Star Health Assure Insurance Plan

Introduction to Star Health Assure Insurance Plan

The Star Health Assure Insurance Plan is a comprehensive health insurance policy designed to provide financial protection to individuals and families against unexpected medical expenses. In today’s world, medical costs are rising rapidly, and having a health insurance plan is essential to avoid financial burdens. This plan offers a wide range of benefits, including coverage for hospitalization, surgical procedures, and other medical expenses.

Key Features of Star Health Assure Insurance Plan

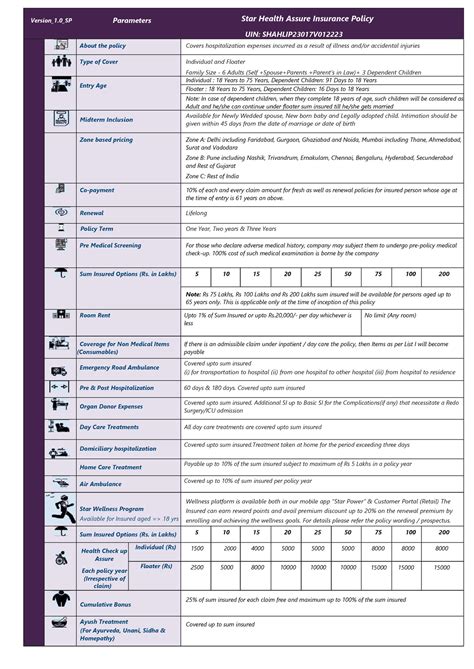

The Star Health Assure Insurance Plan comes with several key features that make it an attractive option for those seeking health insurance. Some of the key features include: * Comprehensive coverage: The plan provides comprehensive coverage for hospitalization, surgical procedures, and other medical expenses. * High sum insured: The plan offers a high sum insured option, which provides adequate coverage for medical expenses. * No sub-limits: The plan does not have any sub-limits, which means that the insured can claim the full sum insured for medical expenses. * No room rent capping: The plan does not have any room rent capping, which means that the insured can choose any hospital room without worrying about the costs. * Pre and post-hospitalization coverage: The plan provides coverage for pre and post-hospitalization expenses, which includes medical expenses incurred before and after hospitalization.

Benefits of Star Health Assure Insurance Plan

The Star Health Assure Insurance Plan offers several benefits to the insured, including: * Financial protection: The plan provides financial protection against unexpected medical expenses, which can help to avoid financial burdens. * Tax benefits: The plan offers tax benefits under Section 80D of the Income Tax Act, which can help to reduce tax liabilities. * Cashless hospitalization: The plan provides cashless hospitalization, which means that the insured can get treated at any network hospital without paying any cash. * Wide network of hospitals: The plan has a wide network of hospitals, which provides the insured with a wide range of options for medical treatment.

Eligibility and Coverage

The Star Health Assure Insurance Plan is available to individuals and families, and the eligibility criteria are as follows: * Age: The minimum age for entry is 18 years, and the maximum age is 65 years. * Family coverage: The plan provides coverage for the insured, spouse, and dependent children. * Pre-existing diseases: The plan covers pre-existing diseases after a waiting period of 4 years. * Coverage: The plan provides coverage for a wide range of medical expenses, including hospitalization, surgical procedures, and other medical expenses.

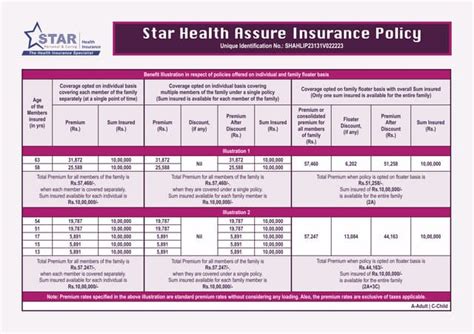

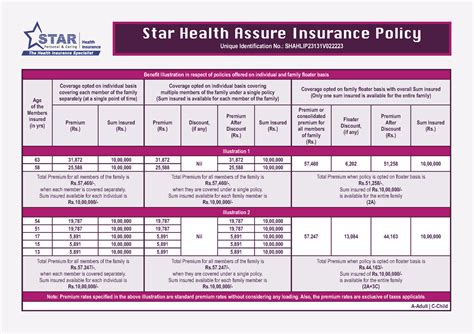

Premium and Payment

The premium for the Star Health Assure Insurance Plan depends on several factors, including age, sum insured, and coverage options. The payment options are as follows: * Annual premium: The premium can be paid annually. * Half-yearly premium: The premium can be paid half-yearly. * Quarterly premium: The premium can be paid quarterly. * Monthly premium: The premium can be paid monthly.

Claim Process

The claim process for the Star Health Assure Insurance Plan is simple and hassle-free. The steps to file a claim are as follows: * Notify the insurer: The insured must notify the insurer about the claim. * Submit documents: The insured must submit the required documents, including medical bills and reports. * Verification: The insurer will verify the documents and approve the claim. * Settlement: The insurer will settle the claim within a specified time frame.

📝 Note: The claim process may vary depending on the insurer and the type of claim.

Exclusions and Limitations

The Star Health Assure Insurance Plan has several exclusions and limitations, including: * Pre-existing diseases: The plan does not cover pre-existing diseases for the first 4 years. * Certain diseases: The plan does not cover certain diseases, such as HIV and AIDS. * Cosmetic treatments: The plan does not cover cosmetic treatments. * Alternative treatments: The plan does not cover alternative treatments, such as acupuncture and naturopathy.

Comparison with Other Plans

The Star Health Assure Insurance Plan can be compared with other health insurance plans in terms of coverage, premium, and benefits. Some of the key differences include: * Coverage: The plan provides comprehensive coverage for hospitalization, surgical procedures, and other medical expenses. * Premium: The premium for the plan is competitive compared to other health insurance plans. * Benefits: The plan offers several benefits, including cashless hospitalization, pre and post-hospitalization coverage, and tax benefits.

| Plan | Coverage | Premium | Benefits |

|---|---|---|---|

| Star Health Assure | Comprehensive coverage | Competitive premium | Cashless hospitalization, pre and post-hospitalization coverage, tax benefits |

| Other plans | Varying coverage | Varying premium | Varying benefits |

In summary, the Star Health Assure Insurance Plan is a comprehensive health insurance policy that provides financial protection against unexpected medical expenses. The plan offers several benefits, including cashless hospitalization, pre and post-hospitalization coverage, and tax benefits. The premium for the plan is competitive compared to other health insurance plans, and the coverage options are flexible. Overall, the Star Health Assure Insurance Plan is a good option for individuals and families seeking health insurance.

What is the minimum age for entry into the Star Health Assure Insurance Plan?

+

The minimum age for entry into the Star Health Assure Insurance Plan is 18 years.

What is the maximum sum insured option available under the Star Health Assure Insurance Plan?

+

The maximum sum insured option available under the Star Health Assure Insurance Plan is Rs. 1 crore.

Does the Star Health Assure Insurance Plan cover pre-existing diseases?

+

Yes, the Star Health Assure Insurance Plan covers pre-existing diseases after a waiting period of 4 years.

Related Terms:

- www starhealth in login

- star health assure vs comprehensive

- star health insurance official website

- star health assure vs optima

- star health assure pdf

- star health assure brochure