Health

Louisiana Health Insurance Options

Louisiana Health Insurance Options: A Comprehensive Guide

Finding the right health insurance in Louisiana can be a daunting task, especially with the numerous options available. From individual and family plans to group and Medicare plans, understanding the different types of health insurance and their benefits is crucial for making an informed decision. In this article, we will delve into the various health insurance options in Louisiana, exploring their features, advantages, and disadvantages.

Understanding Health Insurance in Louisiana

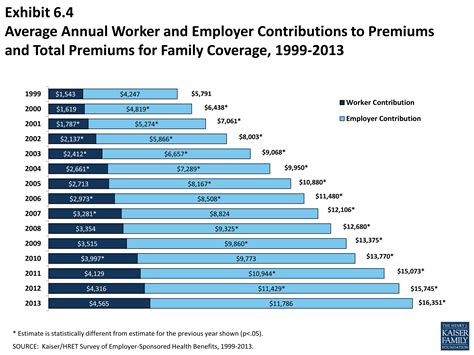

Before diving into the different types of health insurance, it’s essential to understand the basics of health insurance in Louisiana. Health insurance is a type of insurance that covers the cost of medical expenses, including doctor visits, hospital stays, and prescription medications. In Louisiana, health insurance is offered by various providers, including private companies, government programs, and non-profit organizations.

Types of Health Insurance in Louisiana

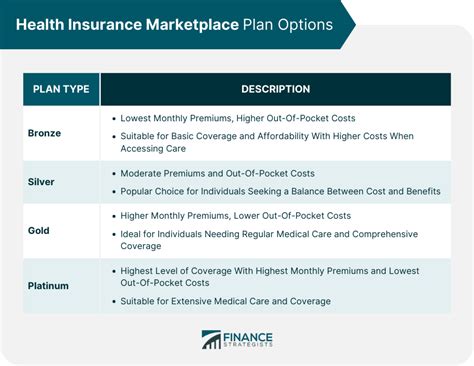

There are several types of health insurance available in Louisiana, each with its unique features and benefits. Some of the most common types of health insurance include: * Individual and Family Plans: These plans are designed for individuals and families who are not covered by an employer-sponsored plan. They offer a range of benefits, including doctor visits, hospital stays, and prescription medications. * Group Plans: These plans are offered by employers to their employees and often provide more comprehensive coverage than individual plans. * Medicare Plans: These plans are designed for individuals 65 and older, as well as those with certain disabilities. Medicare plans offer a range of benefits, including hospital stays, doctor visits, and prescription medications. * Medicaid Plans: These plans are designed for low-income individuals and families and offer a range of benefits, including doctor visits, hospital stays, and prescription medications.

Health Insurance Providers in Louisiana

There are several health insurance providers in Louisiana, each offering a range of plans and benefits. Some of the most popular health insurance providers in Louisiana include: * Blue Cross Blue Shield of Louisiana: Offers a range of individual and family plans, as well as group and Medicare plans. * UnitedHealthcare: Offers a range of individual and family plans, as well as group and Medicare plans. * Humana: Offers a range of individual and family plans, as well as group and Medicare plans. * Aetna: Offers a range of individual and family plans, as well as group and Medicare plans.

Benefits of Health Insurance in Louisiana

Having health insurance in Louisiana offers numerous benefits, including: * Financial Protection: Health insurance helps protect against financial ruin in the event of a medical emergency. * Access to Quality Care: Health insurance provides access to quality medical care, including doctor visits, hospital stays, and prescription medications. * Preventive Care: Many health insurance plans in Louisiana offer preventive care benefits, including routine check-ups and screenings. * Peace of Mind: Having health insurance provides peace of mind, knowing that you and your loved ones are protected in the event of a medical emergency.

How to Choose the Right Health Insurance Plan in Louisiana

Choosing the right health insurance plan in Louisiana can be a daunting task, especially with the numerous options available. Here are some tips to consider when choosing a health insurance plan: * Determine Your Budget: Determine how much you can afford to pay each month for health insurance. * Consider Your Needs: Consider your medical needs and choose a plan that meets those needs. * Research Providers: Research health insurance providers in Louisiana and choose a provider that offers a range of plans and benefits. * Read Reviews: Read reviews from other policyholders to get an idea of the provider’s customer service and claims process.

👍 Note: It's essential to carefully review the terms and conditions of any health insurance plan before making a decision.

Conclusion

In conclusion, finding the right health insurance in Louisiana requires careful consideration of the different types of health insurance, their benefits, and the providers that offer them. By understanding the basics of health insurance, researching providers, and considering your needs and budget, you can make an informed decision and choose a health insurance plan that meets your needs.

What is the difference between individual and group health insurance plans?

+

Individual health insurance plans are designed for individuals and families who are not covered by an employer-sponsored plan, while group health insurance plans are offered by employers to their employees.

What is the eligibility criteria for Medicaid in Louisiana?

+

To be eligible for Medicaid in Louisiana, you must be a low-income individual or family, and meet certain income and resource requirements.

Can I purchase health insurance outside of the open enrollment period?

+

In some cases, yes, you can purchase health insurance outside of the open enrollment period. This is known as a special enrollment period, and it’s typically available to individuals who experience a qualifying life event, such as losing their job or having a baby.

Related Terms:

- Healthcare Marketplace Louisiana phone number

- louisiana healthcare gov login

- Cheapest health insurance in Louisiana

- Free health insurance Louisiana

- Health insurance artinya

- Ambetter Louisiana