Why Health Insurance Costs So Much

Introduction to Health Insurance Costs

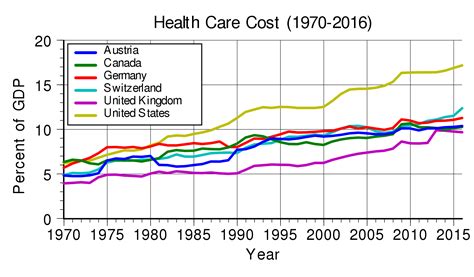

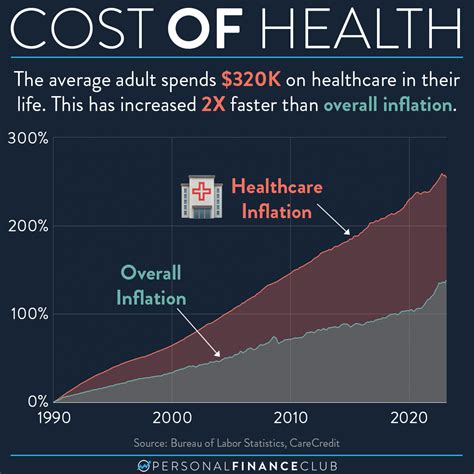

The cost of health insurance has been a topic of concern for many individuals and families around the world. With the rising costs of medical care, it’s no wonder that health insurance premiums have also increased significantly over the years. But what exactly drives the high costs of health insurance? In this article, we’ll delve into the factors that contribute to the high costs of health insurance and explore ways to make healthcare more affordable.

Factors Contributing to High Health Insurance Costs

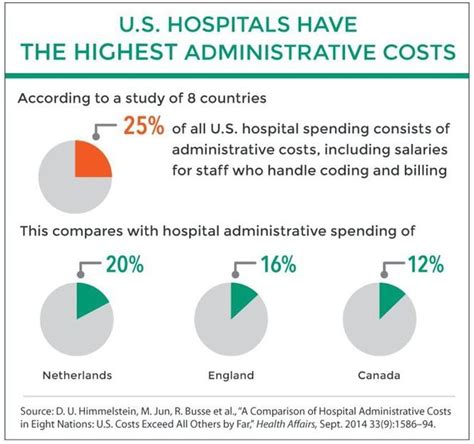

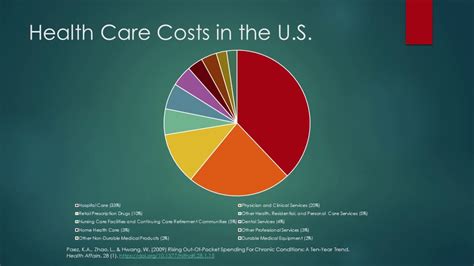

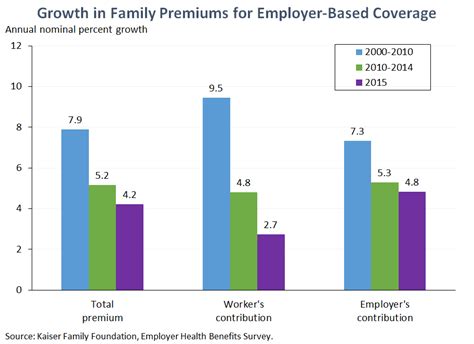

There are several factors that contribute to the high costs of health insurance. Some of the main factors include: * Administrative costs: The cost of administering health insurance plans, including marketing, underwriting, and claims processing, can be quite high. * Medical inflation: The cost of medical care, including hospital stays, doctor visits, and prescription medications, has increased significantly over the years. * Aging population: As the population ages, the demand for healthcare services increases, driving up costs. * Chronic diseases: The prevalence of chronic diseases, such as diabetes and heart disease, has increased, leading to higher healthcare costs. * Advances in medical technology: While advances in medical technology have improved healthcare outcomes, they have also increased costs.

The Role of Insurance Companies

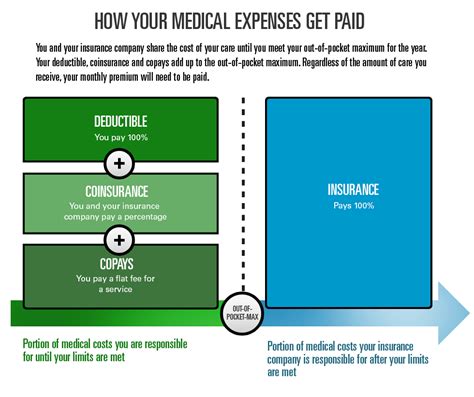

Insurance companies play a significant role in the health insurance market. They determine premiums, coverage, and provider networks. However, their primary goal is to make a profit, which can sometimes conflict with the goal of providing affordable healthcare. Insurance companies have several ways to increase profits, including: * Increasing premiums: Insurance companies can increase premiums to cover the rising costs of medical care. * Reducing coverage: Insurance companies can reduce coverage or increase deductibles and copays to reduce costs. * Selecting providers: Insurance companies can select providers who offer lower rates, which can limit access to certain healthcare services.

Government Policies and Regulations

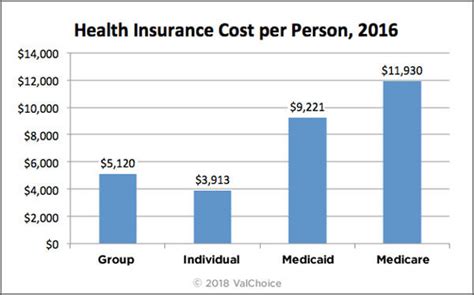

Government policies and regulations can also impact the cost of health insurance. For example: * Affordable Care Act (ACA): The ACA, also known as Obamacare, has increased access to health insurance for millions of Americans. However, it has also led to increased premiums and costs for some individuals and families. * Medicare and Medicaid: Government programs such as Medicare and Medicaid provide healthcare coverage to millions of Americans. However, they can also drive up costs for private insurance companies. * State regulations: State regulations can impact the cost of health insurance by requiring insurance companies to cover certain services or providers.

Ways to Reduce Health Insurance Costs

While the cost of health insurance may seem overwhelming, there are ways to reduce costs. Some strategies include: * Shopping around: Comparing premiums and coverage from different insurance companies can help individuals and families find more affordable options. * Increasing deductibles: Increasing deductibles can reduce premiums, but it’s essential to ensure that individuals and families can afford the out-of-pocket costs. * Using health savings accounts (HSAs): HSAs allow individuals and families to set aside pre-tax dollars for healthcare expenses, which can help reduce costs. * Improving health: Maintaining a healthy lifestyle, including regular exercise and a balanced diet, can help reduce healthcare costs in the long run.

💡 Note: It's essential to carefully review and compare health insurance plans before making a decision, as the best option will depend on individual or family needs and circumstances.

Conclusion and Future Outlook

In conclusion, the cost of health insurance is a complex issue driven by various factors, including administrative costs, medical inflation, and government policies. While there are ways to reduce costs, it’s essential to address the underlying factors driving up costs. As the healthcare landscape continues to evolve, it’s crucial to find innovative solutions to make healthcare more affordable and accessible to all. By understanding the factors contributing to high health insurance costs and exploring ways to reduce costs, we can work towards creating a more sustainable and equitable healthcare system.

What is the main factor driving up health insurance costs?

+

The main factor driving up health insurance costs is medical inflation, which includes the rising costs of hospital stays, doctor visits, and prescription medications.

How can I reduce my health insurance costs?

+

You can reduce your health insurance costs by shopping around, increasing deductibles, using health savings accounts (HSAs), and improving your health through regular exercise and a balanced diet.

What is the impact of government policies on health insurance costs?

+

Government policies, such as the Affordable Care Act (ACA), can increase access to health insurance but also drive up costs for some individuals and families. State regulations can also impact the cost of health insurance by requiring insurance companies to cover certain services or providers.