5 Ways Viva Health RMC Insurance Works

Introduction to Viva Health RMC Insurance

Viva Health RMC Insurance is a type of health insurance plan designed to provide comprehensive coverage to individuals and families. With the rising costs of medical care, having a reliable health insurance plan is crucial for financial protection and access to quality healthcare services. In this article, we will explore the 5 ways Viva Health RMC Insurance works, highlighting its key features, benefits, and advantages.

How Viva Health RMC Insurance Works

Viva Health RMC Insurance operates on a network-based model, where policyholders can access a wide range of healthcare services from participating providers. Here are the 5 ways Viva Health RMC Insurance works: * Network of Healthcare Providers: Viva Health RMC Insurance has a vast network of healthcare providers, including hospitals, clinics, and medical offices. Policyholders can choose from a list of participating providers to receive medical care. * Preventive Care Services: The insurance plan covers preventive care services, such as routine check-ups, vaccinations, and screenings. This helps policyholders stay healthy and detect potential health issues early. * Outpatient and Inpatient Services: Viva Health RMC Insurance covers outpatient and inpatient services, including doctor visits, surgeries, and hospital stays. Policyholders can receive medical care without worrying about the high costs. * Prescription Medication Coverage: The insurance plan covers prescription medications, including generic and brand-name drugs. Policyholders can fill their prescriptions at participating pharmacies and receive discounts on their medication costs. * Claims Processing and Customer Support: Viva Health RMC Insurance has a dedicated claims processing team and customer support staff. Policyholders can file claims easily and receive assistance with any questions or concerns they may have.

Benefits of Viva Health RMC Insurance

Viva Health RMC Insurance offers several benefits to policyholders, including: * Financial Protection: The insurance plan provides financial protection against high medical costs, ensuring that policyholders do not have to pay out-of-pocket for unexpected medical expenses. * Access to Quality Healthcare: Viva Health RMC Insurance gives policyholders access to quality healthcare services from participating providers, ensuring that they receive the best possible care. * Preventive Care Services: The insurance plan covers preventive care services, helping policyholders stay healthy and detect potential health issues early. * Prescription Medication Coverage: The plan covers prescription medications, making it easier for policyholders to manage their health conditions. * Customer Support: Viva Health RMC Insurance has a dedicated customer support team, providing policyholders with assistance and guidance whenever they need it.

Key Features of Viva Health RMC Insurance

Some key features of Viva Health RMC Insurance include: * Deductible and Copayment: The insurance plan has a deductible and copayment structure, which means that policyholders pay a portion of their medical expenses out-of-pocket. * Maximum Out-of-Pocket Expenses: The plan has a maximum out-of-pocket expense limit, which means that policyholders do not have to pay more than a certain amount for their medical expenses. * Pre-Existing Condition Coverage: Viva Health RMC Insurance covers pre-existing conditions, ensuring that policyholders with ongoing health issues can receive the medical care they need. * Dependent Coverage: The plan allows policyholders to add dependents to their coverage, including spouses and children. * Optional Riders: Viva Health RMC Insurance offers optional riders, such as dental and vision coverage, which policyholders can add to their plan for extra protection.

💡 Note: Policyholders should review their policy documents carefully to understand the terms and conditions of their coverage.

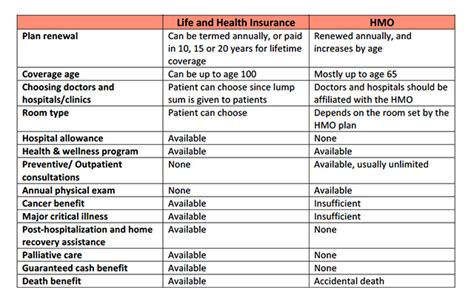

Comparison with Other Health Insurance Plans

Viva Health RMC Insurance is one of many health insurance plans available in the market. When comparing Viva Health RMC Insurance with other plans, policyholders should consider factors such as: * Premium Costs: The monthly premium costs of the plan, including any discounts or subsidies that may be available. * Network of Providers: The size and quality of the plan’s network of healthcare providers. * Coverage and Benefits: The range of medical services and benefits covered by the plan, including preventive care services and prescription medication coverage. * Deductible and Copayment: The deductible and copayment structure of the plan, including any maximum out-of-pocket expense limits. * Customer Support: The quality of customer support provided by the plan, including claims processing and policyholder assistance.

| Plan Feature | Viva Health RMC Insurance | Other Health Insurance Plans |

|---|---|---|

| Premium Costs | Competitive pricing with discounts available | Varying premium costs depending on the plan |

| Network of Providers | Vast network of participating providers | Smaller or larger networks depending on the plan |

| Coverage and Benefits | Comprehensive coverage, including preventive care services and prescription medication coverage | Varying levels of coverage and benefits depending on the plan |

| Deductible and Copayment | Deductible and copayment structure with maximum out-of-pocket expense limit | Varying deductible and copayment structures depending on the plan |

| Customer Support | Dedicated customer support team and claims processing staff | Varying levels of customer support depending on the plan |

In summary, Viva Health RMC Insurance is a comprehensive health insurance plan that provides financial protection, access to quality healthcare services, and a range of benefits and features. When comparing Viva Health RMC Insurance with other health insurance plans, policyholders should consider factors such as premium costs, network of providers, coverage and benefits, deductible and copayment, and customer support.

To wrap things up, Viva Health RMC Insurance is a reliable and trustworthy health insurance plan that can provide policyholders with peace of mind and financial protection against high medical costs. With its comprehensive coverage, vast network of providers, and dedicated customer support team, Viva Health RMC Insurance is an excellent choice for individuals and families looking for a high-quality health insurance plan.

What is Viva Health RMC Insurance?

+

Viva Health RMC Insurance is a type of health insurance plan that provides comprehensive coverage to individuals and families.

What are the benefits of Viva Health RMC Insurance?

+

The benefits of Viva Health RMC Insurance include financial protection, access to quality healthcare services, preventive care services, prescription medication coverage, and customer support.

How do I choose the right health insurance plan for my needs?

+

To choose the right health insurance plan for your needs, consider factors such as premium costs, network of providers, coverage and benefits, deductible and copayment, and customer support.

Can I add dependents to my Viva Health RMC Insurance plan?

+

Yes, you can add dependents to your Viva Health RMC Insurance plan, including spouses and children.

What is the maximum out-of-pocket expense limit for Viva Health RMC Insurance?

+

The maximum out-of-pocket expense limit for Viva Health RMC Insurance varies depending on the plan and policyholder’s needs.

Related Terms:

- Viva Medicare

- Viva Health Network

- Viva Medicare prior authorization list

- Viva claims

- Viva benefits

- Viva healthy