5 HSA Benefits

Introduction to Health Savings Accounts (HSAs)

A Health Savings Account (HSA) is a type of savings account that allows individuals with high-deductible health plans (HDHPs) to set aside money on a tax-free basis to pay for qualified medical expenses. HSAs have become increasingly popular due to their numerous benefits, which include tax advantages, flexibility, and portability. In this article, we will delve into the details of five significant benefits of HSAs, exploring how they can help individuals and families manage their healthcare costs more effectively.

Benefit 1: Tax Advantages

One of the most significant advantages of HSAs is their tax benefits. Contributions to an HSA are tax-deductible, reducing an individual’s taxable income. The funds in the account grow tax-free, and withdrawals for qualified medical expenses are also tax-free. This triple tax advantage makes HSAs an attractive option for those looking to optimize their healthcare savings. For example, if an individual contributes $5,000 to an HSA, they can deduct this amount from their taxable income, reducing their tax liability. The funds then grow tax-free, and when used for qualified medical expenses, the withdrawals are not subject to income tax.

Benefit 2: Flexibility in Using Funds

HSAs offer flexibility in how the funds can be used. Account holders can use their HSA funds to pay for a wide range of qualified medical expenses, including doctor visits, hospital stays, prescriptions, and even some over-the-counter medications. This flexibility allows individuals to manage their healthcare expenses according to their specific needs. Moreover, HSA funds can be used to pay for expenses for the account holder, their spouse, and their dependents, making it a valuable tool for family healthcare management.

Benefit 3: Portability

Unlike other types of health savings plans, HSAs are portable, meaning the account belongs to the individual, not the employer. This portability is a significant benefit, especially in today’s job market where individuals may change jobs frequently. If an account holder changes jobs or retires, they can take their HSA with them, ensuring continuous access to their healthcare savings. This feature provides peace of mind and financial security, as individuals can maintain their HSA regardless of their employment status.

Benefit 4: Investment Opportunities

Many HSA providers offer investment options for account holders, allowing them to invest their HSA funds in stocks, bonds, mutual funds, and other investments. This feature enables individuals to grow their HSA balance over time, potentially accumulating a significant amount of money for future medical expenses. By investing HSA funds, individuals can leverage the power of compound interest, turning their healthcare savings into a long-term investment strategy. However, it’s essential to understand the investment options and any associated fees to make informed decisions.

Benefit 5: Long-Term Savings

HSAs can serve as a long-term savings vehicle for healthcare expenses in retirement. Since there is no requirement to use HSA funds within a specific timeframe, individuals can accumulate funds over their working years and use them to pay for medical expenses in retirement. This benefit is particularly valuable, given the rising costs of healthcare and the potential for increased medical expenses as people age. By saving in an HSA, individuals can ensure they have a dedicated source of funds for healthcare costs, reducing their reliance on other retirement savings or income.

📝 Note: It's crucial to understand the eligibility criteria and rules governing HSAs, including the requirement to have a high-deductible health plan and the limits on annual contributions.

In summary, Health Savings Accounts offer a range of benefits that make them an attractive option for managing healthcare costs. From tax advantages and flexibility in using funds to portability and investment opportunities, HSAs provide a powerful tool for individuals and families seeking to optimize their healthcare savings. By understanding these benefits and how HSAs work, individuals can make informed decisions about their healthcare financing and ensure they are well-prepared for both current and future medical expenses.

What is the primary purpose of a Health Savings Account (HSA)?

+

The primary purpose of an HSA is to allow individuals with high-deductible health plans to save money on a tax-free basis for qualified medical expenses.

Can HSA funds be used for non-medical expenses?

+

Yes, but withdrawals for non-medical expenses are subject to income tax and a 20% penalty before age 65. After age 65, withdrawals for non-medical expenses are subject to income tax but not the penalty.

How do I contribute to an HSA?

+

Contributions to an HSA can be made by the individual or their employer. The contributions are subject to annual limits, and the individual must have a high-deductible health plan to be eligible.

Related Terms:

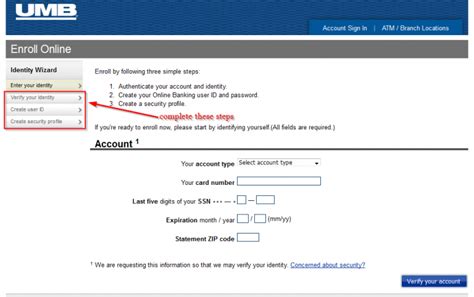

- UMB HSA app

- UMB HSA employer login

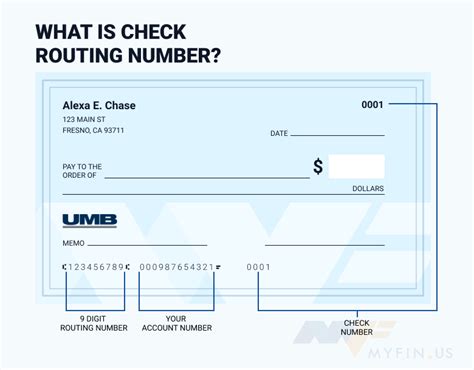

- UMB HSA routing number

- My UMB HSA login

- UMB HSA customer service

- hsa umb com individual web page