Health

5 HRA Benefits

Introduction to HRA Benefits

The House Rent Allowance, commonly known as HRA, is a significant component of an individual’s salary structure. It is provided by employers to their employees to help them meet the expenses of renting a house. HRA benefits are not only limited to financial assistance but also have various other advantages. In this blog post, we will delve into the world of HRA benefits, exploring the top 5 benefits that make it an essential part of one’s salary.

Understanding HRA

Before we dive into the benefits, it’s essential to understand what HRA is and how it works. HRA is a type of allowance provided by employers to their employees, which is exempt from tax under certain conditions. The exemption limit for HRA is calculated based on the least of the following: - Actual HRA received - 50% of the basic salary (for metro cities) or 40% of the basic salary (for non-metro cities) - Rent paid minus 10% of the basic salary

Top 5 HRA Benefits

Now, let’s move on to the top 5 HRA benefits that make it an attractive component of one’s salary:

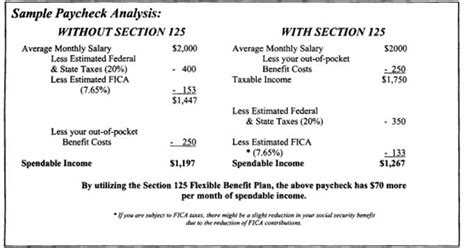

- Tax Savings: HRA helps individuals save tax, as it is exempt from tax under certain conditions. This means that a significant portion of one’s salary can be tax-free, resulting in more take-home pay.

- Increased Take-Home Pay: With HRA, individuals can enjoy a higher take-home pay, as it is not subject to tax. This can be particularly beneficial for those living in metro cities, where the cost of living is high.

- Flexibility: HRA provides individuals with the flexibility to choose their accommodation, as they are not restricted to a specific location. This can be particularly beneficial for those who want to live in a particular area or have specific requirements.

- No Need to Provide Receipts: Unlike other allowances, HRA does not require individuals to provide receipts or proofs of expenditure. This makes it easier for individuals to claim the exemption, as they do not need to maintain detailed records.

- Can be Used for Multiple Purposes: HRA can be used for multiple purposes, such as paying rent, maintaining a house, or even paying off a home loan. This flexibility makes it an attractive option for individuals who want to use their HRA for various purposes.

Important Considerations

While HRA benefits are numerous, there are some important considerations that individuals should keep in mind: - Exemption Limit: The exemption limit for HRA is calculated based on the least of the actual HRA received, 50% of the basic salary (for metro cities) or 40% of the basic salary (for non-metro cities), and rent paid minus 10% of the basic salary. - Tax Implications: HRA is exempt from tax under certain conditions, but any excess amount above the exemption limit is taxable. - Documentation: While receipts are not required for HRA, individuals may need to provide proof of rent payment or other documentation to claim the exemption.

📝 Note: Individuals should carefully review their salary structure and tax implications to ensure they are making the most of their HRA benefits.

Conclusion and Future Outlook

In conclusion, HRA benefits are numerous and can have a significant impact on an individual’s financial situation. By understanding the top 5 HRA benefits and important considerations, individuals can make informed decisions about their salary structure and tax planning. As the cost of living continues to rise, HRA benefits will become even more essential for individuals to maintain their standard of living.

What is the exemption limit for HRA?

+

The exemption limit for HRA is calculated based on the least of the actual HRA received, 50% of the basic salary (for metro cities) or 40% of the basic salary (for non-metro cities), and rent paid minus 10% of the basic salary.

Can HRA be used for multiple purposes?

+

Yes, HRA can be used for multiple purposes, such as paying rent, maintaining a house, or even paying off a home loan.

Is HRA taxable?

+

HRA is exempt from tax under certain conditions, but any excess amount above the exemption limit is taxable.

Related Terms:

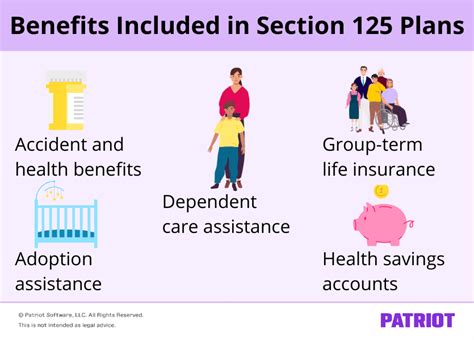

- Section 125 plan example

- Section 125 plan document

- IRS Section 125 rules

- IRS section 125 rules pdf

- Section 125 deductions

- Cafeteria plans for Dummies