5 Warrant Officer Pay Tips

Introduction to Warrant Officer Pay

As a warrant officer in the military, understanding the pay structure and benefits is crucial for financial planning and stability. Warrant officers are technical experts who have gained specialized skills and knowledge in their field, and their pay reflects their unique position within the military hierarchy. In this article, we will explore five key tips related to warrant officer pay, helping you navigate the compensation system and make the most of your military career.

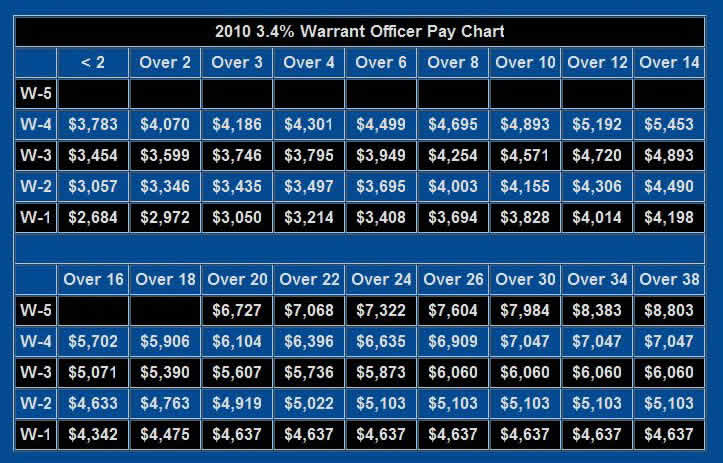

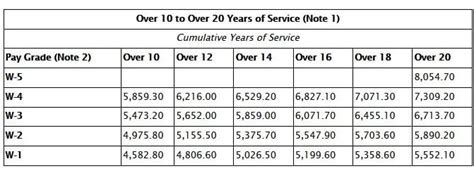

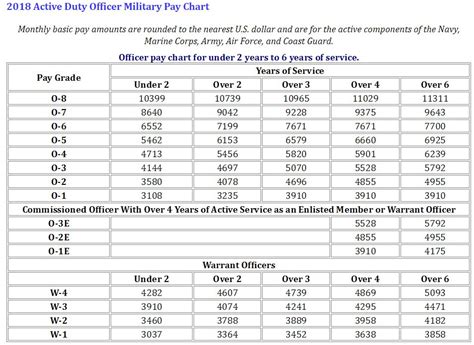

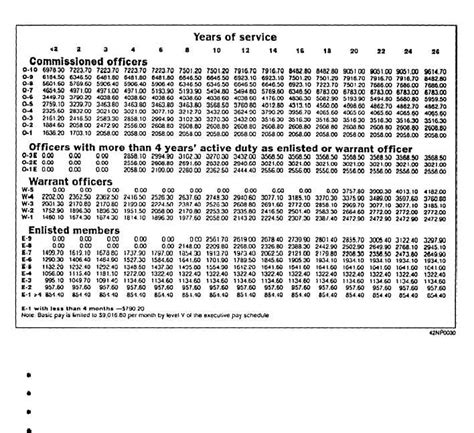

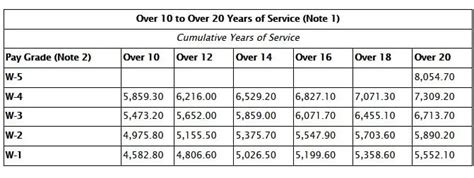

Understanding the Basic Pay Scale

The basic pay scale for warrant officers is determined by their rank and time in service. Rank and time in service are the two primary factors that influence basic pay, with higher ranks and more years of service resulting in higher pay grades. It’s essential to familiarize yourself with the current pay scales and how they apply to your situation. You can find the most up-to-date pay scales on the official military website or by consulting with a military finance expert.

Special and Incentive Pay

In addition to basic pay, warrant officers may be eligible for special pay and incentive pay. Special pay is provided for specific duties or assignments, such as hazardous duty pay or special duty assignment pay. Incentive pay, on the other hand, is offered to encourage warrant officers to pursue certain careers or specialties, like aviation or medicine. These extra pays can significantly impact your overall compensation package, so it’s crucial to understand what you may be eligible for and how to claim these benefits.

Allowances and Benefits

Warrant officers are also entitled to various allowances and benefits, including: * Basic Allowance for Housing (BAH) * Basic Allowance for Subsistence (BAS) * Uniform allowance * Education assistance * Health insurance * Retirement benefits These allowances and benefits can help offset living expenses, support education and career development, and provide long-term financial security. Make sure you’re taking full advantage of the benefits available to you.

Tax Advantageous Pay

Some components of warrant officer pay are tax-free, which can result in significant savings. For example, combat zone pay and certain special pays are exempt from federal income tax. Understanding which parts of your pay are tax-free can help you optimize your finances and reduce your tax liability. It’s also important to consider state tax laws, as some states may tax military pay differently.

Financial Planning and Retirement

Effective financial planning is critical for warrant officers, particularly when it comes to retirement. The military offers a defined benefit retirement plan, which provides a predictable income stream in retirement. However, it’s still essential to plan and save for retirement, considering factors like inflation, healthcare costs, and personal financial goals. Consider consulting a financial advisor to create a personalized retirement plan and make the most of your military retirement benefits.

💸 Note: Always review and understand the terms and conditions of any financial benefits or incentives, as they may be subject to change or have specific eligibility requirements.

In summary, warrant officer pay is a complex system that involves basic pay, special and incentive pay, allowances, benefits, tax advantages, and financial planning. By understanding these components and taking advantage of the benefits available to you, you can optimize your financial situation and set yourself up for long-term success. Whether you’re just starting your military career or nearing retirement, it’s essential to stay informed and make informed decisions about your compensation and benefits.

What is the basic pay scale for warrant officers?

+

The basic pay scale for warrant officers is determined by their rank and time in service, with higher ranks and more years of service resulting in higher pay grades.

What types of special pay are available to warrant officers?

+

Warrant officers may be eligible for special pay, such as hazardous duty pay or special duty assignment pay, depending on their specific duties or assignments.

How do I claim tax-free pay as a warrant officer?

+

To claim tax-free pay, you’ll need to understand which components of your pay are exempt from federal income tax and ensure you’re reporting your income correctly on your tax return.

Related Terms:

- Warrant Officer Pay chart

- Warrant officer pay calculator

- Navy Warrant Officer pay

- Warrant officer retirement pay chart

- Warrant Officer pay air force

- dfas pay chart 2025