5 Tips Level Funded Insurance

Introduction to Level Funded Insurance

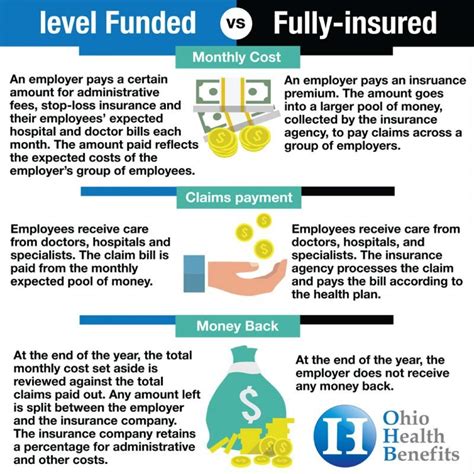

Level funded insurance is a type of health insurance plan that has gained popularity in recent years, especially among small to medium-sized businesses. This type of plan allows employers to pay a fixed monthly premium, which is then used to fund the employees’ health insurance claims. The remaining amount is allocated to a reserve account, which can be used to cover unexpected claims or refunded to the employer at the end of the year. In this blog post, we will discuss the benefits and drawbacks of level funded insurance and provide tips for employers who are considering this type of plan.

What is Level Funded Insurance?

Level funded insurance is a type of self-funded insurance plan that allows employers to pay a fixed monthly premium, which is then used to fund the employees’ health insurance claims. This type of plan is often referred to as a “hybrid” plan, as it combines elements of traditional fully insured plans and self-funded plans. The monthly premium is typically lower than traditional fully insured plans, and the employer has more control over the plan’s design and administration.

Benefits of Level Funded Insurance

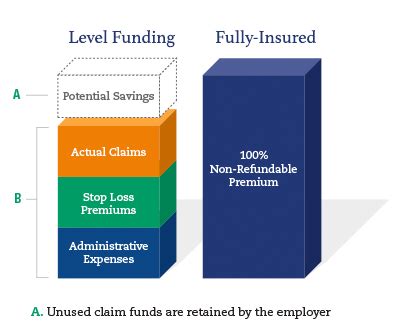

There are several benefits to level funded insurance, including: * Lower monthly premiums: Level funded insurance plans often have lower monthly premiums than traditional fully insured plans. * More control over plan design: Employers have more control over the plan’s design and administration, which can help to reduce costs and improve employee satisfaction. * Potential for refunds: If the employer’s claims are lower than expected, the remaining amount in the reserve account can be refunded to the employer at the end of the year. * Tax benefits: Level funded insurance plans can provide tax benefits to employers, as the monthly premiums are tax-deductible.

5 Tips for Employers Considering Level Funded Insurance

If you are considering level funded insurance for your business, here are five tips to keep in mind: * Tip 1: Understand the plan’s design and administration: It is essential to understand how the plan works, including how claims are processed and how the reserve account is managed. * Tip 2: Choose a reputable insurance provider: Not all insurance providers offer level funded insurance plans, and it is crucial to choose a reputable provider that has experience with this type of plan. * Tip 3: Consider the potential risks and rewards: Level funded insurance plans can provide significant cost savings, but they also come with potential risks, such as unexpected claims or changes in the health insurance market. * Tip 4: Review the plan’s stop-loss coverage: Stop-loss coverage is essential to protect the employer from unexpected claims or catastrophic events. It is crucial to review the plan’s stop-loss coverage to ensure that it is adequate. * Tip 5: Monitor the plan’s performance regularly: It is essential to monitor the plan’s performance regularly to ensure that it is meeting the employer’s needs and to make any necessary adjustments.

Common Misconceptions about Level Funded Insurance

There are several common misconceptions about level funded insurance, including: * Misconception 1: Level funded insurance is only for large businesses: While level funded insurance plans are often associated with large businesses, they can also be a good option for small to medium-sized businesses. * Misconception 2: Level funded insurance is too complex: While level funded insurance plans can be complex, they can also provide significant cost savings and more control over the plan’s design and administration. * Misconception 3: Level funded insurance is not flexible: Level funded insurance plans can be tailored to meet the specific needs of the employer and can provide more flexibility than traditional fully insured plans.

| Plan Type | Monthly Premium | Control over Plan Design | Potential for Refunds |

|---|---|---|---|

| Traditional Fully Insured | Higher | Less | No |

| Level Funded Insurance | Lower | More | Yes |

💡 Note: It is essential to carefully review the plan's terms and conditions to understand the potential risks and rewards.

As we have discussed, level funded insurance can be a good option for employers who are looking for a more cost-effective and flexible health insurance plan. By understanding the plan’s design and administration, choosing a reputable insurance provider, considering the potential risks and rewards, reviewing the plan’s stop-loss coverage, and monitoring the plan’s performance regularly, employers can make an informed decision about whether level funded insurance is right for their business.

In summary, level funded insurance plans offer a unique combination of cost savings, flexibility, and control over plan design, making them an attractive option for employers who are looking for a more innovative approach to health insurance. By following the tips outlined in this blog post, employers can navigate the complexities of level funded insurance and make an informed decision about whether this type of plan is right for their business.

What is level funded insurance?

+

Level funded insurance is a type of health insurance plan that allows employers to pay a fixed monthly premium, which is then used to fund the employees’ health insurance claims.

What are the benefits of level funded insurance?

+

The benefits of level funded insurance include lower monthly premiums, more control over plan design, potential for refunds, and tax benefits.

What are the potential risks of level funded insurance?

+

The potential risks of level funded insurance include unexpected claims, changes in the health insurance market, and the potential for the employer to be responsible for paying a portion of the claims.

Related Terms:

- level funded vs fully insured

- level funded health plan disadvantages

- Level funded vs self funded

- UHC Level Funded

- Level funded vs ASO

- Self funded insurance