Zero Deductible Health Insurance Plans

Introduction to Zero Deductible Health Insurance Plans

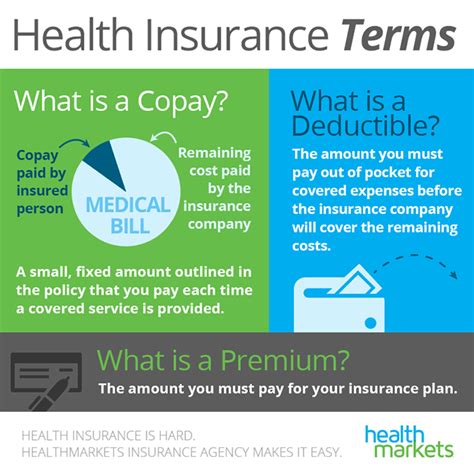

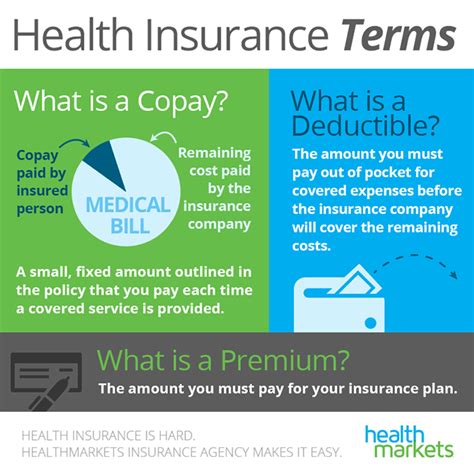

When it comes to health insurance, one of the most critical factors to consider is the deductible. A deductible is the amount you must pay out-of-pocket for healthcare expenses before your insurance plan starts to cover costs. For many individuals and families, high deductibles can be a significant burden, leading to financial stress and difficulty in accessing necessary medical care. This is where zero deductible health insurance plans come into play, offering a potentially more affordable and accessible alternative. In this article, we will delve into the world of zero deductible health insurance plans, exploring their benefits, how they work, and what you should consider when choosing such a plan.

How Zero Deductible Health Insurance Plans Work

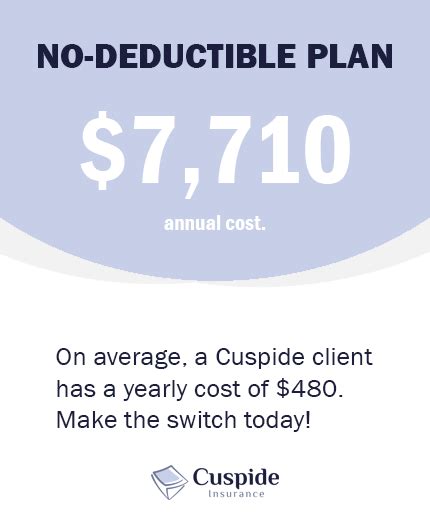

Zero deductible health insurance plans are designed so that you do not have to pay any deductible for covered medical services. This means that from the first dollar spent on healthcare, your insurance plan begins to cover the costs, reducing your out-of-pocket expenses significantly. These plans often come with higher premiums compared to plans with deductibles, as the insurance company takes on more financial risk. However, for individuals who frequently use medical services or have chronic conditions requiring ongoing care, the higher premium can be offset by the savings from not having to pay a deductible.

Benefits of Zero Deductible Health Insurance Plans

The benefits of zero deductible health insurance plans are multifaceted: - Lower Out-of-Pocket Costs: The most obvious advantage is the reduction in out-of-pocket expenses. Without a deductible, you can access medical care without the initial financial barrier, making healthcare more accessible. - Predictable Expenses: With a zero deductible plan, your healthcare expenses become more predictable. You know exactly how much you will pay each month, which can help in budgeting and financial planning. - Incentivizes Preventive Care: By removing the deductible, these plans can encourage individuals to seek preventive care and routine check-ups, potentially leading to early detection and treatment of health issues. - Reduced Financial Stress: High deductibles can be a source of significant financial stress for many families. Zero deductible plans can alleviate this stress, providing peace of mind and financial security.

Considerations When Choosing a Zero Deductible Plan

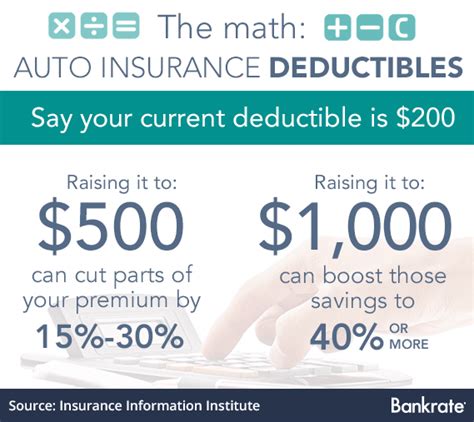

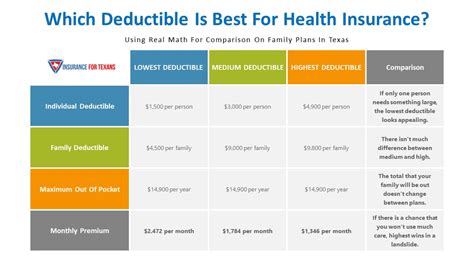

While zero deductible health insurance plans offer several benefits, there are also considerations to keep in mind: - Premium Costs: These plans typically have higher premiums. You need to weigh the cost of the premium against the potential savings from not paying a deductible. - Network Providers: Ensure that your healthcare providers are within the plan’s network to maximize your benefits. - Maximum Out-of-Pocket (MOOP) Limits: Even with a zero deductible plan, there might be other out-of-pocket costs, such as copays and coinsurance, until you reach your MOOP limit. - Plan Details and Exclusions: Carefully review the plan’s details, including any services that might not be covered or have separate deductibles.

Types of Zero Deductible Health Insurance Plans

There are several types of health insurance plans that may offer zero deductible benefits: - Health Maintenance Organization (HMO) Plans: These plans often have lower out-of-pocket costs but require you to receive care from a specific network of providers. - Preferred Provider Organization (PPO) Plans: PPO plans offer more flexibility in choosing healthcare providers but might have higher premiums and out-of-pocket costs compared to HMOs. - Catastrophic Plans: Although these plans have very high deductibles for most services, some preventive services are covered without a deductible. - Medicare Advantage Plans: Some Medicare Advantage plans may offer zero deductible benefits for certain services.

📝 Note: It's essential to carefully read and understand the terms and conditions of any health insurance plan before enrollment, as specifics can vary widely.

Comparison of Zero Deductible Plans

When comparing zero deductible health insurance plans, consider the following factors: - Premium costs - Coverage and exclusions - Network of providers - Out-of-pocket costs, including copays and coinsurance - Maximum Out-of-Pocket (MOOP) limits - Customer service and plan ratings

| Plan Type | Premium Costs | Network Flexibility | Out-of-Pocket Costs |

|---|---|---|---|

| HMO | Lower | Less flexible | Lower |

| PPO | Higher | More flexible | Higher |

| Catastrophic | Lower | Varies | Very high for non-preventive services |

In summary, zero deductible health insurance plans can offer a more accessible and predictable way to manage healthcare expenses, especially for those who regularly use medical services. However, it’s crucial to carefully evaluate the plan’s details, including premium costs, network providers, and any potential out-of-pocket expenses, to ensure it aligns with your health and financial needs. By understanding the benefits and considerations of these plans, individuals can make informed decisions about their health insurance, prioritizing both their health and financial well-being.

What is a zero deductible health insurance plan?

+

A zero deductible health insurance plan is a type of insurance plan where you do not have to pay any deductible for covered medical services, meaning your insurance starts covering costs from the first dollar spent.

How do zero deductible plans compare to traditional plans with deductibles?

+

Zero deductible plans typically have higher premiums but lower out-of-pocket costs since you don’t pay a deductible. Traditional plans with deductibles have lower premiums but require you to pay the deductible before the insurance coverage kicks in.

Are all medical services covered without a deductible in a zero deductible plan?

+

Not all services may be covered without a deductible. While preventive services and some treatments might be covered from the first dollar, other services could have copays, coinsurance, or even separate deductibles. It’s essential to review the plan’s details carefully.

Related Terms:

- Zero deductible health insurance meaning

- Zero deductible health insurance cost

- Best no deductible health insurance

- No deductible vs deductible health insurance

- 0 deductible car insurance

- No deductible meaning