5 Ways Pay Tuition

Introduction to Paying Tuition

Paying tuition can be a significant financial burden for many students and their families. With the rising costs of education, it’s essential to explore all available options to make tuition payments more manageable. In this article, we’ll discuss five ways to pay tuition, including payment plans, scholarships, grants, loans, and tuition reimbursement programs. Whether you’re a student or a parent, understanding these options can help you make informed decisions about financing your education.

Understanding Tuition Payment Options

Before we dive into the five ways to pay tuition, it’s crucial to understand the different types of tuition payment options available. These options can be broadly categorized into two groups: merit-based and need-based. Merit-based options, such as scholarships, are awarded based on a student’s academic achievements, talents, or other qualifications. Need-based options, such as grants and loans, are awarded based on a student’s financial need. By understanding these categories, you can better navigate the tuition payment landscape and make informed decisions about your financial aid.

1. Payment Plans

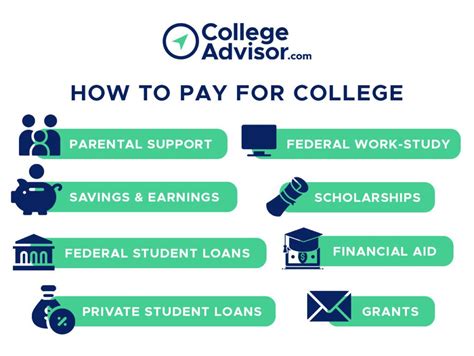

One way to pay tuition is through a payment plan. Many schools offer payment plans that allow students to split their tuition into smaller, more manageable payments. These plans can be especially helpful for students who cannot afford to pay their tuition in full at the beginning of the semester. Payment plans typically require a down payment, followed by monthly installments. By spreading out the cost of tuition over several months, students can avoid financial strain and focus on their studies.

2. Scholarships

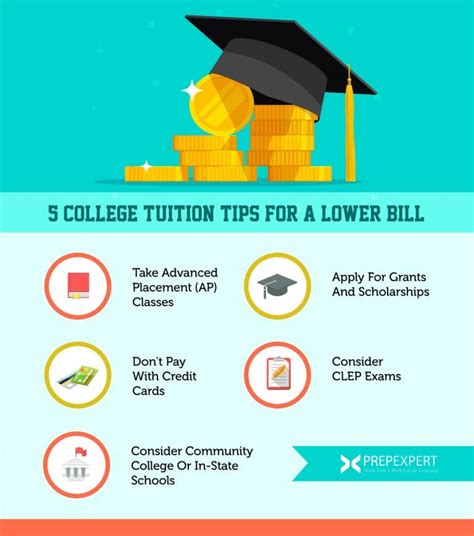

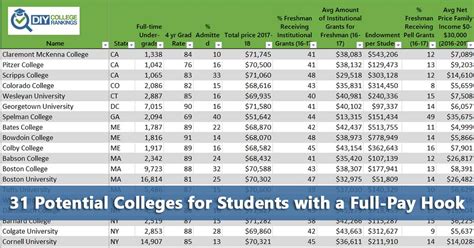

Scholarships are another way to pay tuition. Scholarships are merit-based awards that are given to students who demonstrate exceptional academic achievement, talent, or leadership. There are many types of scholarships available, including academic scholarships, athletic scholarships, and creative scholarships. Students can search for scholarships online or through their school’s financial aid office. By applying for scholarships, students can reduce their tuition burden and focus on their academic pursuits.

3. Grants

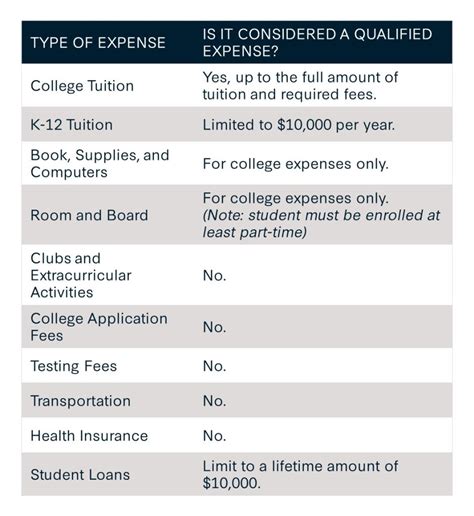

Grants are need-based awards that are given to students who demonstrate financial need. Unlike loans, grants do not need to be repaid, making them a highly desirable form of financial aid. There are many types of grants available, including federal grants, state grants, and institutional grants. Students can apply for grants by completing the Free Application for Federal Student Aid (FAFSA). By receiving a grant, students can reduce their tuition burden and focus on their academic goals.

4. Loans

Loans are another way to pay tuition. Loans are borrowed money that must be repaid, typically with interest. There are many types of loans available, including federal loans, private loans, and institutional loans. Students can apply for loans by completing the FAFSA or by contacting a private lender. By borrowing money through a loan, students can cover their tuition costs and focus on their academic pursuits. However, it’s essential to carefully consider the terms and conditions of a loan before borrowing, as well as to develop a plan for repaying the loan after graduation.

5. Tuition Reimbursement Programs

Tuition reimbursement programs are another way to pay tuition. These programs are offered by some employers, who agree to reimburse their employees for a portion of their tuition costs. Tuition reimbursement programs can be especially helpful for working students who are pursuing a degree in their field. By participating in a tuition reimbursement program, students can reduce their tuition burden and focus on their academic and professional goals.

📝 Note: When exploring tuition payment options, it's essential to carefully consider the terms and conditions of each option. Students should also develop a plan for managing their finances and repaying any borrowed money after graduation.

To summarize the key points, here are the five ways to pay tuition: * Payment plans * Scholarships * Grants * Loans * Tuition reimbursement programs By understanding these options and developing a plan for managing finances, students can make informed decisions about financing their education and achieve their academic goals.

What is the difference between a scholarship and a grant?

+

A scholarship is a merit-based award that is given to students who demonstrate exceptional academic achievement, talent, or leadership. A grant, on the other hand, is a need-based award that is given to students who demonstrate financial need.

How do I apply for a loan to pay tuition?

+

To apply for a loan, students can complete the Free Application for Federal Student Aid (FAFSA) or contact a private lender. It’s essential to carefully consider the terms and conditions of a loan before borrowing, as well as to develop a plan for repaying the loan after graduation.

What is a tuition reimbursement program, and how does it work?

+

A tuition reimbursement program is a program offered by some employers, who agree to reimburse their employees for a portion of their tuition costs. These programs can be especially helpful for working students who are pursuing a degree in their field. By participating in a tuition reimbursement program, students can reduce their tuition burden and focus on their academic and professional goals.

Related Terms:

- methods to pay for college

- paying for college quick check

- paying your way through college

- help paying for college tuition

- options for paying college

- how to pay with 529