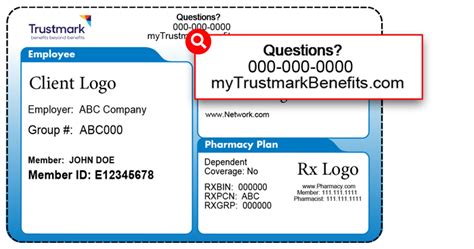

5 Trustmark Health Benefits

Introduction to Trustmark Health Benefits

Trustmark is a company that specializes in providing voluntary benefits to employees. These benefits are designed to supplement traditional health insurance and provide additional financial protection to employees in the event of illness, injury, or other unexpected events. In this article, we will explore five key trustmark health benefits that can help employees protect their health and financial well-being.

Benefit 1: Critical Illness Insurance

Critical illness insurance is a type of insurance that provides a lump sum payment to employees who are diagnosed with a serious illness, such as cancer, heart attack, or stroke. This benefit can help employees pay for medical expenses, such as copays, deductibles, and prescription medications, as well as other expenses, such as mortgage or rent payments, car loans, and daily living expenses. With critical illness insurance, employees can focus on their recovery, rather than worrying about the financial implications of their illness.

Benefit 2: Accident Insurance

Accident insurance is a type of insurance that provides a payment to employees who are injured in an accident, such as a car accident, slip and fall, or sports injury. This benefit can help employees pay for medical expenses, such as emergency room visits, surgeries, and physical therapy, as well as other expenses, such as lost wages and daily living expenses. With accident insurance, employees can get the medical care they need, without worrying about the financial burden of an unexpected accident.

Benefit 3: Hospital Indemnity Insurance

Hospital indemnity insurance is a type of insurance that provides a payment to employees who are hospitalized due to illness or injury. This benefit can help employees pay for medical expenses, such as hospital stays, surgeries, and prescription medications, as well as other expenses, such as lost wages and daily living expenses. With hospital indemnity insurance, employees can focus on their recovery, rather than worrying about the financial implications of their hospital stay.

Benefit 4: Disability Income Insurance

Disability income insurance is a type of insurance that provides a payment to employees who are unable to work due to illness or injury. This benefit can help employees pay for daily living expenses, such as mortgage or rent payments, car loans, and food, as well as other expenses, such as medical bills and prescription medications. With disability income insurance, employees can maintain their standard of living, even if they are unable to work.

Benefit 5: Life Insurance

Life insurance is a type of insurance that provides a payment to the beneficiaries of employees who pass away. This benefit can help employees provide for their loved ones, even if they are no longer alive to support them. With life insurance, employees can have peace of mind, knowing that their beneficiaries will be taken care of, regardless of what happens to them.

💡 Note: These benefits are designed to supplement traditional health insurance and provide additional financial protection to employees. It's essential to review the terms and conditions of each benefit to understand what is covered and what is not.

In terms of costs, the premiums for these benefits vary depending on the employee’s age, health, and other factors. However, the costs are typically very affordable, and the benefits can be tailored to meet the individual needs of each employee. The following table provides a summary of the benefits and their estimated costs:

| Benefit | Estimated Cost |

|---|---|

| Critical Illness Insurance | $20-$50 per month |

| Accident Insurance | $10-$30 per month |

| Hospital Indemnity Insurance | $20-$50 per month |

| Disability Income Insurance | $30-$70 per month |

| Life Insurance | $20-$50 per month |

To summarize, trustmark health benefits provide employees with additional financial protection and peace of mind. By offering a range of benefits, including critical illness insurance, accident insurance, hospital indemnity insurance, disability income insurance, and life insurance, employers can help their employees protect their health and financial well-being. These benefits can be tailored to meet the individual needs of each employee, and the costs are typically very affordable.

What is critical illness insurance?

+

Critical illness insurance is a type of insurance that provides a lump sum payment to employees who are diagnosed with a serious illness, such as cancer, heart attack, or stroke.

How does accident insurance work?

+

Accident insurance provides a payment to employees who are injured in an accident, such as a car accident, slip and fall, or sports injury. The payment can be used to cover medical expenses, lost wages, and other expenses.

What is the difference between disability income insurance and life insurance?

+

Disability income insurance provides a payment to employees who are unable to work due to illness or injury, while life insurance provides a payment to the beneficiaries of employees who pass away.

Related Terms:

- Luminare Health Benefits Inc Perusahaan

- Trustmark Health Benefits Luminare

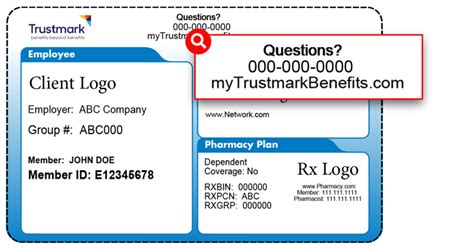

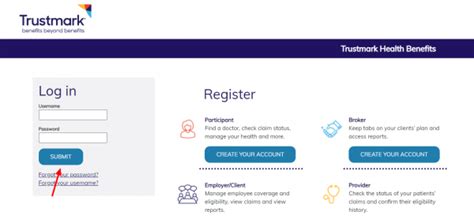

- Trustmark Health Benefits login

- Trustmark Health Benefits phone number

- Trustmark Health Benefits Aetna

- Luminare Health Benefits