Health

St Mary's Health Insurance Options

Introduction to St Mary’s Health Insurance Options

When it comes to choosing the right health insurance, individuals and families have a plethora of options to consider. St Mary’s health insurance is one such option that provides comprehensive coverage and affordable plans. In this article, we will delve into the world of St Mary’s health insurance options, exploring the various plans, benefits, and features that make it an attractive choice for those seeking reliable health coverage.

Understanding St Mary’s Health Insurance

St Mary’s health insurance is a type of health coverage that is designed to provide individuals and families with access to quality healthcare services. The insurance plans offered by St Mary’s are designed to cater to the diverse needs of its policyholders, providing a range of benefits that include doctor visits, hospital stays, prescription medications, and more. With St Mary’s health insurance, policyholders can enjoy peace of mind knowing that they are protected against unexpected medical expenses.

Types of St Mary’s Health Insurance Plans

St Mary’s offers a variety of health insurance plans that cater to different needs and budgets. Some of the most common types of plans include: * HMO (Health Maintenance Organization) plans: These plans require policyholders to receive medical care from a specific network of providers. * PPO (Preferred Provider Organization) plans: These plans offer more flexibility, allowing policyholders to receive care from both in-network and out-of-network providers. * EPO (Exclusive Provider Organization) plans: These plans are similar to HMO plans but do not require a primary care physician referral to see a specialist. * POS (Point of Service) plans: These plans combine elements of HMO and PPO plans, allowing policyholders to choose between in-network and out-of-network care.

Benefits of St Mary’s Health Insurance

St Mary’s health insurance plans offer a range of benefits that make them an attractive choice for individuals and families. Some of the key benefits include: * Comprehensive coverage: St Mary’s plans provide coverage for a wide range of medical services, including doctor visits, hospital stays, and prescription medications. * Affordable premiums: St Mary’s offers competitive pricing, making it an affordable option for those seeking health insurance. * Access to quality care: St Mary’s has a network of quality healthcare providers, ensuring that policyholders receive the best possible care. * Preventive care services: St Mary’s plans cover preventive care services, such as routine check-ups and screenings, to help policyholders stay healthy.

Eligibility and Enrollment

To be eligible for St Mary’s health insurance, individuals and families must meet certain requirements. These requirements may include: * Age: Policyholders must be within a certain age range, typically between 18 and 65. * Income: Policyholders must meet certain income requirements, which may vary depending on the plan. * Residency: Policyholders must reside in a specific area or region to be eligible for St Mary’s health insurance.

Comparison of St Mary’s Health Insurance Plans

The following table provides a comparison of the different St Mary’s health insurance plans:

| Plan Type | Premium | Deductible | Co-pay | Co-insurance |

|---|---|---|---|---|

| HMO | 300</td> <td>1,000 | 20</td> <td>20%</td> </tr> <tr> <td>PPO</td> <td>400 | 1,500</td> <td>30 | 30% |

| EPO | 350</td> <td>1,200 | 25</td> <td>25%</td> </tr> <tr> <td>POS</td> <td>450 | 1,800</td> <td>35 | 35% |

💡 Note: The premium, deductible, co-pay, and co-insurance amounts listed in the table are examples and may vary depending on the specific plan and policyholder.

Conclusion and Final Thoughts

In conclusion, St Mary’s health insurance options provide individuals and families with comprehensive coverage and affordable plans. With a range of benefits and features, St Mary’s health insurance is an attractive choice for those seeking reliable health coverage. By understanding the different types of plans, benefits, and eligibility requirements, policyholders can make informed decisions about their health insurance needs.

What is the difference between an HMO and PPO plan?

+

An HMO plan requires policyholders to receive medical care from a specific network of providers, while a PPO plan offers more flexibility, allowing policyholders to receive care from both in-network and out-of-network providers.

What is the eligibility criteria for St Mary’s health insurance?

+

To be eligible for St Mary’s health insurance, individuals and families must meet certain requirements, including age, income, and residency requirements.

Can I customize my St Mary’s health insurance plan?

+

Yes, St Mary’s offers a range of plans and options that can be customized to meet the specific needs and budgets of individuals and families.

Related Terms:

- is st mary s health insurance

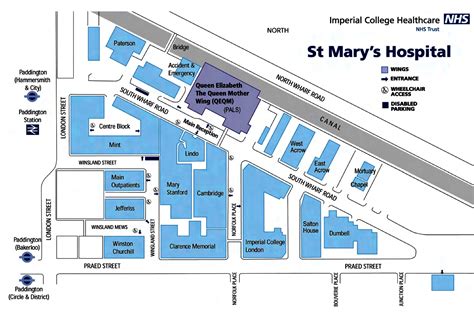

- St Mary s hospital Insurance accepted

- St Marys Primary Care

- Health insurance Athens GA

- St Mary s login

- St Mary billing