Health

5 Tips Short Term Insurance

Understanding Short Term Insurance

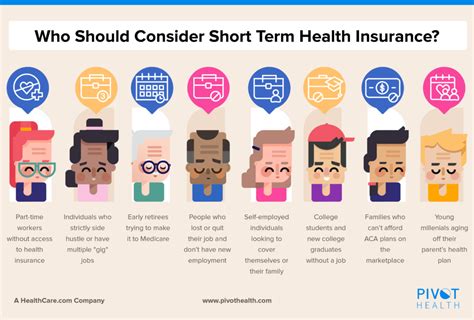

Short term insurance, also known as temporary or term insurance, provides coverage for a specified period, usually ranging from several months to a few years. It is designed to offer financial protection during times of transition or when permanent insurance is not feasible. Short term insurance can be particularly beneficial for individuals who are between jobs, waiting for a permanent insurance policy to take effect, or needing coverage for a specific event or period.

Benefits of Short Term Insurance

There are several benefits of short term insurance, including: * Flexibility: Short term insurance policies can be tailored to fit specific needs and time frames. * Affordability: Temporary insurance is often less expensive than permanent insurance. * Quick Enrollment: Enrollment in short term insurance plans is typically faster and more straightforward than in permanent plans. * Variety of Options: Insurers offer a range of short term plans, allowing individuals to choose the coverage that best suits their situation.

5 Tips for Choosing the Right Short Term Insurance

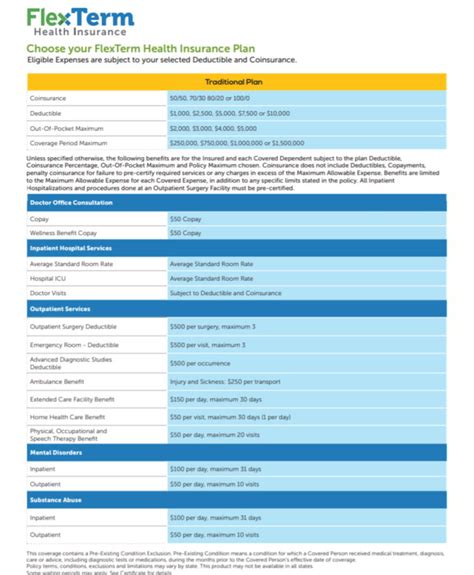

When selecting a short term insurance plan, consider the following tips: * Assess Your Needs: Determine what type of coverage you require and for how long. This will help you choose a plan that provides adequate protection without unnecessary features. * Compare Plans: Research and compare different short term insurance plans from various insurers to find the one that offers the best combination of coverage, cost, and flexibility. * Check the Provider’s Reputation: Ensure the insurance provider is reputable and has a history of paying claims promptly. * Understand the Policy Limitations: Be aware of any limitations or exclusions in the policy, such as pre-existing condition exclusions or coverage caps. * Review the Premium Costs: Calculate the total cost of the premium and ensure it fits within your budget.

Common Types of Short Term Insurance

Some common types of short term insurance include: * Health Insurance: Temporary health insurance provides coverage for medical expenses during a transitional period. * Life Insurance: Short term life insurance offers a death benefit to beneficiaries if the insured passes away during the policy term. * Disability Insurance: Temporary disability insurance provides income replacement if the insured becomes unable to work due to illness or injury. * Accident Insurance: Short term accident insurance covers medical expenses resulting from accidental injuries.

Considerations for Short Term Insurance

Before purchasing a short term insurance policy, consider the following: * Pre-Existing Conditions: Some short term insurance plans may not cover pre-existing medical conditions. * Network Restrictions: Certain plans may have network restrictions, limiting the healthcare providers you can see. * Coverage Caps: Some policies may have coverage caps, limiting the amount of benefits you can receive.

📝 Note: It's essential to carefully review the policy terms and conditions before purchasing short term insurance to ensure you understand what is covered and what is not.

Conclusion and Next Steps

In conclusion, short term insurance can provide valuable protection during transitional periods or when permanent insurance is not feasible. By understanding the benefits and types of short term insurance, following the 5 tips for choosing the right plan, and considering the common types and considerations, you can make an informed decision about your insurance needs. Remember to carefully review policy terms and conditions, and don’t hesitate to seek advice from a licensed insurance professional if needed.

What is the main purpose of short term insurance?

+

The main purpose of short term insurance is to provide temporary financial protection during times of transition or when permanent insurance is not feasible.

How long does short term insurance typically last?

+

Short term insurance can last from several months to a few years, depending on the specific policy and insurer.

Can I cancel my short term insurance policy at any time?

+

Yes, you can typically cancel your short term insurance policy at any time, but be aware that you may not receive a refund for any unused premium.

Related Terms:

- Best short term health insurance

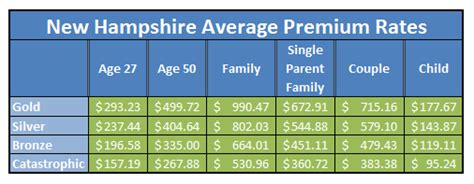

- Short term health insurance cost

- Cigna short term health insurance

- Aetna short term health insurance

- Short term health insurance reddit

- Everest short term health insurance