Medicard Health Insurance Plans

Introduction to Medicard Health Insurance Plans

Medicard health insurance plans are designed to provide individuals and families with comprehensive coverage for medical expenses. With the rising costs of healthcare, having a reliable health insurance plan is crucial to ensure that you and your loved ones receive the best possible care without breaking the bank. In this article, we will delve into the world of Medicard health insurance plans, exploring their features, benefits, and how to choose the right plan for your needs.

Features of Medicard Health Insurance Plans

Medicard health insurance plans come with a range of features that make them an attractive option for those seeking comprehensive healthcare coverage. Some of the key features include: * Comprehensive coverage: Medicard plans cover a wide range of medical expenses, including hospitalization, surgery, and outpatient care. * Flexibility: Medicard offers a variety of plans to suit different needs and budgets, allowing you to choose the coverage that best fits your lifestyle. * Affordable premiums: Medicard plans are designed to be affordable, with premiums that are competitive with other health insurance providers. * Access to a network of healthcare providers: Medicard has a large network of healthcare providers, including hospitals, clinics, and doctors, ensuring that you have access to quality care when you need it.

Benefits of Medicard Health Insurance Plans

The benefits of Medicard health insurance plans are numerous, and include: * Financial protection: With a Medicard plan, you can rest assured that you are protected against unexpected medical expenses, which can be a significant financial burden. * Peace of mind: Knowing that you have comprehensive coverage in place can give you peace of mind, allowing you to focus on your health and well-being. * Access to quality care: Medicard plans provide access to a network of quality healthcare providers, ensuring that you receive the best possible care when you need it. * Preventive care: Many Medicard plans cover preventive care services, such as routine check-ups and screenings, to help you stay healthy and prevent illnesses.

Types of Medicard Health Insurance Plans

Medicard offers a range of health insurance plans to suit different needs and budgets. Some of the most common types of plans include: * Individual plans: These plans are designed for individuals and families, providing comprehensive coverage for medical expenses. * Group plans: These plans are designed for businesses and organizations, providing coverage for employees and their families. * Senior plans: These plans are designed for seniors, providing coverage for medical expenses related to aging and age-related health issues. * Student plans: These plans are designed for students, providing coverage for medical expenses while they are in school.

How to Choose the Right Medicard Health Insurance Plan

Choosing the right Medicard health insurance plan can be overwhelming, but there are several factors to consider when making your decision. These include: * Level of coverage: Consider the level of coverage you need, including the types of medical expenses you want to be covered for. * Premium cost: Consider the cost of the premium, and whether it fits within your budget. * Network of healthcare providers: Consider the network of healthcare providers included in the plan, and whether they are convenient for you to access. * Pre-existing conditions: If you have a pre-existing condition, consider whether the plan covers it, and what the terms of coverage are.

💡 Note: It's essential to carefully review the terms and conditions of any health insurance plan before making a decision, to ensure that you understand what is covered and what is not.

Conclusion and Final Thoughts

In conclusion, Medicard health insurance plans offer a range of benefits and features that make them an attractive option for those seeking comprehensive healthcare coverage. By considering your individual needs and budget, you can choose a plan that provides the right level of coverage for you and your loved ones. Whether you’re an individual, family, or business, Medicard has a plan that can meet your needs, providing you with financial protection, peace of mind, and access to quality care.

What is the difference between an individual and group Medicard health insurance plan?

+

An individual plan is designed for individuals and families, while a group plan is designed for businesses and organizations. Group plans often offer more comprehensive coverage and lower premiums, but are typically only available to employees of the organization.

Do Medicard health insurance plans cover pre-existing conditions?

+

Yes, many Medicard health insurance plans cover pre-existing conditions, but the terms of coverage may vary depending on the plan. It’s essential to review the terms and conditions of the plan before making a decision, to ensure that you understand what is covered and what is not.

How do I choose the right Medicard health insurance plan for my needs?

+

To choose the right Medicard health insurance plan, consider your individual needs and budget, including the level of coverage you need, the premium cost, and the network of healthcare providers included in the plan. It’s also essential to review the terms and conditions of the plan, to ensure that you understand what is covered and what is not.

Related Terms:

- How to check MediCard coverage

- MediCard Individual plan price

- MediCard prepaid

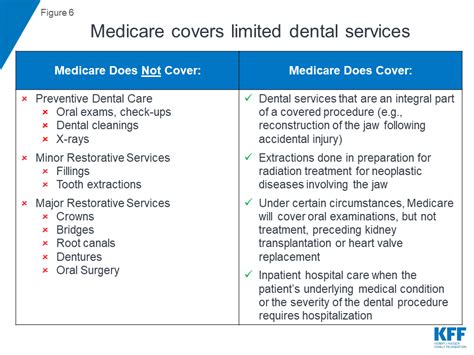

- MediCard dental coverage

- How to avail MediCard

- MediCard hospital coverage