyzing patterns and anomalies in the data, insurance companies can detect and prevent fraudulent activities.

Security Risks Associated with Big Data in Health Insurance

While big data offers many benefits, it also poses significant security risks. Some of the key security risks associated with big data in health insurance include: * Data breaches: The collection and storage of large amounts of sensitive customer data create a high risk of data breaches. * Cyber attacks: Insurance companies are vulnerable to cyber attacks, which can compromise customer data and disrupt business operations. * Insider threats: Authorized personnel with access to sensitive data can pose a significant threat to security if they intentionally or unintentionally compromise customer information. * Compliance risks: Insurance companies must comply with various regulations, such as HIPAA, to ensure the secure handling of protected health information (PHI).

Measures to Ensure Big Data Security in Health Insurance

To mitigate the security risks associated with big data in health insurance, companies can implement the following measures: * Data encryption: Encrypting sensitive data both in transit and at rest can help protect it from unauthorized access. * Access controls: Implementing strict access controls, such as role-based access and multi-factor authentication, can help prevent unauthorized personnel from accessing sensitive data. * Monitoring and incident response: Continuously monitoring the system for potential security threats and having an incident response plan in place can help quickly respond to and contain security incidents. * Employee training: Providing regular training to employees on security best practices and the importance of data protection can help prevent insider threats.

💡 Note: Insurance companies should also consider implementing a chief information security officer (CISO) to oversee the development and implementation of a comprehensive security strategy.

Best Practices for Big Data Security in Health Insurance

In addition to implementing security measures, insurance companies should also follow best practices for big data security. Some of these best practices include: * Data minimization: Collecting and storing only the minimum amount of data necessary to achieve business objectives can help reduce the risk of data breaches. * Data anonymization: Anonymizing sensitive data can help protect customer identities and prevent unauthorized access. * Regular security audits: Conducting regular security audits can help identify vulnerabilities and ensure compliance with regulatory requirements. * Collaboration with security experts: Collaborating with security experts and staying up-to-date with the latest security threats and technologies can help insurance companies stay ahead of potential security risks.

Conclusion and Future Outlook

In conclusion, the integration of big data in the health insurance sector offers numerous benefits, but it also poses significant security risks. By implementing robust security measures and following best practices, insurance companies can help protect sensitive customer information and ensure the secure handling of big data. As the use of big data continues to grow in the health insurance sector, it is essential for companies to stay vigilant and adapt to emerging security threats to maintain customer trust and comply with regulatory requirements.

What is the biggest security risk associated with big data in health insurance?

+

The biggest security risk associated with big data in health insurance is the risk of data breaches, which can compromise sensitive customer information and disrupt business operations.

How can insurance companies ensure the secure handling of big data?

+

Insurance companies can ensure the secure handling of big data by implementing robust security measures, such as data encryption, access controls, and monitoring and incident response, and by following best practices, such as data minimization and regular security audits.

What is the role of a chief information security officer (CISO) in big data security?

+

A CISO is responsible for overseeing the development and implementation of a comprehensive security strategy, including the secure handling of big data, and ensuring compliance with regulatory requirements.

Related Terms:

- Big data analytics in healthcare

- Protecting big data in healthcare

- Big data security and privacy

- Data analytics in health insurance

- Big Data magazine

- Big data research